10 things that will matter in 2026

Stocks up, rates up, Trump down, AI everywhere, and a few possible surprises

We have to start with artificial intelligence, which grabs two of the top 10 spots.

AI 1. Don’t write off the AI trade. The boom in spending on data centers and other AI infrastructure drove much of the stock market’s 18% gain in 2025, with the Magnificent 7—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—racking up outsized gains. By November, some analysts thought the AI trade had played out, with a rotation under way into the “other 493” stocks in the S&P 500 index.

But killer returns in the past don’t preclude killer returns in the future. Bank of America tech analyst Vivek Arya argues that the AI boom, which started in 2023, could last 10 years, with plenty of gains ahead. “This race is still in the early stages,” he said during a December briefing. Arya thinks tech giant Nvidia—up more than 1,300% during the last five years—might actually be undervalued, given massive profits it has to invest somewhere.

One thing that has changed about the AI trade is new concern that there might be some epic losers. The worry is that some companies—OpenAI, ahem—will never earn enough money to justify the massive amounts they’re spending on data centers and other infrastructure. The end result could include debt write-downs, consolidation, and bankruptcies. Well-capitalized tech giants such as Nvidia, Microsoft and Alphabet will be fine, but any tremors could puncture sky-high stock valuations. That’s the bursting bubble scenario.

Yet most forecasters aren’t predicting a painful reckoning in 2026. As Sam Ro points out, most Wall Street firms think the overall stock market will rise by 8% to 16% in the coming year. Market guru Sam Stovall of CFRA has a more moderate view. He points out that the S&P has risen by double digits for three years in a row—a “threepeat”—and a “fourpeat” would be very unusual. He sees a 7% gain.

Tip: Famed short seller Michael Burry is one of the leading AI bears predicting a bursting bubble. You can follow his Substack if you want to know why. It’s wonky.

AI 2. The AI business revolution will intensify. This is totally different from whatever happens with AI stocks. Businesses are aggressively testing how AI can boost productivity and profitability. Massive experimentation is bound to affect workers in good ways and bad.

Morgan Stanley recently published a detailed outlook for 24 different sectors, with AI central to many coming developments. Examples: “Agentic” shopping could transform retail, with AI functioning as the agent. In freight transportation, AI-driven savings could exceed 100% of pre-tax earnings. Apple’s Siri is due for an AI reboot in 2026, which might help Apple catch up to competitors that have outrun it.

[See 18 things that mattered in 2025]

The obvious worry is that AI will displace workers. But it’s well understood that while transformative technology destroys some jobs, it also creates many new ones plus entrepreneurial opportunities that didn’t exist before.

Smart workers should learn everything they can about how AI might affect their jobs and careers. If your work seems threatened, branch out. But also look for ways to exploit AI to get better results and find new opportunities.

The upper-K economy will prosper in 2026. Those tax cuts President Trump signed last summer will start to juice the economy soon. Tax withholdings for many workers will decline starting in January. That’s more disposable income right off the bat. Many of the tax cuts applied to the 2025 tax year, which means refunds could be bigger than many taxpayers expect. Refunds generally arrive from February through April.

[I joined CNN on December 29 to discuss the economic outlook for 2026. Here’s the clip👇]

The fiscal stimulus from the tax cuts is substantial, one reason economists think growth will be solid in 2026 (also helping boost corporate profits and stock values). On top of that, Republicans are likely to pass another tax cut bill, probably in the first half of the year. It’s not clear what will be in it, but Rs know that Democrats could snatch one or both houses in the midterm elections, so this could be their last shot at big partisan legislation.

[What the heck happened in 2025, anyway? Take the Pinpoint Quiz]

The Supreme Court could kill many of Trump’s tariffs, which would also be good for the economy. Trump might roll out replacement tariffs, but whatever the case, most of the market shock from tariffs is in the past. Markets have found ways to live with them and Trump himself backs down when the stakes get too high.

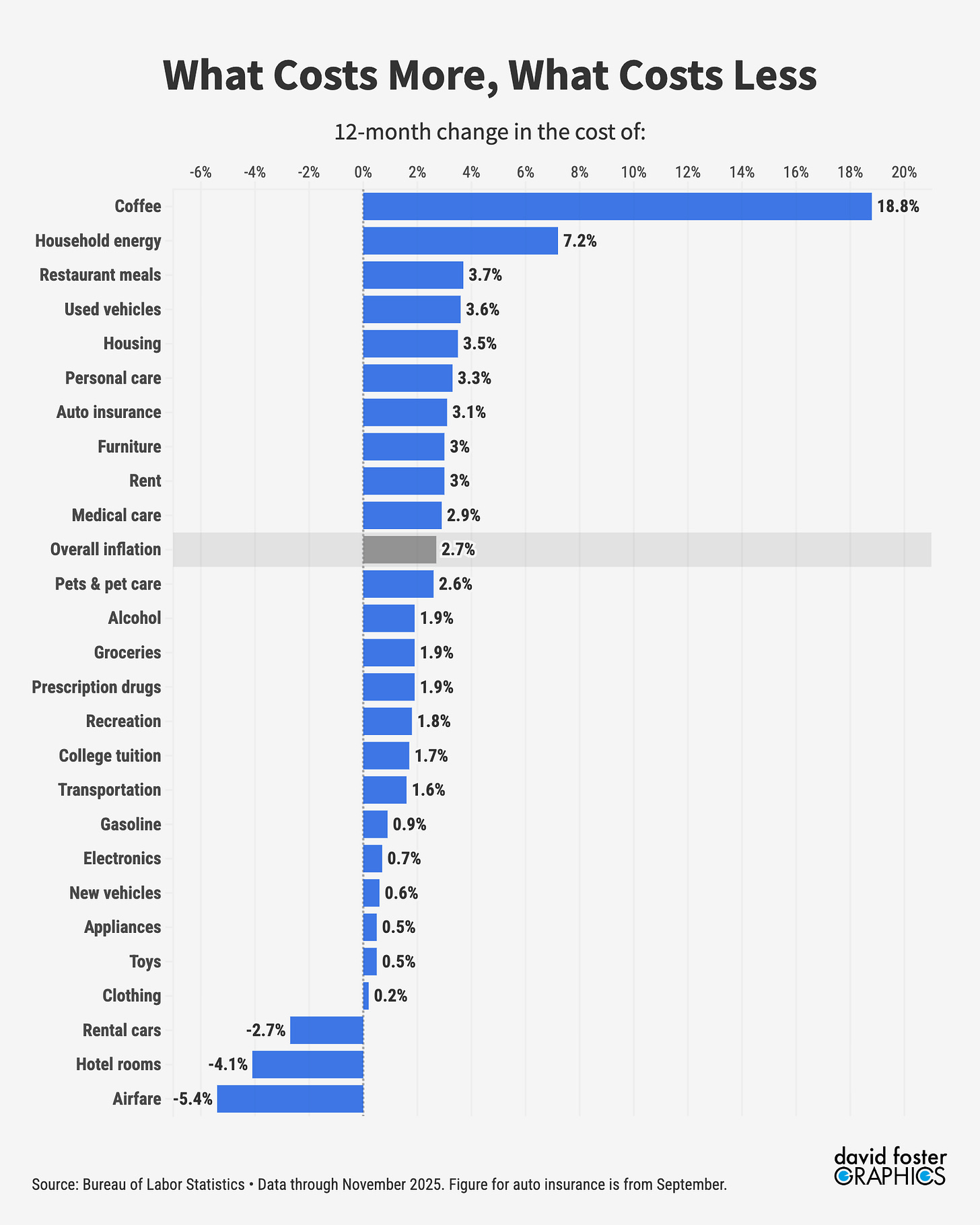

Affordability struggles will continue to dog lower-K Americans. Lower earners, alas, won’t gain much from the Trump tax cuts. Plus, the tax bill cuts Medicaid and food aid. Gasoline is pretty cheap, but anybody who pays a utility bill knows that heating and electricity costs are jumping. And most people spend more on utilities than gasoline.

Health care costs, meanwhile, will spike for millions as federal subsidies for insurance purchased under the Affordable Care Act expire. That fight will continue into 2026, with another government shutdown possible at the end of January as Democrats demand a health care fix and Republicans balk. Affordability dominated several off-year elections in 2025 and it will be the main attraction in the 2026 midterm elections.

Don’t expect a break on interest rates. Federal Reserve rate cuts get tons of attention, but those are short-term interest rates that mostly affect banks. Changes in long-term rates matter a lot more to consumers and businesses. And those rates are probably stuck where they are, even if the Fed cuts short-term rates in 2026.

[See 3 Trump disasters that didn’t happen in 2025]

The Fed has lowered short-term rates by nearly 2 percentage points in 16 months. Yet long-term rates such as the 10-year Treasury and the average 30-year mortgage haven’t budged. Bond markets are complicated, but investors in general are worried about future inflation and excessive government debt in the United States and many other countries. That means they demand higher rates on bonds to compensate for increased risk. “Bond vigilantes” have been warning for years that reckless borrowing will eventually mean higher rates for everybody. It’s finally happening.

GLP-1s go mainstream. The economic impact of weight-loss drugs, which also treat diabetes and other conditions, will accelerate in 2026, for a few reasons. First, new oral forms of the drugs will eliminate the need for injections for many. Costs are coming down, too. Medicare recently said it would begin a program in 2026 to cover much of the cost of some popular weight-loss drugs.

Morgan Stanley says this category of drugs is “set to become among the largest pharma categories in history.” About 12% of American adults currently take some form of GLP-1. Side effects lead some to quit, but the market could still double or triple in coming years.

The economic implications could be surprising. The restaurant industry, for instance, is worried that people will eat less (or eat healthier), with one report warning that the rapid uptake of GLP-1s is “signaling a critical need for retailers and manufacturers to adapt.” Goldman Sachs thinks a healthier population could actually boost GDP growth.

War will trump peace (sorry☹️). Two conflicts relevant to Americans won’t go away and could get worse. First: Venezuela. Trump is clearly trying to force dictator Nicolás Maduro from power and open up Venezuela’s vast oil reserves to more American influence. The catch is that Maduro is unlikely to go along. A US ground invasion could roust Maduro from power, but that would be risky and there’s no guarantee a replacement will be better. The Council on Foreign Relations conflict tracker says there’s a “high” likelihood direct US strikes on Venezuela are coming.

Second: Ukraine. Trump has been pushing a peace plan, but there’s a huge barrier: Russian leader Vladimir Putin won’t stop unless he gets almost everything on his wish list, including lots of Ukrainian territory his troops have illegally seized. That would be fine with Trump—but not with Ukraine or its European allies, who fear appeasing Putin will just lead to more aggression in eastern Europe. The CFR conflict tracker says an intensification of the war is the most likely development in 2026, with Ukraine likely to increase its attacks on Russia’s defense and energy infrastructure.

Watch oil prices: Absent any shock, they should remain subdued, in the $55 range they’re in now. But either of these two conflicts could affect oil supplies and push prices higher.

Trump will do and say many outrageous things. That’s his brand and he thinks it works for him. Trump caused a lot of trouble for a lot of people in 2025, through deportations, tariffs, attacks on political enemies and other aggressions. But it’s worth keeping in mind that the economy has survived, courts have stalled much of Trump’s agenda and voters still have the power to boot politicians they don’t like. Trump’s falling approval rating suggests his power and the overall MAGA influence may have peaked in 2025.

You’ll get sick of hearing about the 2026 midterm elections any day now. The elections are obviously important, given that Democrats have solid odds of flipping one or both houses of Congress and blocking Trump’s legislative agenda for the last two years of his presidency. But the media is going to overhype everything about the midterms all year long. If you’re not a political junkie, feel free to disregard until the fall.

Tip: Larry Sabato’s Crystal Ball, affiliated with the University of Virginia, is a great source for the latest odds on who’s likely to win.

There will be surprises. It could be something dreadful, such as a cyber or terrorist attack. Maybe the awful Iranian regime will fall. Maybe Ukraine will assassinate Putin. Technological or medical breakthroughs are always possible. Unexpected things will surely happen in 2026. Try to imagine what some of them might be.

Rick as usual excellent insights.... One thing that may take up a whole column is the rise in gold an silver prices and the causes like Japanese interest rates..

Hello Rick,

We met many years ago online on the subject of "job search." We spoke as well.

If you would like a conversation on the subject of vaccine safety, I'd be glad to engage with you, presuming you'd like to preserve your credentials and moral compass of "journalist.'

I warn you. I am an OG veteran of the subject of vaccine dangers. I have spent thousands of hours reading, reviewing, educating others on the subject.

My son was vaccine injured more than 30 years ago. My family brought the first ever lawsuit versus Big Pharma in U.S. District Court in NY. (2002)

Our son is totally disabled and "incompetent" requiring 24/7/365 care. Yes, it's personal.

Provide an e-mail address and I will reveal myself with contact info.