The other affordability problem: Incomes are flatlining

Workers are backsliding. Trump doesn't get it.

The affordability crisis afflicting millions of Americans—and Donald Trump’s presidency—is partly a problem of high prices. Inflation is down from the 40-year high of 9% in 2022, but most prices that shot up stayed up, and families on a budget still feel the pain.

There’s another aspect of affordability that gets less attention but is just as important: Incomes that are barely keeping up with inflation and, for some workers, falling behind.

Real income, or earnings adjusted for inflation, is positive most of the time, economywide. Incomes usually rise by a little more than overall inflation, which is how workers get ahead and the economy becomes more productive over time.

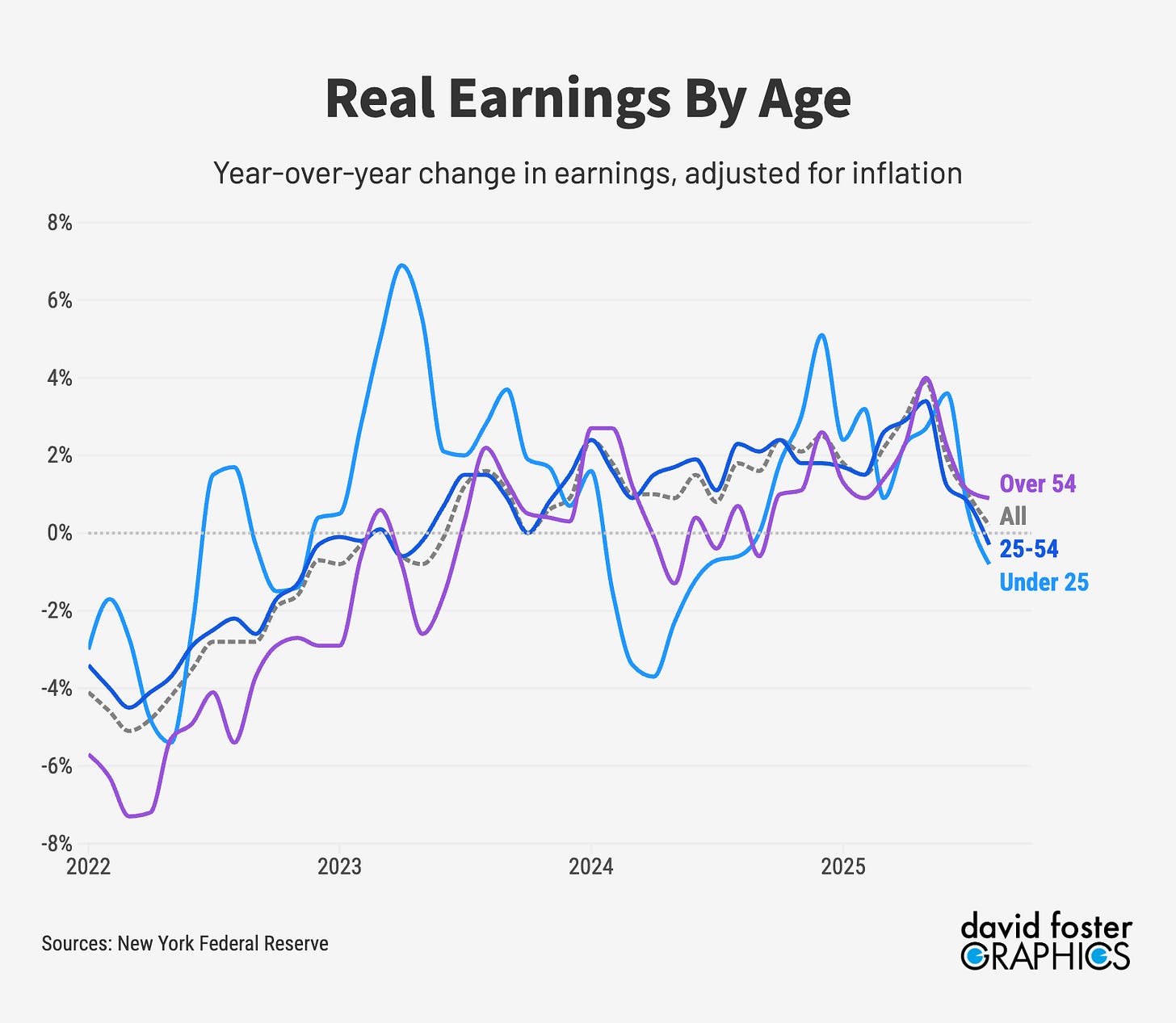

But real income growth is suddenly stalling. For all workers, real income has risen just 0.2% during the last 12 months, according to data compiled by the New York Federal Reserve. For workers under 54, real income has turned negative, as the following chart shows. It’s still positive for older workers, keeping overall real income growth slightly positive, for now.

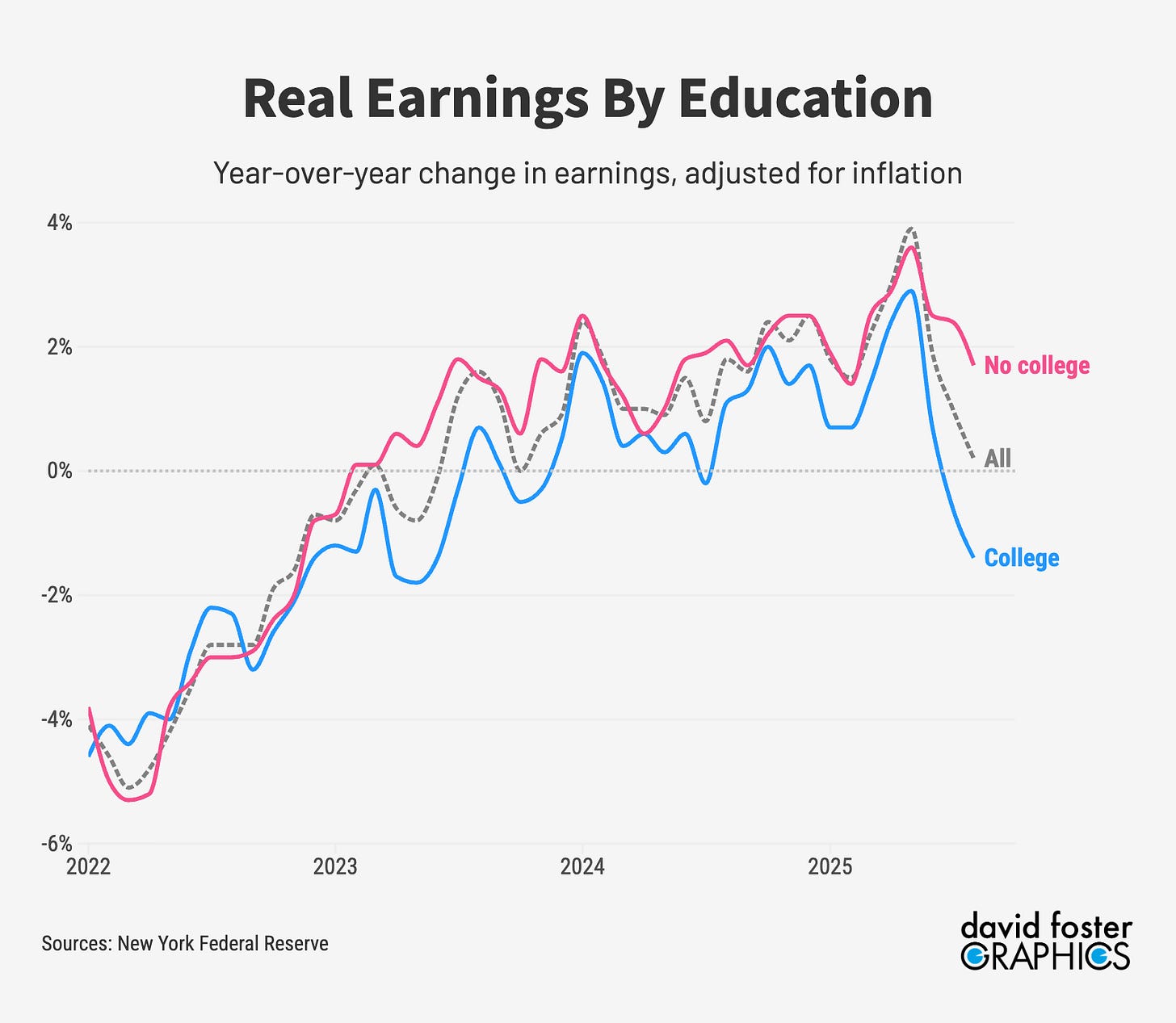

Over the summer, Treasury Secretary Scott Bessent bragged about “the ongoing boom in real blue-collar wage growth.” It wasn’t that much of a boom, but the trend was positive.

Now, there’s nothing to brag about. On a monthly basis, real income peaked in May and is now about 1.3% below that level. Falling real income is partly a mirror image of inflation, which has been rising since April. If inflation rises and income stays the same, then real income, adjusted for inflation, falls.

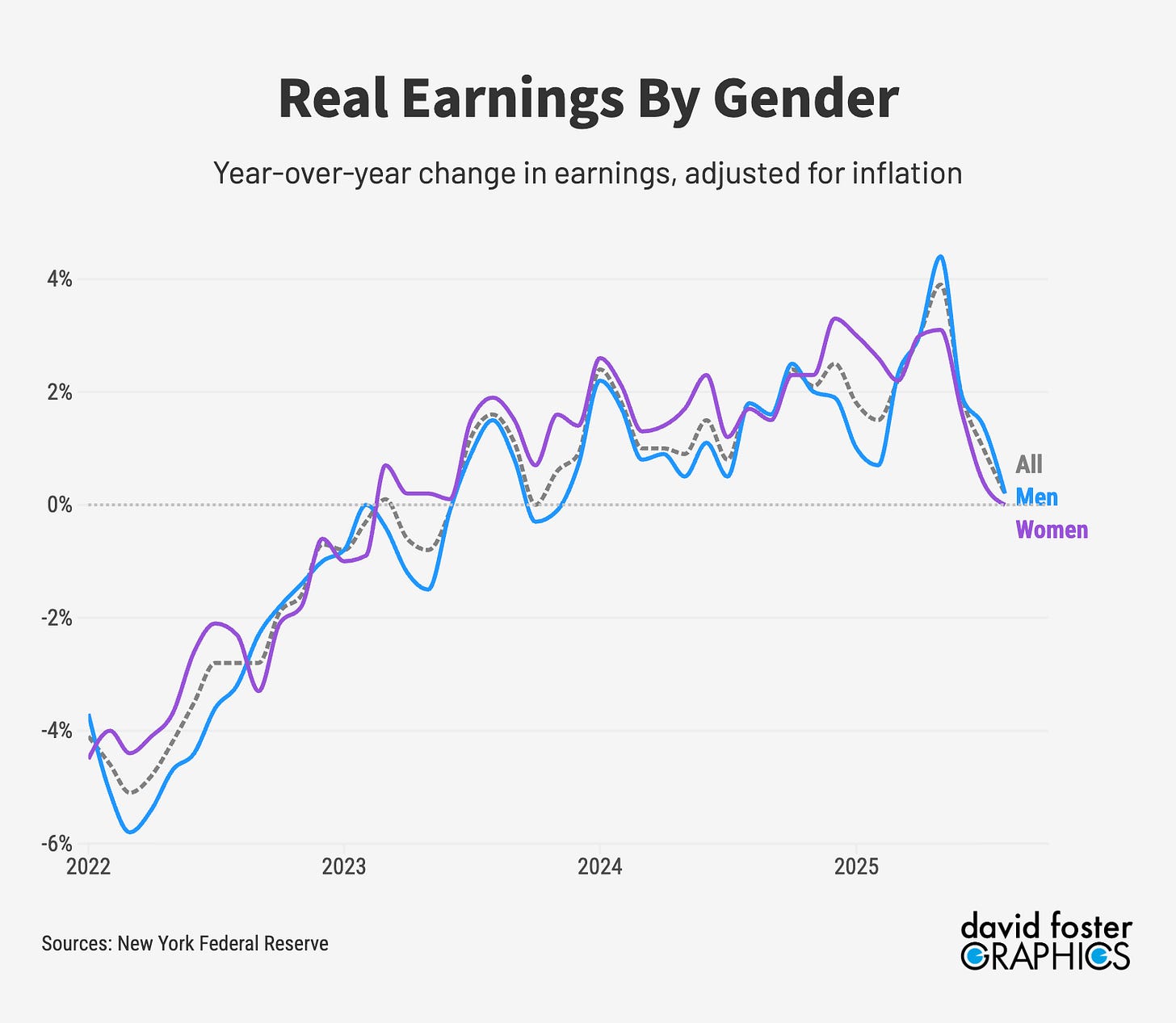

But real income also reflects how much people work, which has been gradually declining for four years. “This is about overall worker wellbeing, and weekly hours are a big part of the story,” says Philippa Dunne of TLR Analytics.

Real income is now considerably lower than the historical average. For the 20 years prior to the Covid outbreak in 2020, real income growth averaged 0.43% per year, and that included four years of declines starting in 2010, after the Great Recession. For the five years prior to Covid, real income growth was a robust 1.4%.

Covid threw the numbers out of whack, but everybody knows what happened starting in 2021, when inflation surged and real income turned negative. That meant prices were rising by more than incomes.

By the middle of 2023, real income growth was positive again, and consumers were regaining lost ground. That trend continued until this past summer, prompting Bessent’s boast. From January 2024 through July 2025, real income growth averaged 2% per year, better than the five-year pre-Covid period.

The dropoff since then coincides with the rollout of Trump’s tariffs. Trump began his tariff binge in April, and his tariffs have now pushed the average tax on imports from 2.5% to nearly 17%. American businesses and consumers pay the tax, which raises costs and is basically built-in inflation.

The inflation rate fell steadily from 9% in June of 2022 to just 2.3% in April of this year. But since then it has bounced back to 3%, and could drift higher as Trump’s tariffs become unavoidable.

Most Americans don’t keep a spreadsheet gauging the monthly change in their purchasing power. But they know intuitively when it’s falling—and express their frustration in a variety of ways.

Consumer attitudes are dismal, with some confidence surveys at recessionary levels. A year ago, only 21% of Americans said they expected their financial situation to worsen during the next year, according to University of Michigan surveys. That has nearly doubled, to 41% who now expect their finances to worsen.

In the same survey, 68% now say they expect prices to rise by more than incomes during the next year. That’s the highest level in data that goes back to 1967. If incomes were rising by more, inflation would be less of a problem. But there’s a sharp slowdown in hiring and many workers don’t have the leverage to demand a raise or switch to a higher paying job.

Voters clearly blame Trump and his fellow Republicans for lost purchasing power. In a handful of off-year elections last month, Democrats running against Trump’s economic plan and stressing affordability romped. Some analysts think that foretells a wipeout for Republicans in the 2026 midterms, with Dems taking back the House and maybe the Senate.

Trump sounds like somebody who’s hearing the words but doesn’t understand what they mean. After those Democratic wins, Trump claimed that he’s the “affordability president,” insisting that living costs are lower now than they were during the Biden presidency. But then he tried a new approach and said, “affordability is a con job by the Democrats,” as if it’s just a tagline that doesn’t resonate with real people.

Maybe Trump thinks his falling approval rating is fake news. But that’s exactly what happened to Biden when inflation spiked and paychecks effectively shrunk. Biden’s approval rating started to sink in 2021, just as inflation was taking off. Inflation improved, but voter attitudes toward Biden didn’t. Trump is heading the same way if he continues to blow off affordability woes that are intensely real for millions of Americans.

We were out shopping today and, we pasted by two young couples a male and, a female that had two shopping cart's full of all kind's of things for every day living but, you could tell that they were broke and, living on the street.I truly believe the baby boomers are the only thing that is making Trump's economy from totally crashing.If these policies stay in effect our country will be in bad shape . I "ll put my guarantee on it.