What mattered this week: Trump’s wars on everything, everywhere, all at once

And we're not even including his war on Minnesota!

KEY TAKEAWAYS:

Trump wants lower interest rates so badly that he may criminally prosecute Fed Chair Jerome Powell for not cutting rates enough. The gambit will probably backfire.

Trump’s Venezuela war is simmering down.

His threatened attack on Iran hasn’t happened (yet).

His attempted hostile takeover of Greenland is still underway.

Trump says the war on inflation is over, and he won. Millions of Americans disagree.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

SEVEN ITEMS THIS WEEK:

Trump’s war on Fed Chair Jerome Powell. This one backfired. Trump escalated his feud with Powell by sending Justice Dept. prosecutors after him on the premise that he broke the law by testifying untruthfully to Congress last year about a Fed renovation project. We know because Powell delivered an unprecedented video message on January 11 saying the Justice Dept. had issued subpoenas in the matter. Trump’s real beef with Powell has nothing to do with renovations. Trump thinks the Fed should set interest rates ridiculously low to stimulate growth, even if it risks higher inflation. The Fed has cut short-term rates by 1.5 percentage points since September 2024, but Trump still wants rates 2 or 3 points lower.

Everybody knows this supposed prosecution is bogus. The question is whether Trump will go through with an attempted prosecution or just let the possibility hang over Powell and the Fed. Here’s what he’s probably doing: Using the threat of a politically motivated prosecution to coerce the entire Fed—including the next chair—to do what he wants after Powell’s term ends in May and a new chair replaces him. So don’t bet on a Powell prosecution. It’s probably a warning shot. But do bet that Trump will hector the Fed to cut rates no matter who’s running it, and continue to use pressure tactics no president has ever tried.

[More: You’re only better off under Trump if you own stocks]

The good news about Trump’s attack on the Fed is the heavy pushback from many quarters, including Powell himself, who finally accused Trump of political meddling after months of more cautious protestations. A couple of important Republican senators said they’d block any Trump nominees for the Fed if Trump went after Powell. JPMorgan Chase CEO Jamie Dimon said Trump would push rates higher, not lower, if he wrecked confidence in the Fed. And investors, who initially wavered on the news, kept buying stocks, indicating they think the prospect of prosecution is an empty threat. Let’s hope they’re right.

The S&P 500 slipped about 0.4% for the week, but the smaller-cap Russell 2000 rose by about 2%. That’s good news. Market analysts like that kind of rotation, which shows a broader set of companies leading stocks up, not just a narrow band of favorites. The Russell is up about 8% for the year, while the S&P is up 1.4%.

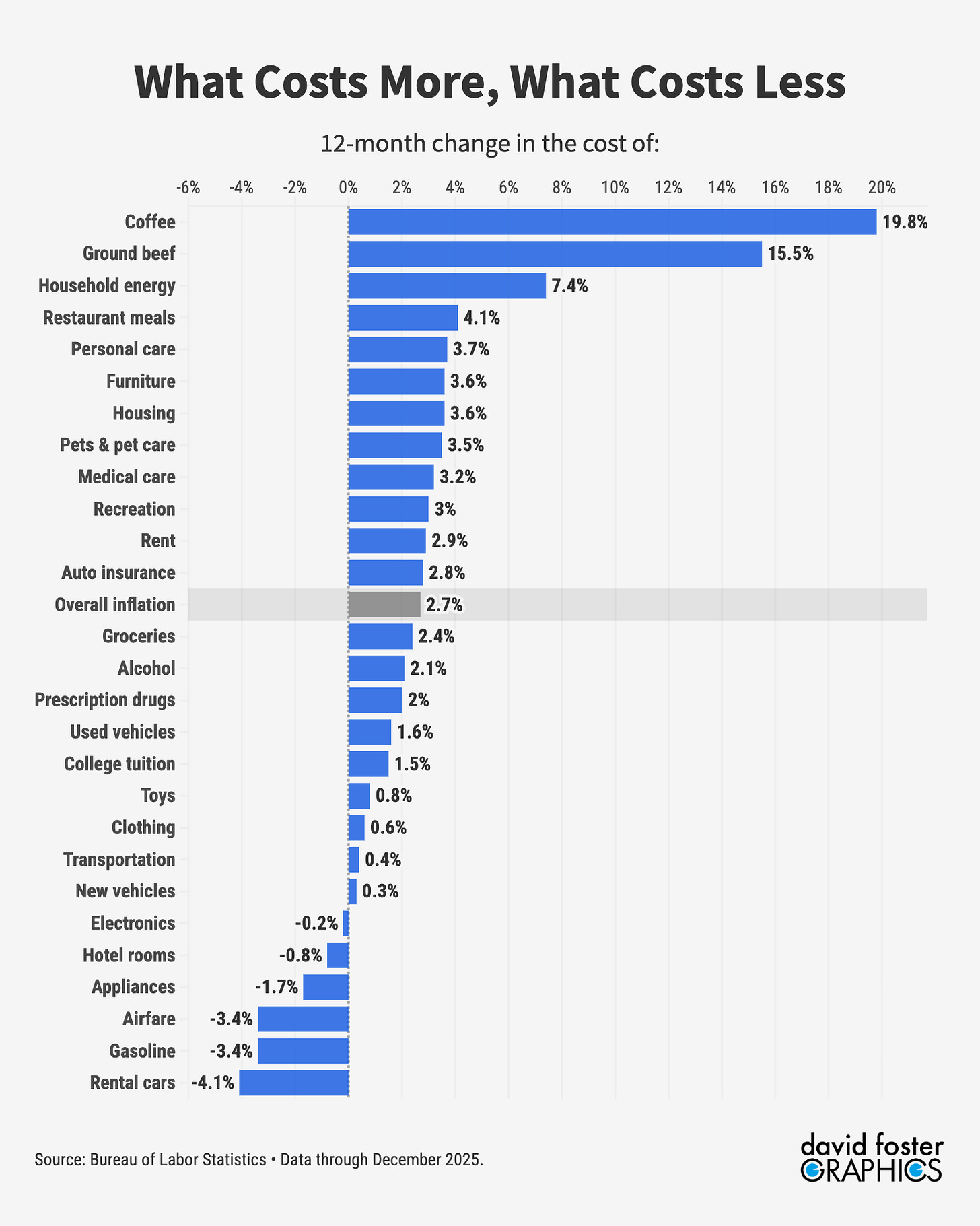

Trump’s war on inflation, Trump seems to think this war is over, because he said inflation is “defeated” in a speech on January 13 in Detroit. But the enemy gets a say, as good generals remind us, and pricing data that came out the same day show the inflation rate to be 2.7%. Coffee prices are up 19.8% year-over-year. Hamburger is up 15.5%. Household energy—heat and electricity—is up 7.4%. Incomes are up 3.7% on average, so some people don’t mind 2.7% inflation. But others will find Trump’s dismissal of inflation insulting.

[More: Inflation moderates but affordability is still a problem]

Trump’s war on Venezuela. This one is simmering down. Trump will likely have notional control of Venezuela for a long time, and the leaders there probably figure they can yes Trump just enough to prevent another US raid like the one that deposed President Nicolás Maduro on January 3. They have no choice, really. The US ability to blockade Venezuela’s oil shipments gives Trump de facto control of the country, or at least the source of graft that keeps the current socialist dictators fat and happy.

Whether American energy companies can revamp Venezuela’s decrepit oil industry is a fascinating business story. But It doesn’t really matter to most Americans. It might work, to some extent. But oil prices and gasoline prices are relatively low now because of a global oil glut, not because of anything involving Venezuela. The United States doesn’t need Venezuelan oil, but refiners and some energy-service companies will profit if it arrives.

Trump’s threatened attack on Iran … didn’t happen. Trump threatened US military strikes against Iran if government thugs didn’t stop killing protesters outraged about a failing economy and one of the world’s worst governments. The Islamist regime killed thousands, but Trump seemed to back down anyway. Probably a good call. There are no easy targets in Iran that would target the mullahs while avoiding civilian deaths, and airstrikes wouldn’t necessarily end the murderous Iranian regime or produce a better one. The point of US strikes last June against Iranian nuclear facilities was to destroy physical targets, which was different. Trump can still order strikes but the moment seems to have passed.

Trump’s war on (or for) Greenland. Trump continues to insist the United States must have Greenland, as an actual physical territory it controls and administers. This is a crazy affront to Denmark, up till now a close US ally, which runs Greenland and says it’s not handing over the huge, frozen island. But Trump may have shown his hand when he threatened tariffs against any nation opposing his effort to acquire Greenland, because that’s an economic—not military—threat.

So maybe Trump is bluffing about taking Greenland by force to gain leverage in negotiations to buy the massive island. Even if he is, this is one of Trump’s loopier obsessions. Otherwise compliant Republicans in Washington will try to talk him out of it. If there’s a face-saving way out, it would be for Denmark to offer Trump free access to Greenland—which the United States basically already has—and pretend it’s some brilliant new deal Trump conjured up.

[More: Voters hate both political parties more than ever]

Here’s a nice primer on why Greenland is strategically important, from Harvard’s Kennedy School.

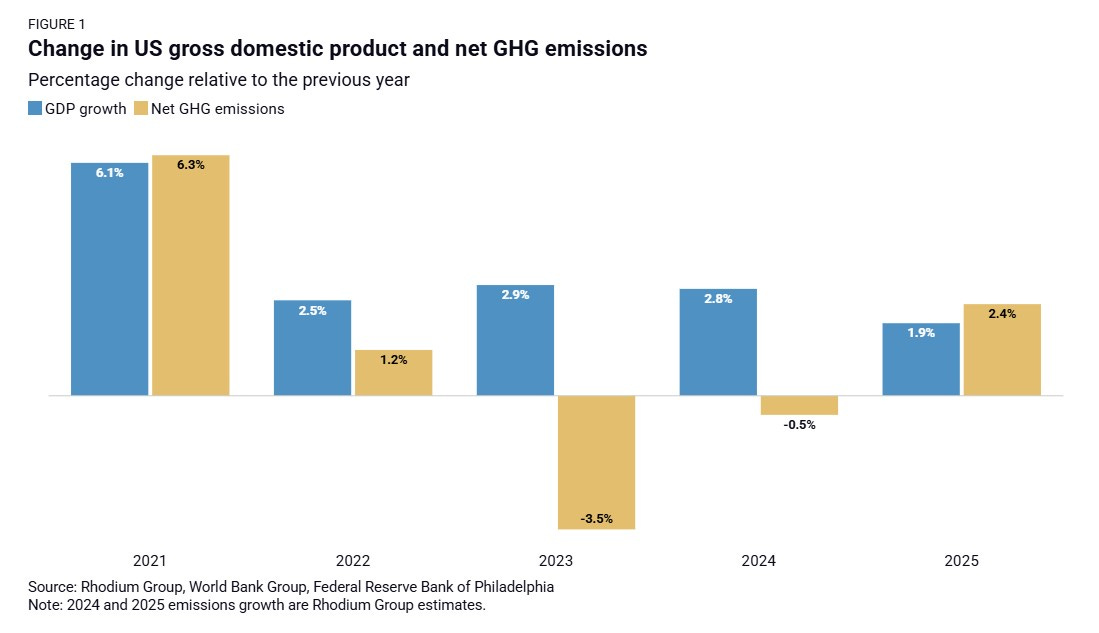

Remember global warming? US greenhouse-gas emissions rose in 2025 for the first time in three years, according to a preliminary estimate from The Rhodium Group. It’s not because of Trump’s hostility toward green energy, though that will probably become a factor in future years. Emissions rose 2.4% because of growing power demand by data centers and also because of unusually cold weather that required more heat. Natural-gas prices were also somewhat high, leading some utilities to switch to cheaper coal, which is dirtier.

US emissions have generally been falling, because of better efficiency and the growing use of non-polluting renewables. It’s important to get back onto that trendline, and the sooner the better.

You can page through Rhodium’s fascinating data visualizations by establishing a free account. One thing you’ll notice is we’re going to need a lot of natural gas for a long time. That’s climate realism.

Bob Weir, wow. The music becomes so familiar you take it for granted. But when a legend like Grateful Dead guitarist Bob Weir dies and you listen again, the genius astonishes. Bob and the gang created magic where none existed before. They made blossoms bloom.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

WHAT WILL MATTER NEXT WEEK:

Ridiculous MLK diss. Monday, January 19, is Martin Luther King, Jr. Day. It’s still a federal holiday, which only Congress can change. But Trump struck MLK Day—and also Juneteenth, June 14—from the list of days when visitors to National Parks get free entry. What was the point of that? MLK had some flaws, but also more courage than every racist he ever had to contend with, combined. C’mon, man.

If you’ve never been to the Lorraine Motel in Memphis, where James Earl Ray assassinated MLK on April 4, 1968, it’s worth a visit. It’s now a museum, but Room 306 is preserved down to the ashtrays. You can also walk through the former rooming house across the street where Ray supposedly fired from. It’s haunting, infuriating, and, for better or worse, America.

Tariff watch (yaaawwwwwn). Don’t zone out on tariffs! The Supreme Court could rule any week now (but also as late as June 🙄) on whether more than half of Trump’s tariffs are illegal. It’ll be big news and stocks might jump if the court invalidates the levies.

Earnings will drive financial news. Netflix (earnings due January 20) might comment on its bidding war for Warner Brothers Discovery. Halliburton (January 21) could comment on prospects for new business in Venezuela as part of Trump’s oil grab there. Procter & Gamble (January 22) will provide updates on the effects of Trump’s tariffs on prices, and pinched consumers.

All i can say is Trump does not like any one unless they kiss his feet.So if your" Mary" in the "BIBLE"and,you want to take charge you can make a best friend there in no time at all.Just kidding .Not