What mattered this week: The Kristi Noem clown show, ailing stocks, the revenge of greenhouse gases

Plus, the coming debt crisis

Key takeaways:😉

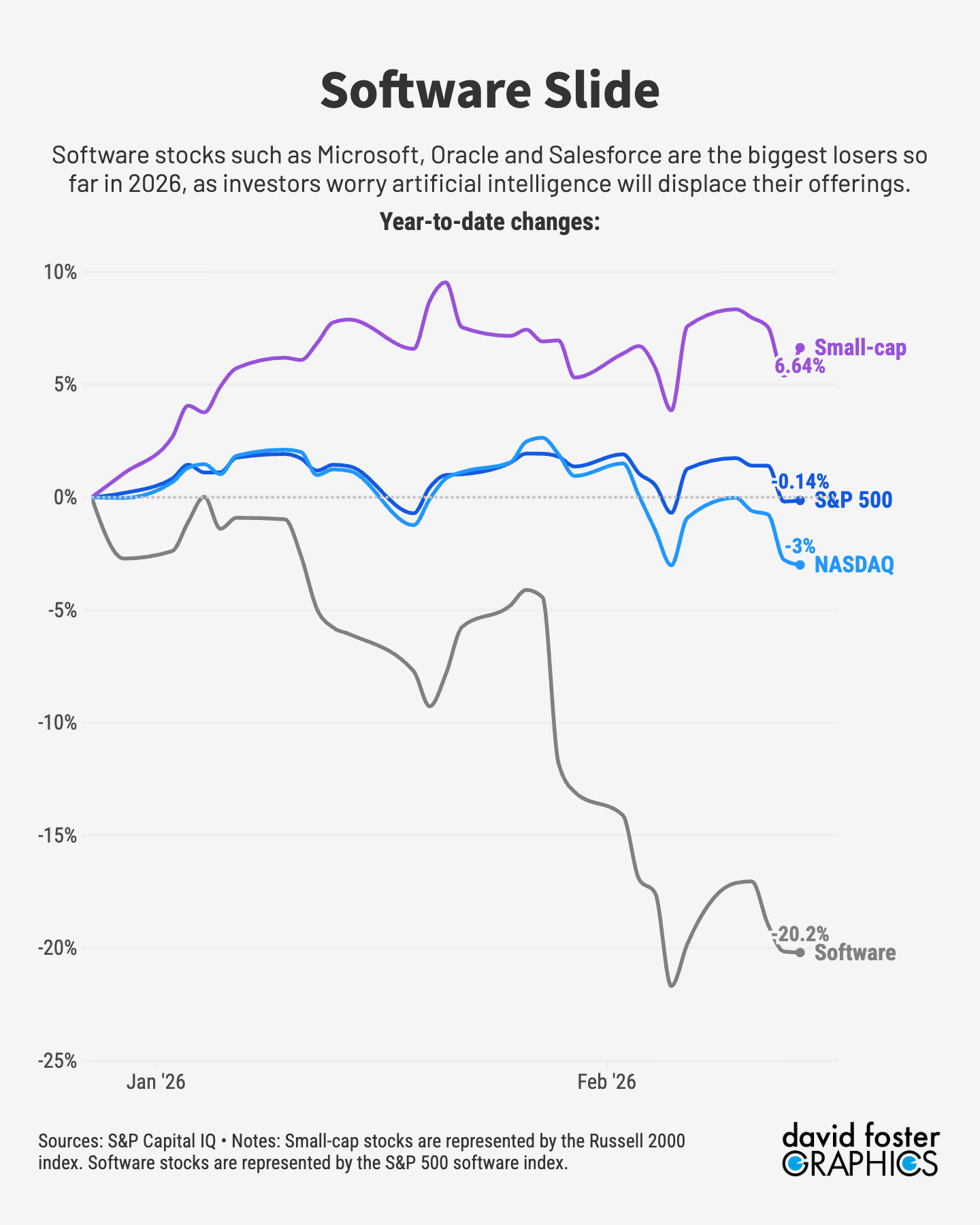

Stocks are struggling in 2026 because of the software sector. One simple chart tells the story.

The Dept. of Homeland Security has become an outrage and a laughingstock.

The economic news is pretty good but even some economists don’t believe it.

More! Greenhouse! Gases!

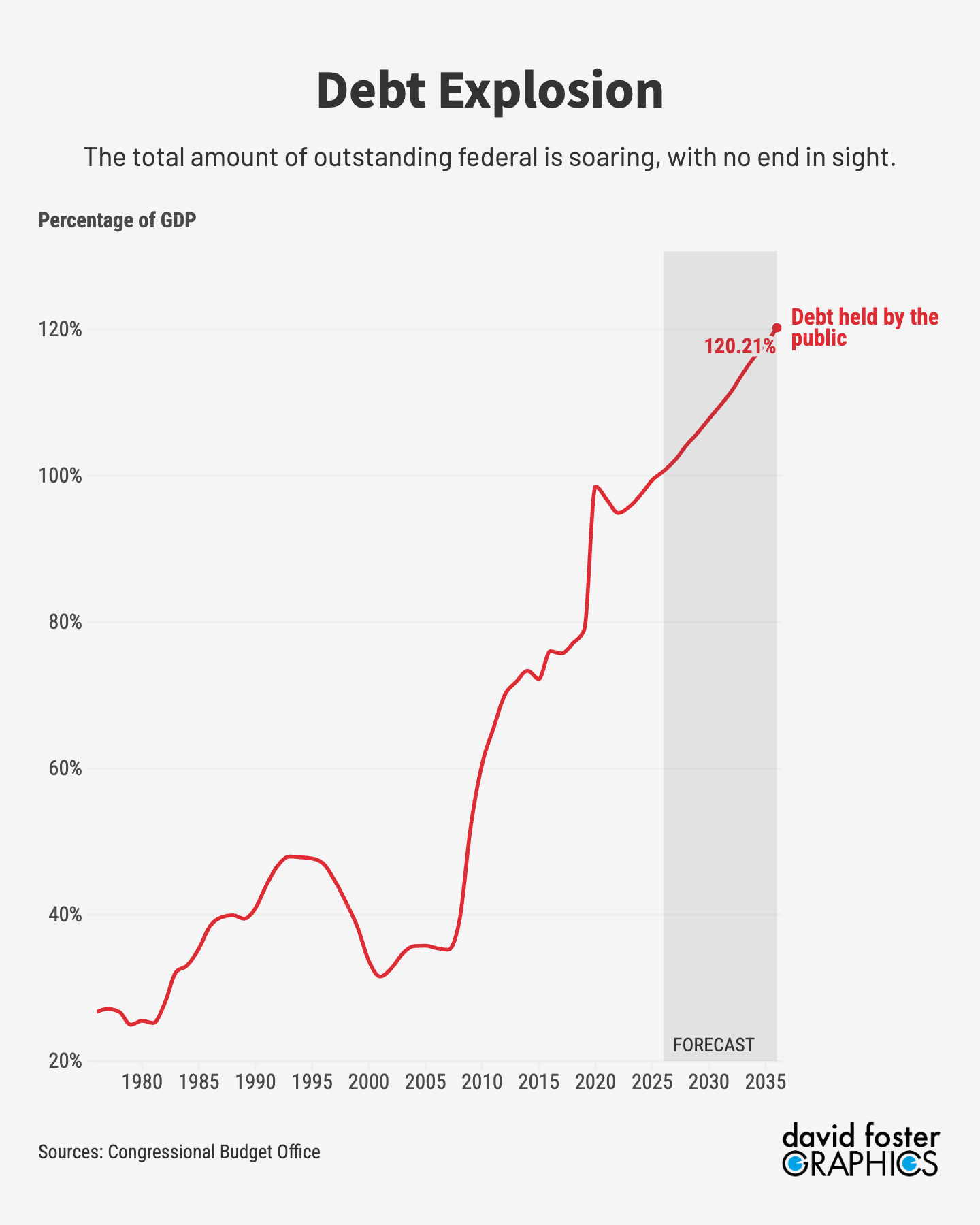

Can you guess where America’s debt situation is heading?

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Stocks stumble. Stocks had a bumpy week and they’re struggling so far in 2026, with occasional selloffs fueled by worries about what artificial intelligence might bring. The S&P 500 dropped 1.4% for the week, with the tech-heavy NASDAQ down 2.2%. The small-cap Russell 2000, which has outperformed so far this year, was down just a bit less than the S&P, with a 1.3% decline.

Investors remain bullish on AI in general, which could boost productivity and profit margins. But they get jumpy from time about who the winners and losers are likely to be. The latest worry is that AI will make some software obsolete, hurting profits at big providers such as Microsoft, Oracle and Salesforce.

The following chart tells the story. Software stocks represented by the S&P 500 software index are down about 20% this year. That’s a big short-term drop for what have otherwise been some high-flying names, especially Microsoft.

For those worrying that a repeat of the dot-com bust is underway, the good news is that most of the stocks dropping on AI fears are established players with profits, and in some cases lots of profits. These are not phantom companies. They could be overvalued, but not by 90% or more, like some of the dot-com bombs.

[The sell-America trade is looking pretty good.]

Department of Homeland Shenanigans. The Dept. of Homeland Security has taken a commanding lead in the race to become the most clownish agency of the Trump administration. In a February 12 exposé, The Wall Street Journal detailed DHS Secretary Kristi Noem’s regal travels aboard a taxpayer-funded luxury jet while she botches contracts, belittles aides, vies for flattering media coverage and oversees an agency in disarray. In one incident, Noem had a Coast Guard pilot fired because her personal blanket did not get transferred from one plane to another when a maintenance issue forced a change of aircraft. Off with their heads!

If DHS were some backwater agency, Cruella de Noem might be little more than titillating mean-girl gossip. But DHS is a huge agency, established after the 2001 terror attacks, that has a $350 billion budget and is responsible for border security, immigration enforcement, antiterrorism operations at airports and a lot more. And it’s been performing poorly.

DHS oversees Customs and Border Protection, which apparently caused the seven-hour airspace closure in El Paso, Texas on February 11 when it used anti-drone laser technology to attack what it thought were drones sent by Mexican drug cartels—without coordinating with the Federal Aviation Administration. Since lasers can blind pilots, the FAA issued an emergency order to close the airspace once it learned of the weapon’s use. Then it turned out the Mexican drones were really runaway metallic party balloons and there was no threat at all. This was a farce that caused considerable public disruption, and heads should roll.

[Scenes from a broken government]

DHS also oversees the immigration agents who killed two nonviolent civilians in Minnesota in January. That has now led to a federal retreat from Minnesota, a tacit acknowledgement by the agency that their goons are giving the Trump administration and the whole country a black eye.

The agency’s thuggish behavior has now left it as the only government agency Congress hasn’t funded for the rest of the year, with a DHS partial shutdown underway. Some agency functions will continue. But airport security agents will be working without pay and some of them may ditch work, snarling air travel.

It’s no accident the Journal article popped just as DHS is on the hot seat in Congress. The many unnamed sources dunking on Noem in the article obviously want her out. President Trump doesn’t object to incompetence, as long as flunkies are loyal to him. But Noem may become too much of a liability, and her self-promotional fervor doesn’t do Trump any favors.

The Kalshi betting site puts the odds at 35% that Noem will be out of her job by July. I’d put the odds higher.

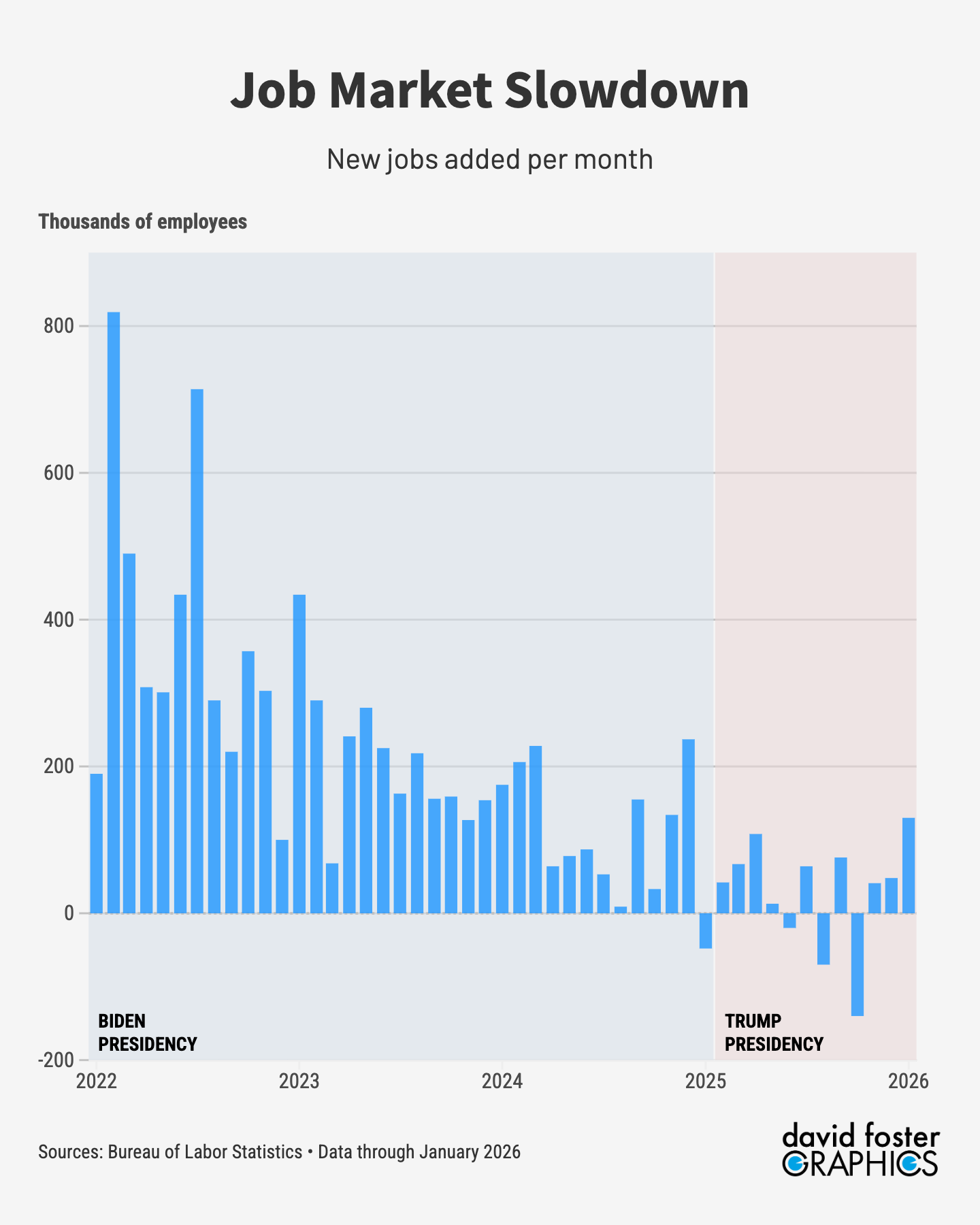

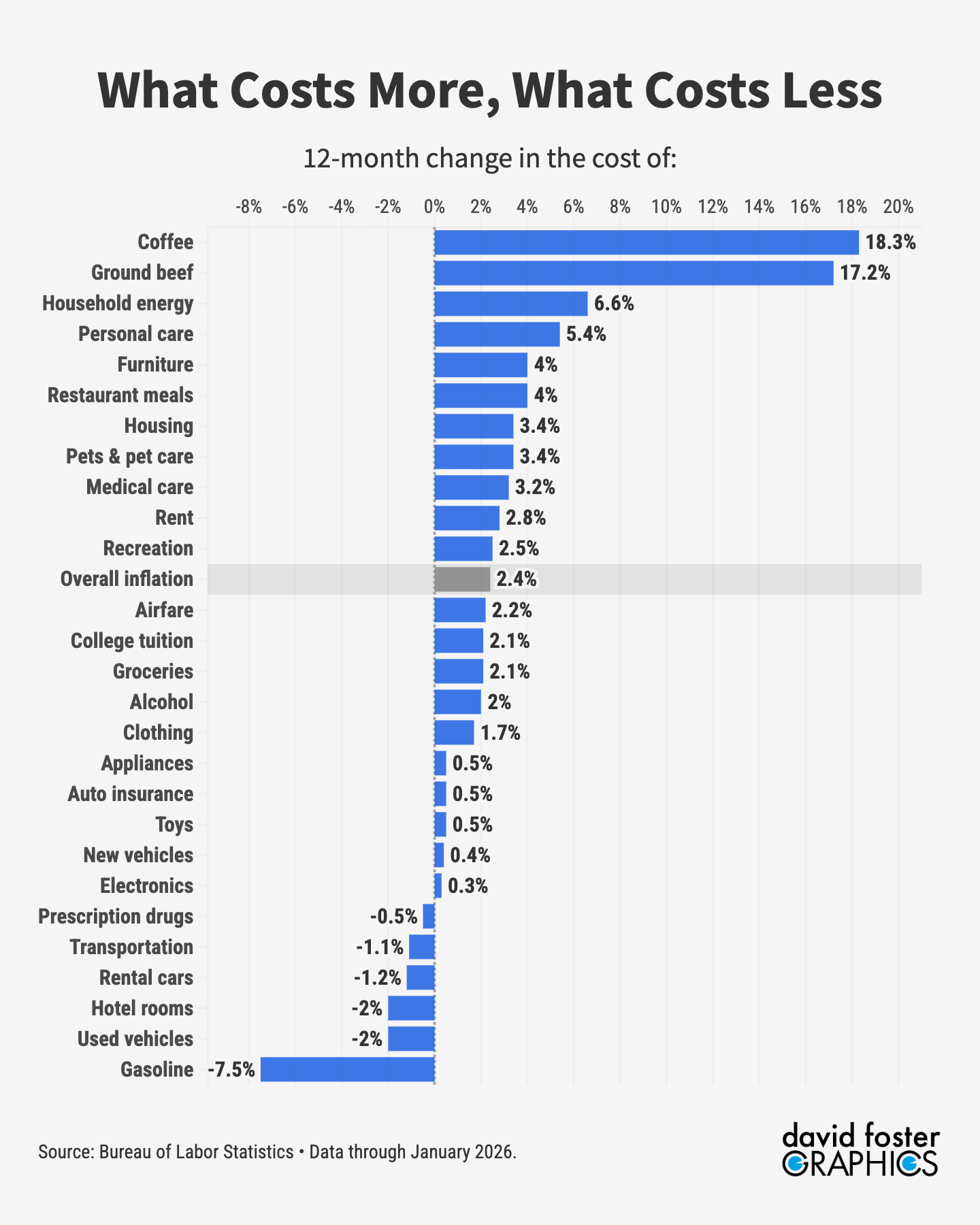

The data is better than the economy. Reports on jobs and inflation were better than expected, and pretty good overall. Employers added 130,000 new jobs in January, and the inflation rate dropped from 2.7% in December to 2.4% in January. If that’s really where the economy is heading, then consumers ought to start feeling better, with President Trump’s sagging approval due for a rebound.

But economists don’t think that’s what is likely to happen. Economist David Rosenberg of Rosenberg Research called the 130,000 job gain for January “the biggest con job of all time.” He thinks it’s a statistical anomaly, with the job gains vanishing as the data gets revised. Other evidence backs that up. There was a surge in layoffs in January, and job growth measured by payroll firm ADP was weak. Shutdowns have messed with government data and large revisions have become somewhat normal, so watch for that nominal job gain to shrink or disappear.

[We have a K-shaped job market, too]

Inflation, at 2.4%, is heading toward the preferred level of 2% or so. Economists are split on this: Some think inflation will tick back up as the Trump tariffs work through the pipeline. Others see Trump dialing back his tariffs ahead of this year’s midterm elections. What’s more certain is that consumers still feel aggrieved by five years of elevated prices, and remain in a gloomy mood.

Greenhouse. Gases. Good? The Trump administration moved to repeal a key tool in the battle to regulate carbon dioxide, methane and other “greenhouse gases” that are a byproduct of burning carbon. The “endangerment finding,” which dates to the Obama administration in 2009, is a scientific basis for declaring greenhouse gases harmful to health and welfare, establishing a legal basis to regulate them. Trump is repealing that finding. Environmental groups say that Trump’s move will lead to an increase of 10% or more in US greenhouse gas emissions during the next 30 years.

It sounds regressive and stupid. Opponents of the endangerment finding are basically climate deniers, such as Trump, who mistakenly say climate change is a hoax. They’re now in a position to make global warming worse.

But there’s still a lot of pressure on businesses and utilities to limit greenhouse gas emissions. First of all, the Trump move will face immediate legal challenges that could tie it up for years. There’s also the prospect that a future administration will overturn Trump. Businesses may want to wait and see instead of changing their practices immediately.

[The Weekly WTF: Bad Bunny whomps Trump]

Big energy companies have been investing in decarbonization technology, which is in growing demand around the world, even if America’s current leadership has its head in the tar sands. They want to keep that going. Insurance companies have to factor in the cost of climate change to price their policies correctly, no matter what federal policy is. States regulate emissions too, and they can step up more.

In a rational world, there would be a unified and measured effort to deal with climate change gradually. In the real world, each political party goes overboard, prompting the other party to go overboard in the other direction when it gains power. Climate policy will swing back again, though with more damage done than necessary.

Depressing debt outlook. The Congressional Budget Office released its latest annual outlook for the nation’s finances, and everything is pretty rosy.

Ha, you know that’s a lie.

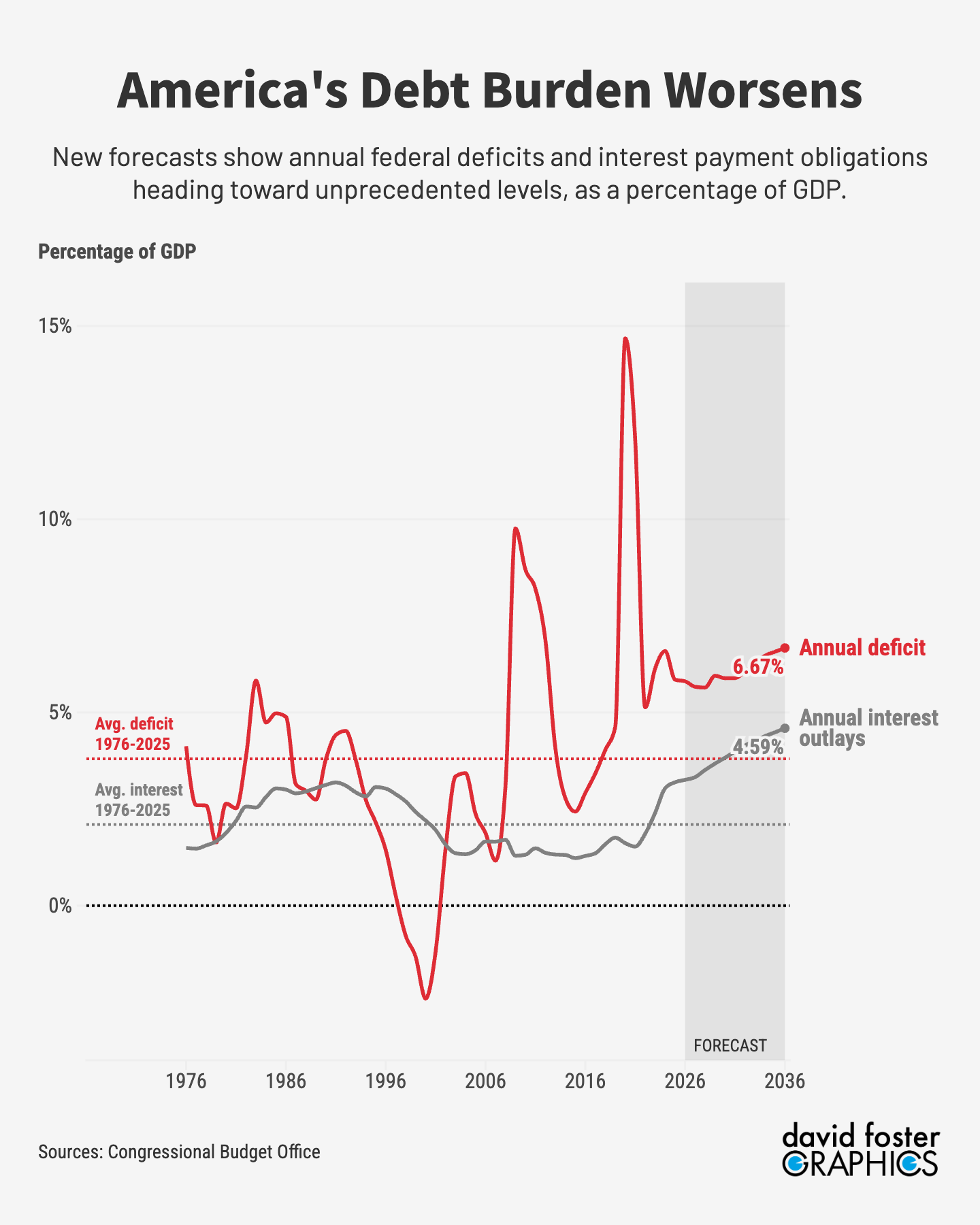

The outlook is terrible, with the national debt on an awful trajectory and interest payments due to gobble up a suffocating portion of federal outlays. These depressing charts tell the story:

Annual deficits averaged 3.8% of GDP from 1976 through 2025. Within 10 years, the deficit will be nearly double that, at 6.7% of GDP. One contributor is the tax-cut law President Trump signed last year, which the CBO says will add about $3 trillion to the national debt.

Interest payments on the debt have averaged 2.1% of GDP since 1976. Within 10 years, they’ll be 4.6% of GDP.

At the current pace, we may not even make it 10 years without some crisis that forces Congress to fix this. A debt crisis need not be a sudden catastrophe. It can come on slowly and may already be underway. The main characteristic of a debt crisis will be long-term interest rates going higher than they ordinarily would—at first by a little, and then by a lot. Some economists think that is already happening. When the situation becomes untenable, Congress will have no choice but to raise taxes and cut spending. Plan the rest of your life accordingly. ☹️

~ ~ ~ ~ ~ ~ ~ ~ ~

WHAT WILL MATTER NEXT WEEK:

Gunboat diplomacy. Trump is sending a second aircraft carrier to the Middle East, to further intimidate Iran as he negotiates … something … with the Islamic theocracy. He threatened to attack Iran if it killed protesters, which it did, by the thousands. There was no Trump attack. Now Trump is trying to force Iran to give up its nuclear weapons program, which was badly damaged by the US and Israeli attacks last June. It’s not clear what Trump’s endgame is here, and there may be no endgame, just the usual mercurial Trumpiness.

I predicted a few weeks ago that there would be no Trump-ordered attack on Iran, and that still seems likely. Trump likes one-and-done actions and there’s no simple target set in Iran that would satisfy Trump’s short attention span. One exception might be if there were an opportunity to take out the crusty old Iranian leader, Ali Khamenei. But he spends a lot of time in his bunker.

Tariff watch. Boring and redundant, I know, but the Supreme Court still has a big ruling coming on Trump’s emergency tariffs, and February 20 is a possible decision day. The Supreme Court will rule on whether the emergency tariffs that account for most of Trump’s new import taxes are legal. It seems likely to shoot them down, forcing Trump to come up with more laborious ways of imposing tariffs. This is a possible market-moving event, but the court is obviously in no hurry to resolve the matter. Maybe the Justices suffer from tariff fatigue like all the rest of us.

It is not my life i am concerned about! It's my kids aaaaaaand my grand kid's and, my great grand kid's.If any one was paying any attention to what is going on is there is no such thing as a conservative in our government, and certainly not one in the Republican Party.Geez i used to think only Democrat's were big spender's but, these Republican's can out do them any day.If you want to talk about Trump's cabinet they were a bunch of clown's to start with so let's not go there.It is run like a Circus and, it cost's are just as high.