The Trump stock market is good, not great

Record highs are great, but also routine. Overall, stock-market gains under Trump are middling.

Stocks have had a good year, something President Trump wants everybody to know. “Stock market breaks record high today,” Trump posted recently on social media, one of his many boasts about rising asset values.

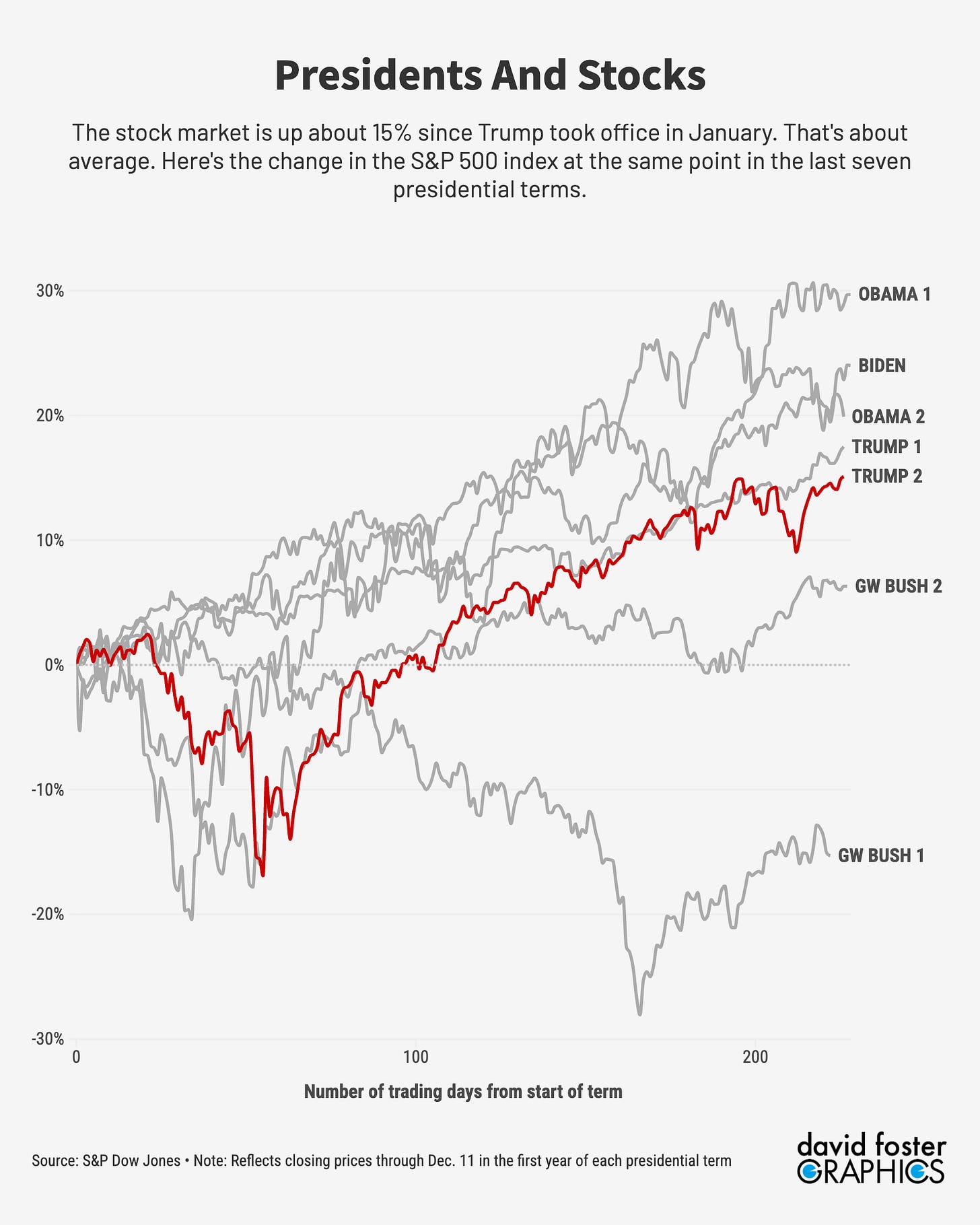

The S&P 500 stock index has risen about 15% since Trump took office in January. Best stock market ever? Not by a long shot. The Trump stock market is in the middle of the pack, compared with stock gains under the six prior presidential terms going back to George W. Bush at the start of the century.

The Pinpoint Press does detailed tracking of the Trump economy using data supplied by Moody’s Analytics, including stock values for every president. Our methodology lets us compare the current president with his predecessors at the same point in each presidential term, using six key metrics.

Here’s how the stock market has performed under Trump, compared with the six prior presidential terms, as of December 11 of each year:

Even with the S&P hitting a new record high on December 11, the Trump stock market ranks 4th out of 7 compared with six prior presidents, at the same point in each term. Nobody’s complaining about the 15% Trump gain. It’s just not extraordinary.

Stocks got off to a wobbly start after Trump took office, mostly because markets reacted poorly to the steep tariffs Trump rolled out in April and May. Trump canceled some of those tariffs, calming markets. That set the stage for a stock rally that began in May and has continued mostly uninterrupted ever since.

It’s been a perfectly normal rally. On average, the S&P gained 14% at the same point in the first year of every presidential term of the 21st century. So Trump’s 15% return is slightly above average. But the stock market did better at the same point in both of Barack Obama’s two terms, in 2009 and 2013. It did better during Trump’s first presidential term, in 2017, and during Joe Biden’s first year, in 2021.

Trump also brags just about every time stocks hit a new record high. But record highs are routine. The stock market rises over time, and stock prices are not indexed for inflation. That means there will always be new record highs. In 2024, Biden’s last year as president, the S&P hit 57 record highs. So far this year, the index has hit 35 record highs.

Presidents normally angle for credit when stocks do well. But presidents have less control over stocks and the broader economy than many people think. Trump demonstrated the harm bad policies can cause in April, when he unveiled his “Liberation Day” tariffs, and stocks sank 11% in five days. That selloff forced Trump to call off some of those tariffs.

But the stock market gain during the rest of the year is probably more in spite of Trump’s policies than because of them. The artificial-intelligence frenzy has been the main propellant, with investors bidding tech stocks to stratospheric levels as they hope to cash in on a technology revolution. That’s the market at work (and maybe a mania), not government policy.

Obama notched the best stock return at the mid-December mark of his first year mainly through a quirk of timing. Obama took office during the late stages of the Great Recession. Stocks had been plunging for 15 months and would bottom out just two months after Obama took office. His presidency began just before an epic bull market kicked off. That bull market continued all the way through Obama’s second term and most of Trump’s first term.

When Biden took office in 2021, the stock market and the whole economy were just regaining steam after the Covid shutdowns of the year before. Unprecedented fiscal and monetary stimulus were helping fuel the market’s gains. That rally stalled for most of 2022 and 2023, amid Russia’s invasion of Ukraine, spiking energy prices and a nasty bout of inflation. But those depressants dissipated and stocks had a banner year in 2024, rising more than 23%.

The incumbent Democrats lost the White House all the same in 2024, underscoring the old adage that the stock market and the real economy aren’t the same thing. Stocks rose last year even as many Americans struggled with high prices and stagnating incomes, the main reason voters demanded change and elected Trump.

Now Trump is the one with decent stock market gains that aren’t trickling down far enough into the real economy. Stock owners are generally doing well, representing the upward slant in the so-called K-shaped economy. But the working class on the downward slant is still struggling to get ahead, and they’re beginning to blame Trump for their woes. No matter how bubbly it might be, the stock market can’t save presidents.

Just one comment! Have you ever heard of the term"Air Head"! It fit's.