A drop in inflation won’t solve the affordability problem

3 reasons why cost pressures will continue to hammer many families.

President Trump gave a strident televised speech on December 17 insisting that “prices are down” and “inflation has stopped.” Everybody who pays their own bills knows that’s bunk. Fact-checkers concur.

But Trump did get a bit of an assist the next day, when the government price report showed a surprise dip in the inflation rate, from 3% in September to 2.7% in November. (Nobody knows what the inflation rate was in October because the six-week government shutdown stopped data collection.)

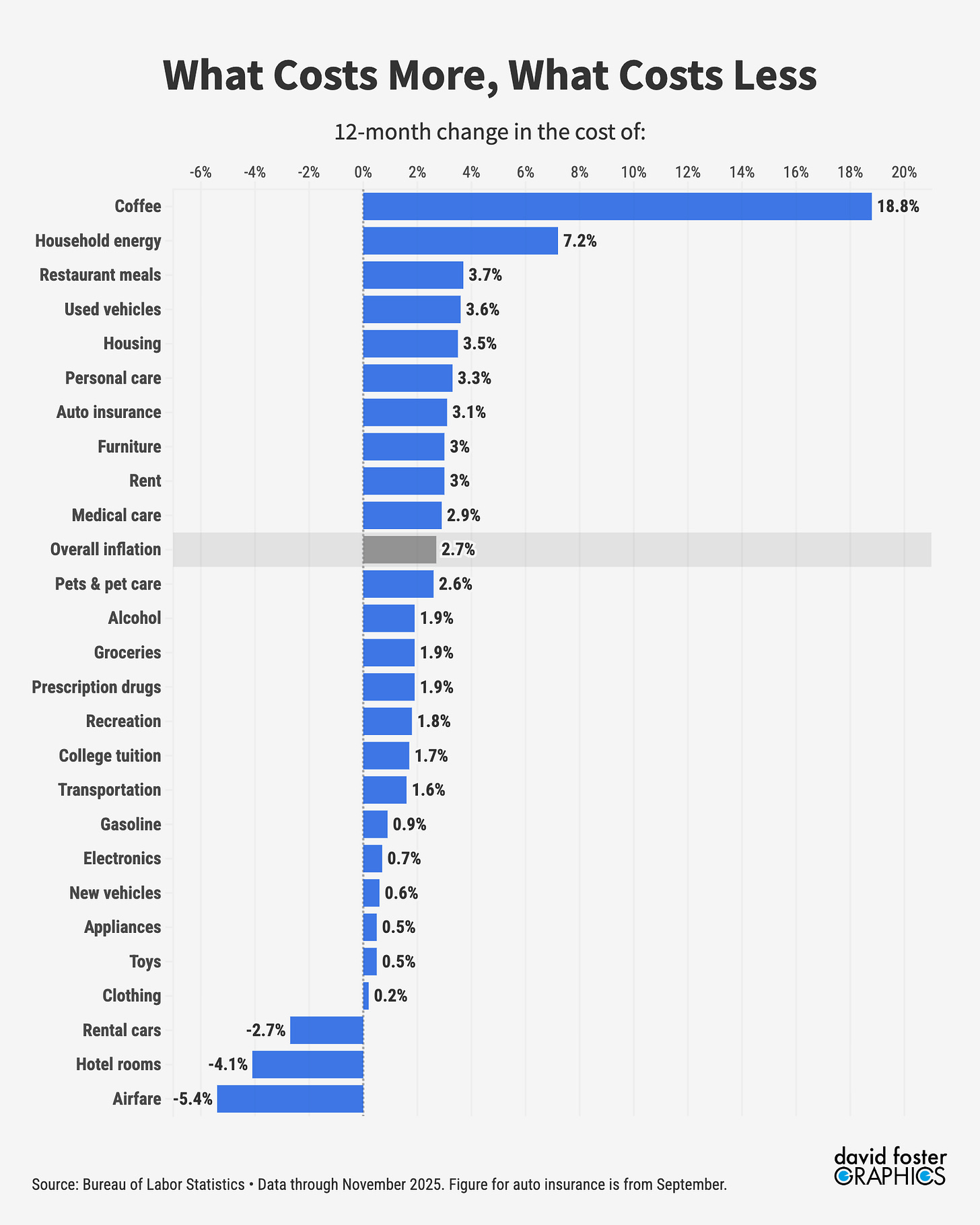

A lower inflation rate is welcome news for Trump, and for everybody else. If the data is accurate, grocery inflation is a tame 2%, gasoline is cheap and the cost of travel is actually declining. Here’s a breakdown:

But skeptical consumers have good reason to think something is off. For one thing, take a look at the second line in that chart above. The cost of household energy—electricity and heat—is rising at 7.2% per year, and that’s up from 6.2% in September. Americans spend 6% of their budget on utilities, nearly twice what they spend on gasoline. Higher utility bills are swallowing all the savings from cheap gas, and then some.

[How well do you know the Trump economy? Take The Pinpoint Quiz]

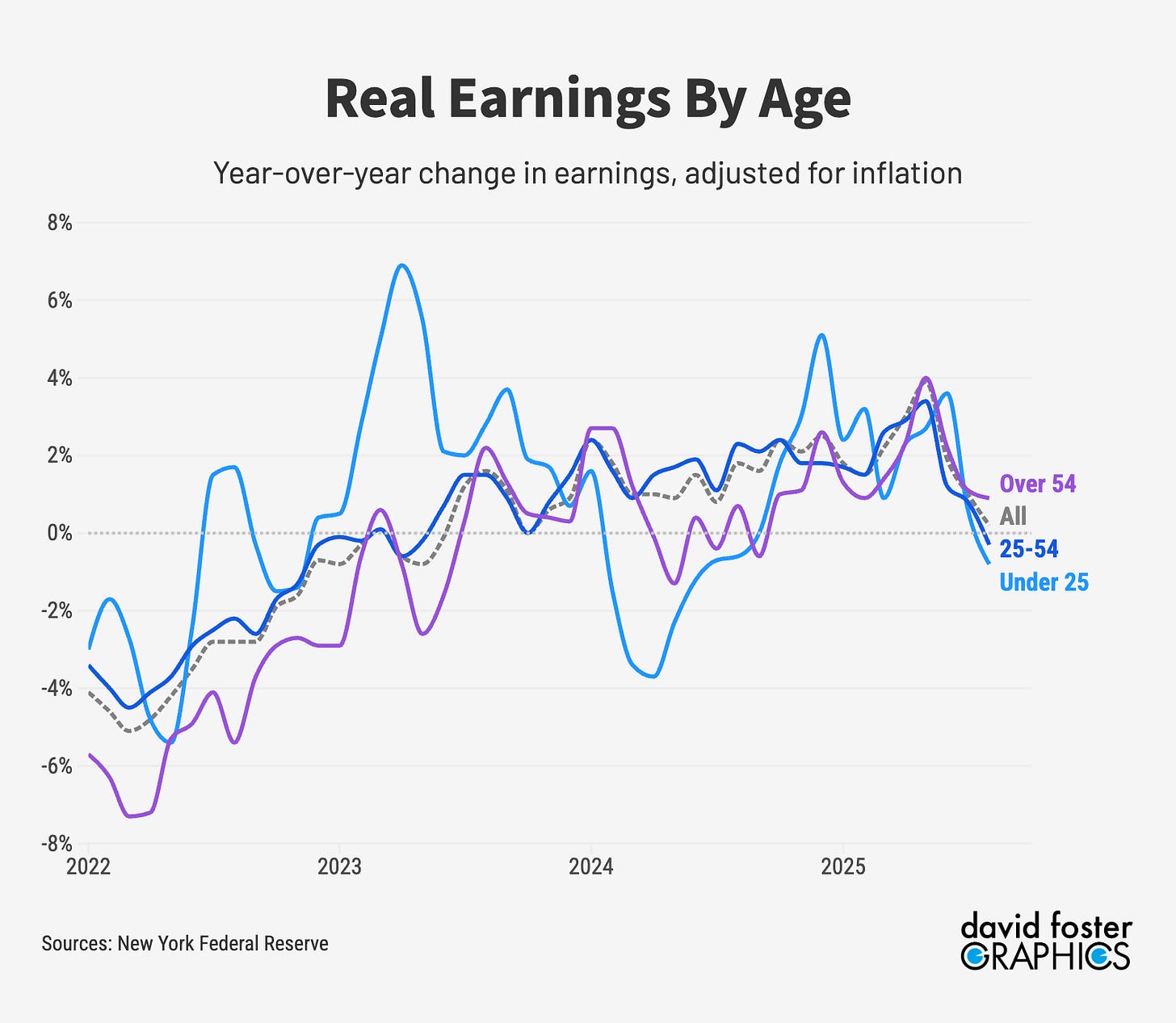

The second problem is that real incomes, adjusted for inflation, are flatlining. This is partly a function of inflation itself, since a higher inflation rate degrades the purchasing power of a fixed paycheck. But hours worked are down, as well, and the unemployment rate is rising. That’s nibbling away at nominal incomes before inflation even takes a bite.

It’s also possible that the unexpected drop in the inflation rate is an anomaly caused by the shutdown, which distorted the way the government collected the November data. There was no November data on auto insurance, for instance, which has been a budget buster during the last couple of years.

[Big picture: The Trump economy is supbar]

“It’s possible that this does reflect a genuine drop-off in inflationary pressures,” Capital Economics reported on December 18. “But such a sudden stop is very unusual, at least outside of a recession. It looks like we will have to wait until the December data is published to verify whether this is a statistical blip or a genuine disinflation.”

Many Americans probably feel like they already know: inflation is still a problem, and Trump can’t talk it away.

[At least there’s this: 3 Trump disasters that didn’t happen in 2025]