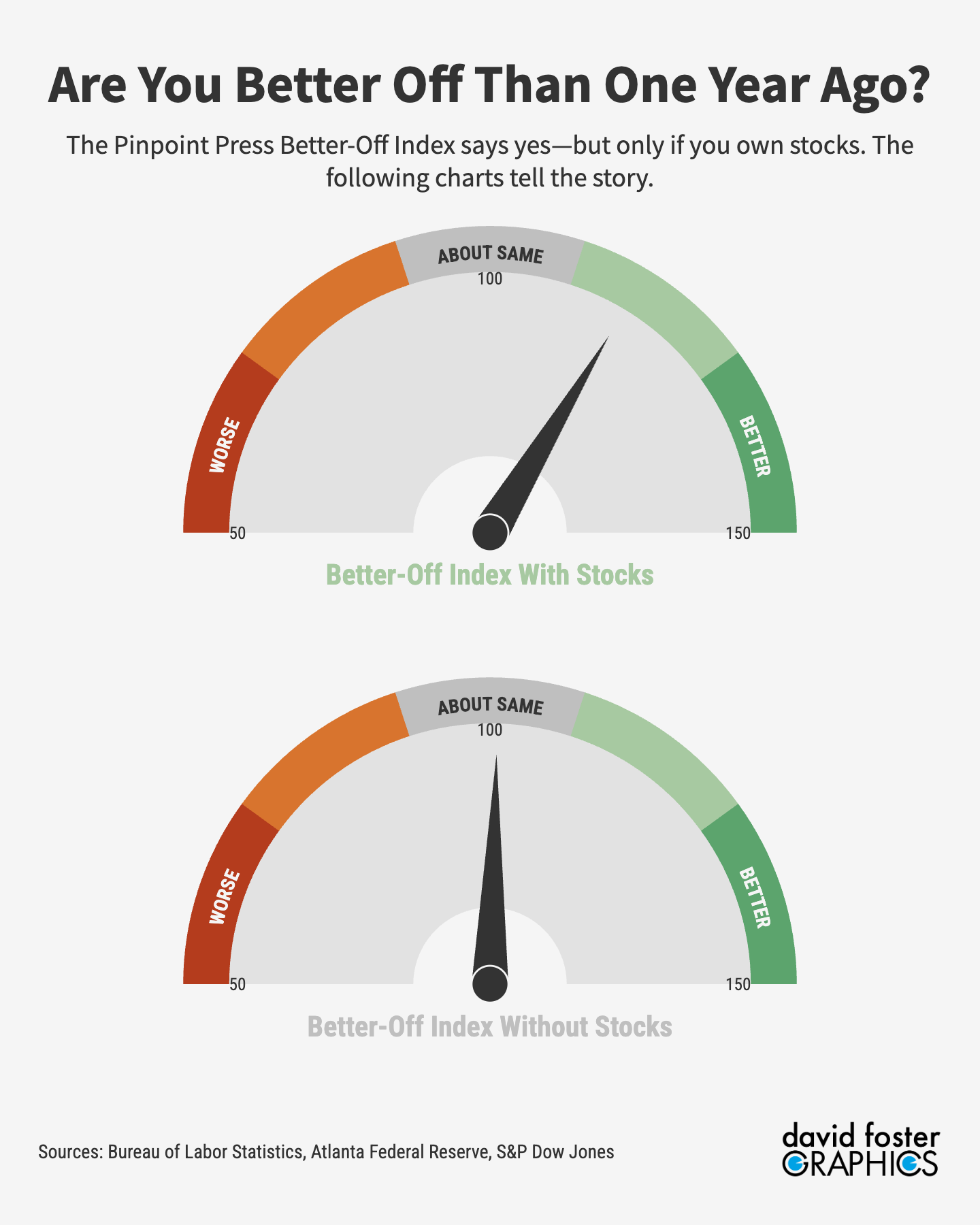

You’re only better off under Trump if you own stocks

The new Pinpoint Press Better-Off Index shows who's winning and losing in the K-shaped economy.

Key takeaways: 😉

Current index value: The Pinpoint Press Better-Off Index level for January 2026 is 117.3, which is slightly better than the historical median.

Stock-market gap: But removing stock-market performance lowers the Better-Off Index to 100.9, which means Americans who lack financial wealth are not getting ahead.

Job growth slowdown: Total employment in December was just 0.4% higher than one year earlier.

Home affordability stinks: It’s near 20-year lows.

This is the K-shaped economy: Stock owners are near the top, while people without stocks are closer to the bottom.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

President Trump sees an “economic boom.” Under his watch, he said in a January 13 speech, “growth is exploding, productivity is soaring, investment is booming, incomes are rising, inflation is defeated.”

His sagging approval ratings suggest many Americans disagree.

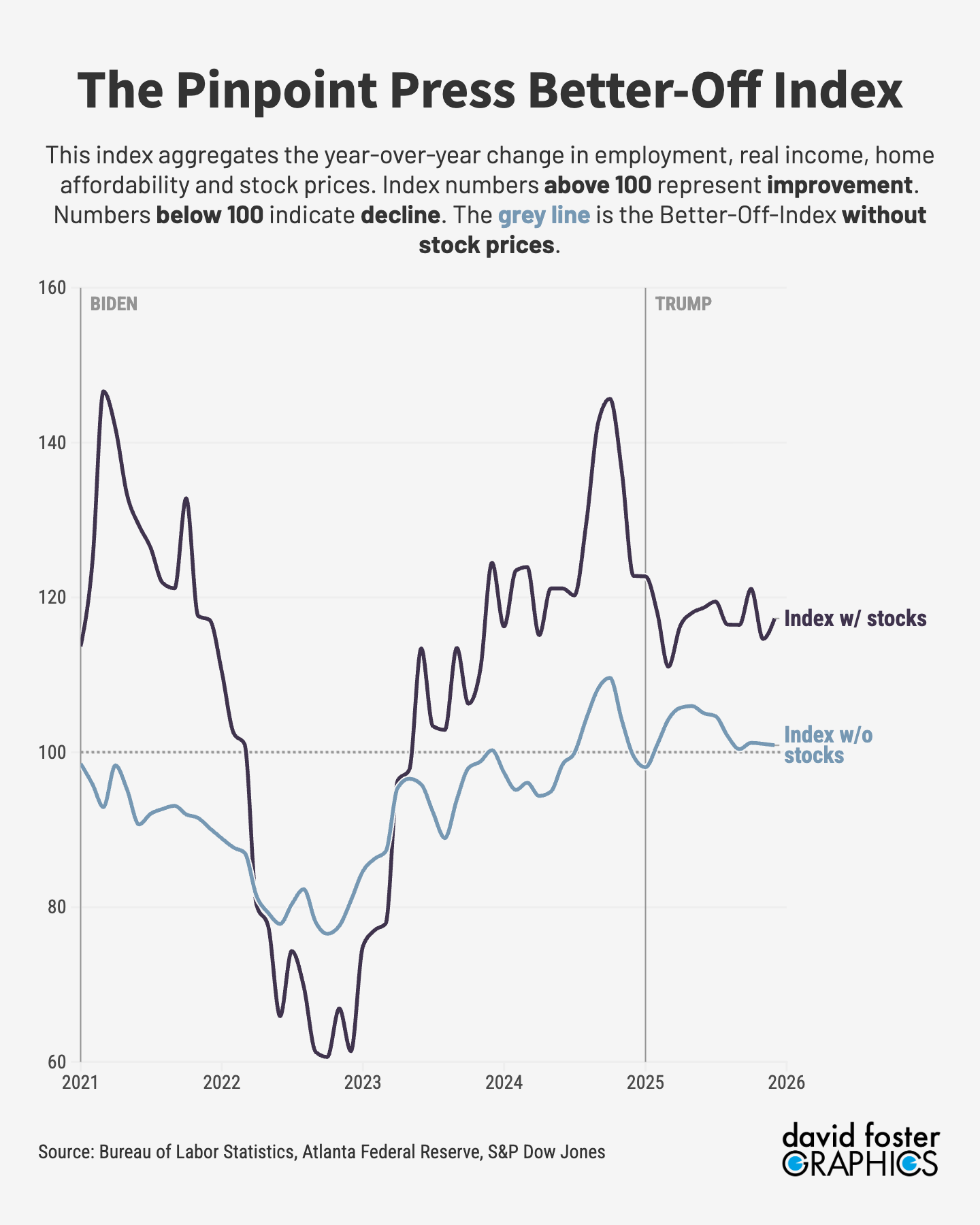

The Pinpoint Press has developed a new tool to explain why. The Pinpoint Press Better-Off Index measures how the economy is doing compared with one year earlier on jobs, incomes, home affordability and stock values. Many Americans ask themselves, am I better off than I was one year ago? This index answers the question.

It also provides a stark explanation for who’s getting ahead in America, and who is not. Using all four metrics, the Better-Off Index is currently 117.3. Numbers above 100 mean we’re better off, while numbers below 100 mean we’re worse off. An index of 117 is slightly above the median in data going back to 2006. Things ought to be good.

[See more details about how we built the Better-Off Index]

But removing stocks from the index generates a very different result. Based on jobs, incomes and home affordability alone, the Better-Off Index is just 100.9. So people who don’t benefit from stock ownership are basically no better off than they were one year ago, when Trump began his second presidential term.

It could be worse. In 2022, the Better-Off Index bottomed out at 61. The main problem then, as many Americans recall, was inflation that peaked at 9%. That wrecked real incomes, adjusted for inflation, which is part of the index. Home affordability was drastically worsening, as prices and interest rates both rose. Stocks were selling off, as well.

[More: Voters hate both political parties more than ever]

President Biden, at the time, kept bragging about record job growth, which was true. But purchasing power was collapsing and financial wealth was declining. As the Better-Off index shows, strong job growth totally failed to compensate for everything going wrong. No wonder Biden’s approval rating tanked.

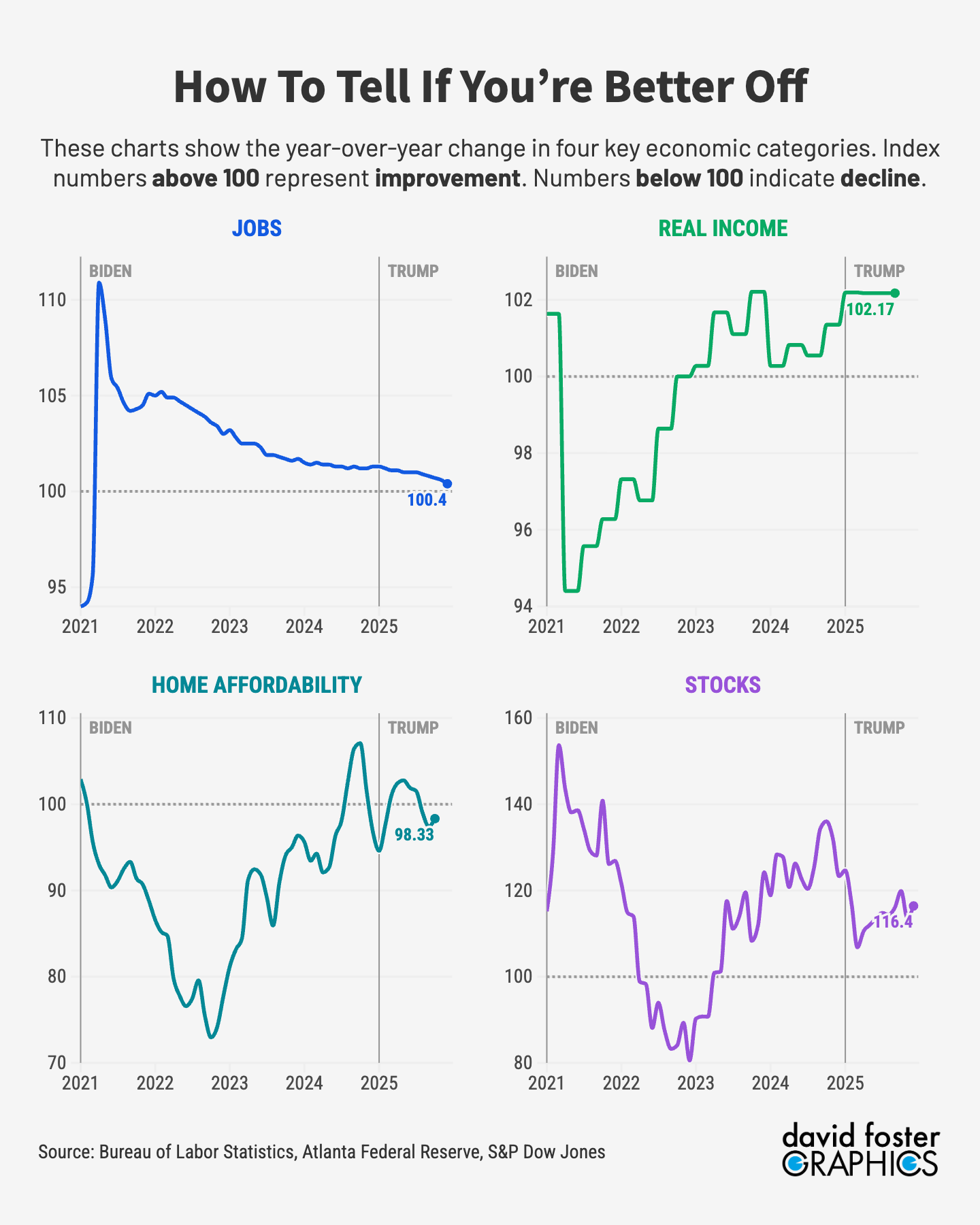

Probing the four indicators that go into the Better-Off Index help explain who’s up and who’s down in the so-called K-shaped economy. Job growth, for instance, is modestly positive, with total employment in December up 0.4% from the level of December 2024. But notice the sharp slowdown in the chart. The pace of job growth has been slowing since 2022 and it’s now close to stall speed, which would be no year-over-year improvement at all. Surveys and a lot of other data clearly show Americans getting skittish about the job market.

Real incomes were negative for most of 2022 and 2023, because inflation rose by more than incomes. Earnings have has since turned positive, with inflation-adjusted incomes about 2% higher now than one year earlier. That may not seem great, but it’s better than the median of the last 20 years.

Home affordability, as measured by the Atlanta Federal Reserve, is near the worst levels of the last 20 years. Home prices during the last four years have risen by far more than incomes, while mortgage rates have risen as well. Compared with one year ago, affordability is slightly worse, mainly because of rising prices.

[More: Inflation moderates, but affordability is still a problem]

Stocks are the standout performer in the Better-Off Index. The S&P 500 index rose 16.4% from the end of December 2024 to the end of December 2025. We weight each metric equally, so including stocks in the index accounts for essentially all of the improvement in the Better-Off Index during the last year. That’s why stripping out stocks shows no improvement.

So if you own stocks, you probably reside on the upper slant of the K-shaped economy. And the more stocks you own, the higher on the slant you are. If you don’t own stocks, you’re most likely on the downward slant.

We’ll update the Pinpoint Better-Off Index monthly and refer to it frequently to help illuminate what’s happening in the Trump economy. As always, we welcome comments and feedback on what you like about The Pinpoint Press and what we can do better.