3 Trump disasters that didn’t happen in 2025

Trump himself called off the tariff recession many economists predicted

As the end of 2025 approaches, the obligatory retrospectives on the first year of Donald Trump’s second presidential term are rolling in. It’s been eventful, for sure.

Trump has mounted a “hostile takeover of Washington,” as CNN put it, exerting executive authority on a scale not seen since FDR during the Great Depression, and maybe surpassing that. He has attempted to remake the immigration system, the federal bureaucracy, the global trading regime, the national security environment and much more, sometimes shoving legalities aside. Critics worry that Trump may ultimately try to scrap democracy itself.

Yet some predicted disasters haven’t happened. The economy is still growing, the stock market sits close to record highs and forecasters are fairly optimistic about the upcoming year. Understanding what Trump didn’t do in 2025 may help clear some of the fog about what might happen in 2026, starting with these three Trump disasters that didn’t happen:

The Trump tariffs didn’t cause a recession. Some analysts say economists got this one wrong, given the many forecasts of a shrinking economy if Trump imposed all the tariffs he threatened at the beginning of his term. But that’s not really right. Trump never laid out a detailed tariff scheme for economists to model. They had to guess what kind of import taxes he’d impose, how steep those taxes would be and what kind of retaliatory measures trade partners would impose in return.

The doomy forecasts looked to be on the mark after Trump unveiled extremely aggressive “reciprocal tariffs” on April 2. Those taxes were so egregious that the S&P 500 index fell 12% in six days. Had Trump left those tariffs in place, we could have had the recession many economists foresaw.

[Feeling worse off? The data says you’re right]

But Trump got the message and ultimately rolled back many of those tariffs. For the next few months, Trump basically tested the market by threatening or announcing certain tariff levels then changing them or claiming that country-by-country trade deals were suddenly in place.

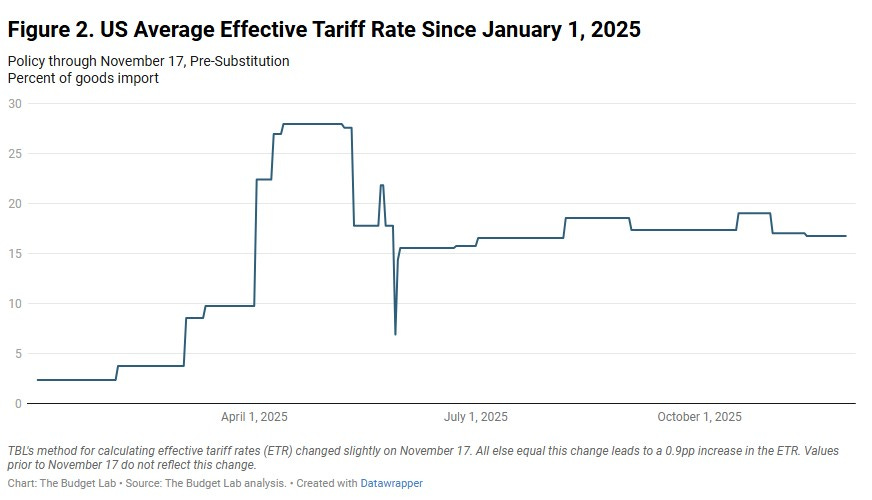

The trial-and-error finally produced an unsteady equilibrium in which everybody has figured out how much tariffing the market can actually handle. This chart from the Yale Budget Lab—seen everywhere in 2025—tells the story.

The average tax on imports when Trump came into office was about 2.5%. By April, Trump had pushed it to 28%. We know from the adverse market reaction that that was too high, and could have caused the recession economists worried about. Changes since then have brought the average tariff rate down to about 17%. Markets have signaled they can live with that.

Two other factors have limited the collateral damage caused by import taxes that push costs higher. One is that Americans importers proved extremely adept at adjusting their global supply chains to offset the higher costs of tariffs and keep them from stoking inflation. The other is that Trump is issuing thousands of exemptions on a case-by-case basis that let some importers avoid the highest tariffs. It’s possible the real-world average tariff could end up well below 17% once the dust settles.

[The Trump stock market is good, not great]

Finally, Trump simply wasn’t willing to take the blame for the economic damage his tariffs would have caused had he left them at his preferred April 2 levels. Trump himself called off the tariff-induced recession.

Trump didn’t seize control of the Federal Reserve. He yawped repeatedly about how badly he wanted to fire Fed chair Jerome Powell and install a loyalist who would slash interest rates to stoke growth. But he never did. Many business leaders warned how dangerous it would be to have a political activist running the Fed, and as of now, the Fed remains independent. Investors think its rate-setting policies are more or less justified by economic conditions, as they are supposed to be, and not by political concerns.

Trump isn’t done trying to influence the Fed. He will appoint the next chair, who will take over when Powell’s term ends next May. Trump may also try to stack the 12-person policymaking committee with a few more loyalists. But Trump may find he’s better off using the Fed as a scapegoat for whatever goes wrong in the economy—which markets can tolerate—than trying to manipulate the Fed and answering when markets quake.

Trump didn’t rig the economic data. This became a concern after Trump fired the head of a governments statistical agency when it reported weak job numbers Trump didn’t like. Trump then nominated a controversial conservative economist to replace her, stoking fears that Trump would order government agencies to fudge economic data to make the economy under his watch look better than it really was.

[The other affordability problem: Incomes are flatlining]

But Trump withdrew that nomination amid pushback from Republicans in the Senate, who balked at confirming him. There have been no signs, meanwhile, of any effort to rig the official numbers. And some of that data has actually gotten worse, with job growth, as one example, weakening even more than when Trump had his firing fit over the summer. The 6-week government shutdown disrupted some data releases, but nobody thinks that was an effort to cook the books.

None of this means Trump was a saint in 2025 or will be in 2026. It’s a safe bet Trump will do something that surprises markets during the next year. But we should at least acknowledge disaster avoided and try to keep that trend going.

We still have 16 days left in 2025. Don't count him out yet! After all, he's not exactly known for holiday-season cheer and charity (witness the post today on Rob Reiner's death). But I'm hoping he stays calm and doesn't do much damage over the remaining 16 days. Come to think of it, it would be nice if he did the same for the remaining 36.5 months of his term after the next 2 weeks! LOL

Hello Rick. I enjoy your articles. From my vantage point, trump has wrecked the goodwill the United States has spread around the world for more than a century. The world knows who he is, a bloated american misfit who is in love with himself. History will not treat him kindly. As for those who voted for him, only the wealthy are pleased and the market is simply waiting for "the moment" when everyone awakes to the folly of AI. the U.S. dollar has significantly lost value in 2025, dropping over 10% against major currencies, its worst performance in 50 years, driven by trade uncertainties (like Trump's tariffs), rising U.S. deficits, and policy confusion.

In short, at this time, the United States is operating on a wing and a prayer. Got Gold? you'll wish you did.