What mattered this week: Venezuela wow, Tesla down, Trump’s compression socks

Plus: The coming Trump tax revolt

THE TOP 5:

Trump owns Venezuela, now. Hardly anybody foresaw the stunning capture of Venezuelan dictator Nicolás Maduro by American troops in Caracas on January 3. It’s an astonishing display of prowess by the US military. Maduro must have been careless and completely unaware that US commandos were tracking his moves. The Trump administration will now prosecute Maduro for drug trafficking and related charges.

Capturing Maduro may turn out to be a lot easier than managing what happens next in Venezuela. Trump said on January 3 that “we are going to run the country” until there’s a transition to new Venezuelan leadership acceptable to Washington. This is incredibly audacious and possibly crazy. Since there’s no US invasion force in Venezuela, Trump’s team will have to work with authorities there, including Maduro allies and others tied to trafficking groups, criminal gangs and even terrorist organizations. Trump also said American oil experts will intervene to modernize Venezuela’s oil industry, which sits atop the world’s largest known reserves. That could eventually make Venezuela a rich country, but it will probably also generate astounding amounts of graft.

There are many unhappy examples of American-led regime change that went bad. The US invasion of Iraq in 2003, for one, turned into a disastrous bloodbath. US troops captured Saddam Hussein in 2003, then spent the next eight years trying to manage a nation riven by sectarian violence. Nearly 4,500 American servicemembers died in the violence, plus more than 100,000 Iraqis. US forces finally left in 2011.

Few in Venezuela will miss the unelected thug Maduro. That doesn’t mean something better is inevitable. Deposing Maduro could end up as the most momentous decision Trump makes in his second presidential term. Expect unintended consequences.

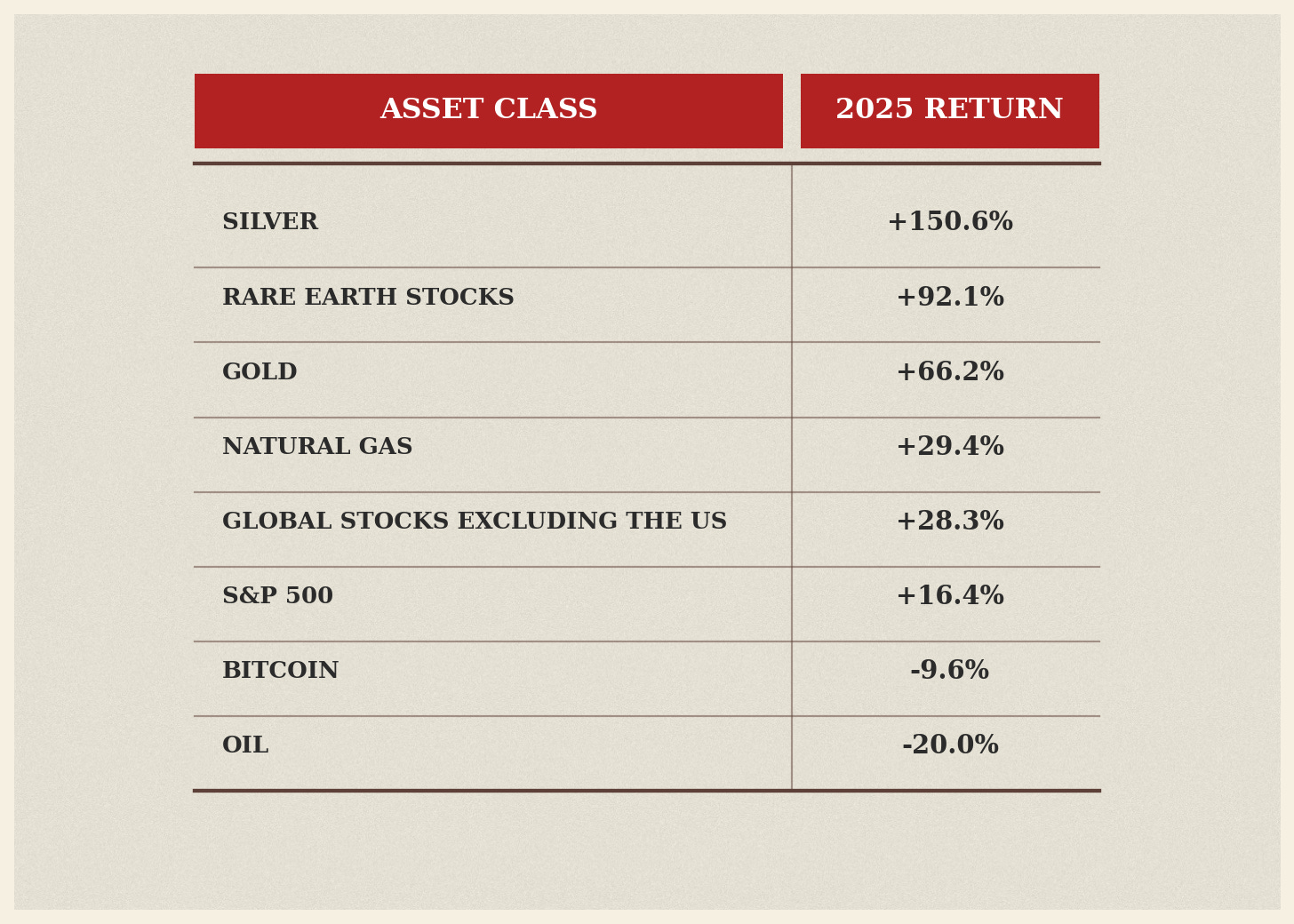

Stocks had a solid but not spectacular year in 2025. The S&P 500 index ended the year up 16.4%, after a 23% gain in 2024 and a 24% return in 2023. That’s a great run. Most Wall Street forecasts call for continued gains in 2026, though perhaps in the single digits.

US stocks, however, weren’t all that in 2025. “As good as a year as it was for the S&P 500, there were far better investment opportunities,” David Rosenberg of Rosenberg Research pointed out in a review of the year. US equities underperformed stocks in South Korea (up 75.6%), Brazil (up 34%), Mexico (up 29.9%), Canada (up 28.3%), Japan (up 26.2%), and even China (up 19.3%). Gold, silver and other metals also did better than US stocks.

[See 10 things that will matter in 2026]

Many investors expect better returns abroad than in the US stock market in 2026. A weaker dollar should persist this year, which would boost foreign returns for American investors. Long-term interest rates are more likely to rise than fall, which could also undercut the performance of US stocks. You’ll hear more about the weakening dollar and the implications for American investors in coming weeks at The Pinpoint Press.

Trump’s health. President Trump’s propaganda machine (aka his thumbs) let everybody know that he “aced” a cognitive exam and is in “perfect health,” according to a January 2 social-media post. But much more believable was an unusually candid interview Trump gave the Wall Street Journal, in which he acknowledged some health challenges and sounded kind of like a normal 79-year-old.

Trump told the Journal that he pops more aspirin every day than his doctors advise because “I want nice, thin blood pouring through my heart.” The aspirin, he said, explains why he bleeds easily and why he frequently has noticeable bruises on his wrists and hands.

To treat a condition known as chronic venous insufficiency, which causes leg swelling, Trump said he tried wearing compression socks over the summer. “I didn’t like them,” he told the Journal. So he stopped.

[More: How to undo Trumpism]

Trump also said he has trouble hearing “when there’s a lot of people talking.” But he mocked the idea that his hearing is otherwise impaired. He also denied that he falls asleep in meetings, even though there’s photographic evidence. Trump said he just closes his eyes sometimes “because it’s very relaxing to me.” He said footage that appears to show him sleeping really just shows him “blinking.”

Whatever you think of Trump, he appears vigorous for a 79-year-old who gets little exercise and eats like crap. He wrestles regularly with the press and reportedly functions on little sleep. Trump credits his longevity to good genes. Maybe so.

Iran boils. Protests are erupting throughout Iran—where protests are basically illegal—as infuriated business owners, consumers and students react to soaring inflation that’s wrecking purchasing power. The official inflation rate is 50%, with real inflation probably much higher. The Islamic theocratic regime, meanwhile, plans to hike taxes to offset declining revenue from oil sales. You and I would be pissed, too.

Trump entered the fray on January 2 by saying that if Iran kills any protesters, “the United States of America will come to the rescue. We are locked and loaded and ready to go.” That obviously implies another bombing raid in the vein of the June attacks on Iranian nuclear facilities. But it’s not obvious what Trump would target. The June strike had a singular goal: Destroying Iran’s nuclear facilities. Bombing Iran to punish the regime would be a lot messier. As the Maduro capture indicates, it takes troops on the ground to depose a foreign leader. Airstrikes alone won’t do it.

Tesla toppled. Elon Musk’s electric-car company is no longer the world’s EV champ. China’s BYD sold 2.26 million EVs in 2025, while Tesla sold 1.64 million. So BYD topped Tesla in annual sales for the first time.

But that doesn’t really matter. BYD sells cheap EVs around the world and was bound to become the world’s volume leader. The bigger issue for Tesla is that sales dropped 9% in 2025, for a variety of reasons. Musk, the CEO, has become a pariah to some consumers, on account of his right-wing political activities. EVs in general are in a lull, with Trump canceling federal subsidies and trash-talking green energy. Tesla’s price-to-earnings ratio is 302, roughly 10 times higher than the S&P 500 average. That means investors expect outsized earnings from Tesla in the future. From what?

[Do you know enough about artificial intelligence? Take the Pinpoint Quiz]

You can’t buy a BYD vehicle in the United States, due to tariffs, regulations and other barriers. In Mexico, the company’s lineup ranges from the compact Seagull, starting at about $18,000, to the Han luxury sedan at around $68,000. Reviewers say BYD vehicles are pretty good and getting better.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

WHAT WILL HAPPEN NEXT WEEK:

Marjorie Taylor Tax Revolt? Firebrand Marjorie Taylor Greene of Georgia will leave Congress on January 5, and … do what? The former MAGA stalwart has broken with Trump recently, complaining that he’s ignoring affordability concerns and other issues he once championed as part of his “America First” policy. She recently suggested that a “tax revolt” is underway among some Trump voters. So an obvious question is whether Greene will retreat into the private sector or try to foment a new type of anti-Trump conservative movement. Greene is kooky but also strangely charismatic. At a minimum, she could probably become a MAGA spoiler if she wants to.

Jobs data. The jobs report for December will arrive on January 9. The last few monthly datasets have been distorted by the six-week government shutdown that ended in November. Job growth has been slowing sharply and economists expect the December numbers to confirm the trend. A stagnant labor market will be one of the biggest economic stories of 2026.