The latest stock market buzzword you might want to know

The "HALO trade" is an antidote to AI mania. That doesn't mean every investor should jump in.

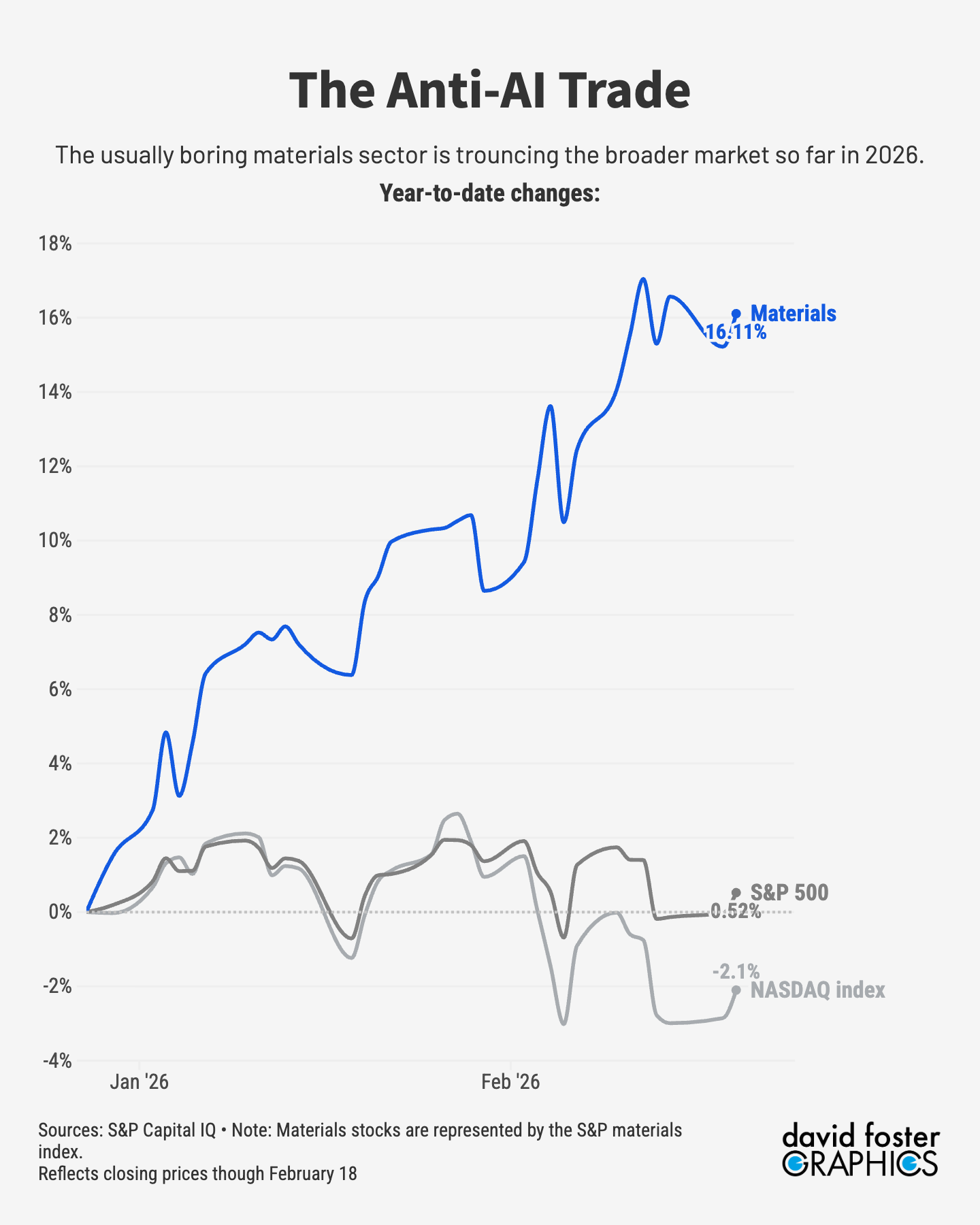

The US stock market is off to a grinding start in 2026, with the S&P 500 index flat and the tech-laden NASDAQ down about 2%. As we explained last week, the biggest loser so far this year has been the software industry, which investors fear could shrink as artificial intelligence replaces human programming.

But investors selling those stocks are buying other ones, giving rise to the HALO trade: companies that specialize in heavy assets with low obsolescence. That’s a cumbersome way of saying “products we use every day that are some sort of physical thing,” as Josh Schafer of Barron’s wrote recently.

HALO isn’t an industry, per se, but a way of grouping companies that make products not easily disrupted by AI. Examples might be generator company Generac (up 67% this year), transporter FedEx (up 24%), machinery company Caterpillar (up 17%), and retailer Walmart (up 14%). The Magnificent 7 stocks, by contrast (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) are mostly down this year.

One proxy for the HALO trade is the S&P 500 materials index, which includes businesses such as industrial gas company Linde, mining company Newmont, paint maker Sherwin Williams and steelmaker Nucor. That index has risen 16% for the year, handily outperforming the broader market and the once white-hot tech sector. Josh Brown, CEO of Ritholz Wealth Management, calls HALO “the most important investing theme of 2026.”

That doesn’t mean ordinary investors should plow into the HALO trade the way professional traders might. While many retail investors own index funds that mimic the overall market or a broad sector such as technology, most don’t target industries as narrow as software specifically. So there’s less need to rotate out of a cold trade into a hotter one.

By the same token, chasing a memey trade amounts to market timing, which most money managers advise retail investors to avoid. Better to factor the HALO trade or any other trend into periodic diversification and rebalancing.

It’s also worth keeping in mind that trading patterns can form long before anybody spots the trend. Morgan Stanley pointed out in a February 17 research note that the HALO trade has been underway since before it had a name, as more businesses outside of tech boost investments, in part to take advantage of tax incentives in the tax law President Trump signed last year.

[More: The “sell America” trade is looking pretty good]

The broader question is whether the AI trade has run its course. The NASDAQ peaked in October and has fallen by about 4% since then. There have been many declarations during the past few months of a rotation out of tech into other sectors. In addition to the HALO trade, for example, investors have been buying shares of smaller companies represented by the Russell 2000 index, which has outperformed the market and is up about 6% this year.

Yet investors still tend to snap up certain tech and AI stocks when they dip and seem like a relative bargain.

AI is obviously a long-term trend that could take many unexpected turns. Stocks exposed to AI will probably remain turbulent as investors continue to assess who the winners and losers will be.

[More: Why I started gambling on the news]

Bank of America thinks a lot of upside remains. “Despite a strong market rotation out of AI-exposed stocks, info tech and the Magnificent 7 continue to beat on fundamentals,” the bank’s analysts wrote in a February 17 research note summarizing fourth-quarter earnings. B of A thinks the AI trade could gain 25% this year, with the broader market up about 10%.

That would be a nice improvement on the market’s performance so far in 2026. And it might make us forget about HALO.