The “sell America” trade is looking pretty good

American investors should check out the eye-popping returns elsewhere in the world.

President Trump is proud of the “best stock market in history,” as he proclaimed on February 8. But which country is he looking at?

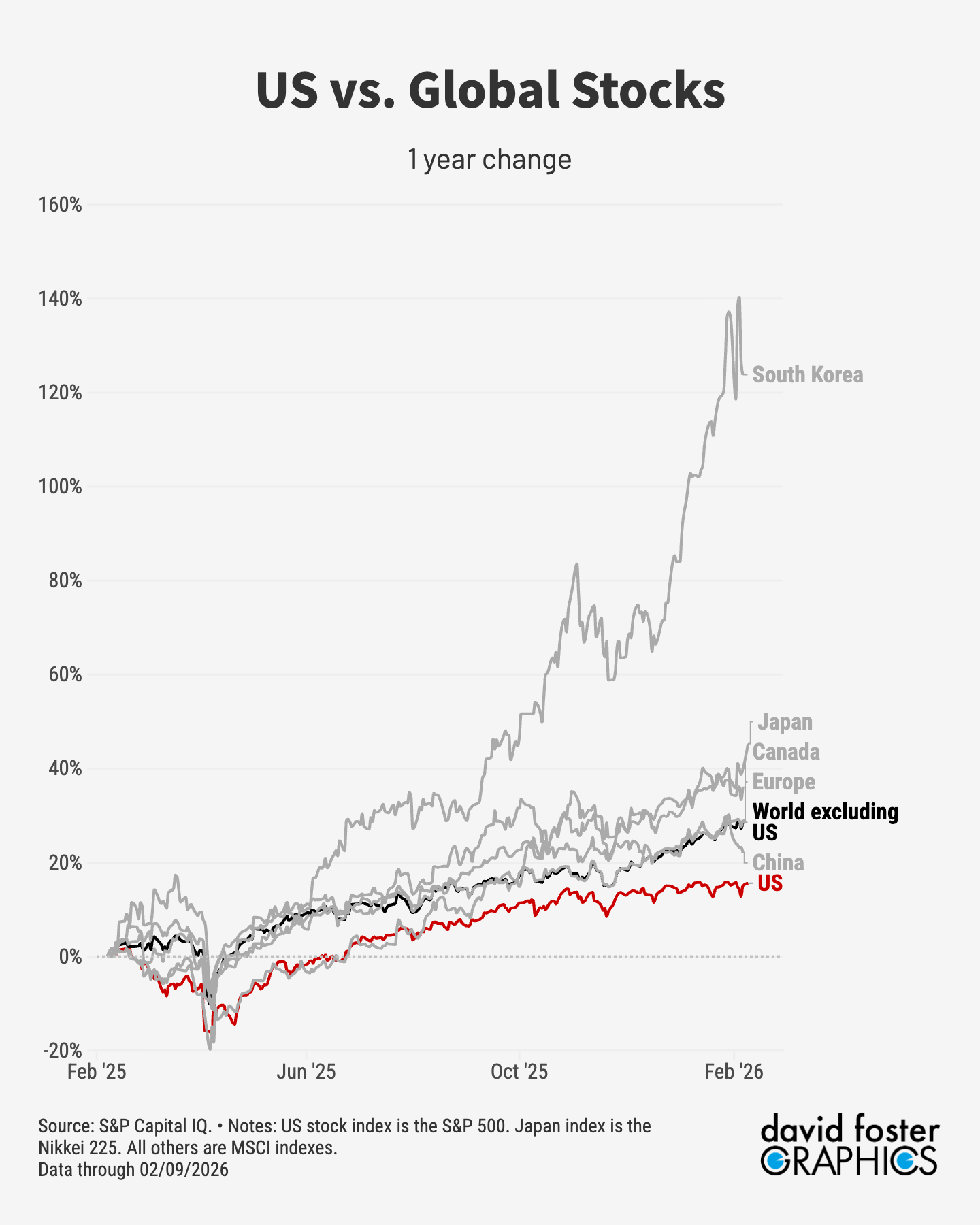

US stocks have done pretty well during the last year, with the S&P 500 index up a tidy 14%. The narrow Dow Jones index closed above 50,000 for the first time on February 6.

But US stocks have been laggards, not leaders, during the past 12 months. Global stocks, excluding US shares, have risen by 28% during the last 12 months. That’s double the return of the S&P 500. Stocks in many other countries have sharply outperformed US shares.

Not long ago, US stocks were the default for investors everywhere, due to years of outperformance. “American exceptionalism” pulled foreign money into US markets, further fueling gains. That was especially true after the Covid pandemic that started in 2020. Aggressive stimulus measures passed by Congress and adopted by the Federal Reserve powered the US economy out of the Covid downturn faster than virtually any other advanced nation.

But returns during the last year show a rotation under way. The following charts tell the story.

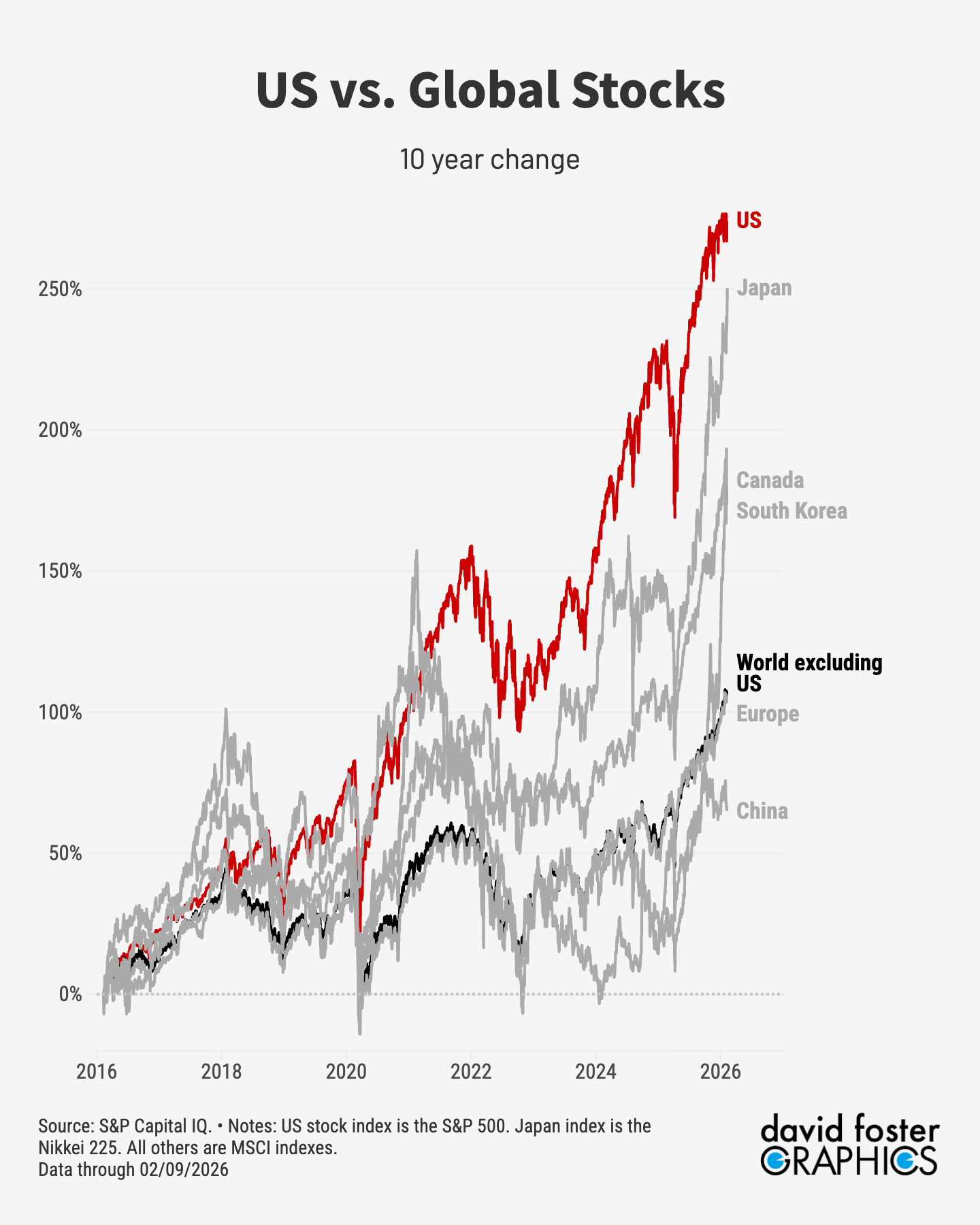

The first shows stock returns in the United States and several other regions for the last 10 years. US shares beat everybody.

But during the last 12 months, US shares are at the bottom of the same group of indexes, with the worst stock performance. On a longer-term basis, foreign markets are catching up.

There’s no single explanation. South Korean shares are going gangbusters partly because chipmakers there are huge beneficiaries of the artificial intelligence boom. Japanese stocks are moving on hopes for new stimulus measures under the government of the popular prime minister Sanae Takaichi.

[See who’s up and down in the K-shaped economy]

But the “sell America” trade is also part of the reason foreign shares are popping. Global investors worry that Trump’s tariffs will hurt US companies by raising their costs. The massive US national debt, now nearly $39 trillion, may be growing so large that there won’t be enough buyers at some point, which would push interest rates higher, and stocks probably lower. Trump’s efforts to manipulate the Federal Reserve could also undermine confidence in the world’s most powerful financial institution.

Sell America doesn’t mean sell everything. Investors are still buying plenty of US stocks, though they seem to be shifting from tech plays linked to AI to smaller companies, energy, consumer staples and other sectors that aren’t as excessively valued as tech.

The fundamentals for future US stock gains seem to be in place. Goldman Sachs predicts 2.8% real GDP growth in the United States in 2026, and a 9% gain in the S&P 500 by February 2027. Corporate earnings have been beating expectations, as usual, with big companies helped by their own geographic dispersion: 40% of S&P 500 earnings come from overseas.

But ordinary investors can dip their toes into foreign waters just as the pros can, through ETFs and mutual funds most US brokerages offer providing exposure to foreign markets. Strategist Ed Yardeni of Yardeni Research recently recommended “moving from Stay Home to Go Global,” as a way of diversifying. “We don’t view it as a Sell America call,” Yardeni wrote in a January 26 research note, “but rather as a rebalancing call.”

If the US market is no longer exceptional, it could make sense for American investors to get some international exposure. Most brokerages offer all-world stock funds, with or without US shares, allowing customers to buy into the global market, whether it’s to diversify or seek higher returns outside the United States. There are legions of regional, country-specific and themed funds, as well.

In addition to the usual risks of owning stocks, foreign funds can be vulnerable to exchange rate fluctuations, geopolitical developments or foreign news events you might not hear much about in the American press. It might be smarter to diversify into commodities or other asset classes, rather than foreign stocks. Some investors may prefer to keep their money in US assets if only because they’re familiar.

But markets are demonstrating that the United States is no longer the only game in town. America first is a slogan, but not necessarily a fact.

I started rotating into international stocks last January as a means of diversifying from overpriced US stocks, over valued US dollar and generally improving market conditions in Europe. Europe is about as much as I can understand. At least they now have a common currency which makes it easier.

Good to no! Debt though is still Debt! I hope we do not get to the point were just paying down our on debt simply because, Republican's and Democrat's alike can not stop dipping in the till an running our Democracy into the ground.