Why low gas prices aren’t cheering anybody up

Prices are down for things that constitute a small fraction of spending. Many other things are going up.

President Trump seems flustered. He and his aides keep pointing out that gas prices are falling and people ought to feel good about the economy. But everybody keeps carping about affordability. Consumer attitudes are dismal. And Trump’s approval rating is sinking.

Trump is right and wrong about gas prices. The average national price recently dipped below $3 per gallon, to $2.98. That’s the lowest since 2021 and obviously a lot better than the $5 peak pump prices hit in 2022. Drivers no longer lose their minds with every fill-up.

But Trump, the exaggerator-in-chief, keeps saying gas is at $2 per gallon, or heading there soon. There are a handful of retailers selling gas in that range, but most Americans aren’t seeing gas prices that low. Hearing Trump talking about $2 gas might convey the impression that he doesn’t gas his own car 🤔 and doesn’t really identify with people who do.

But there’s a bigger reason modest gas prices aren’t boosting spirits. Americans don’t spend all that much on gas in the first place. And other important budget items are getting more expensive, including things that account for much bigger chunks of spending than gas.

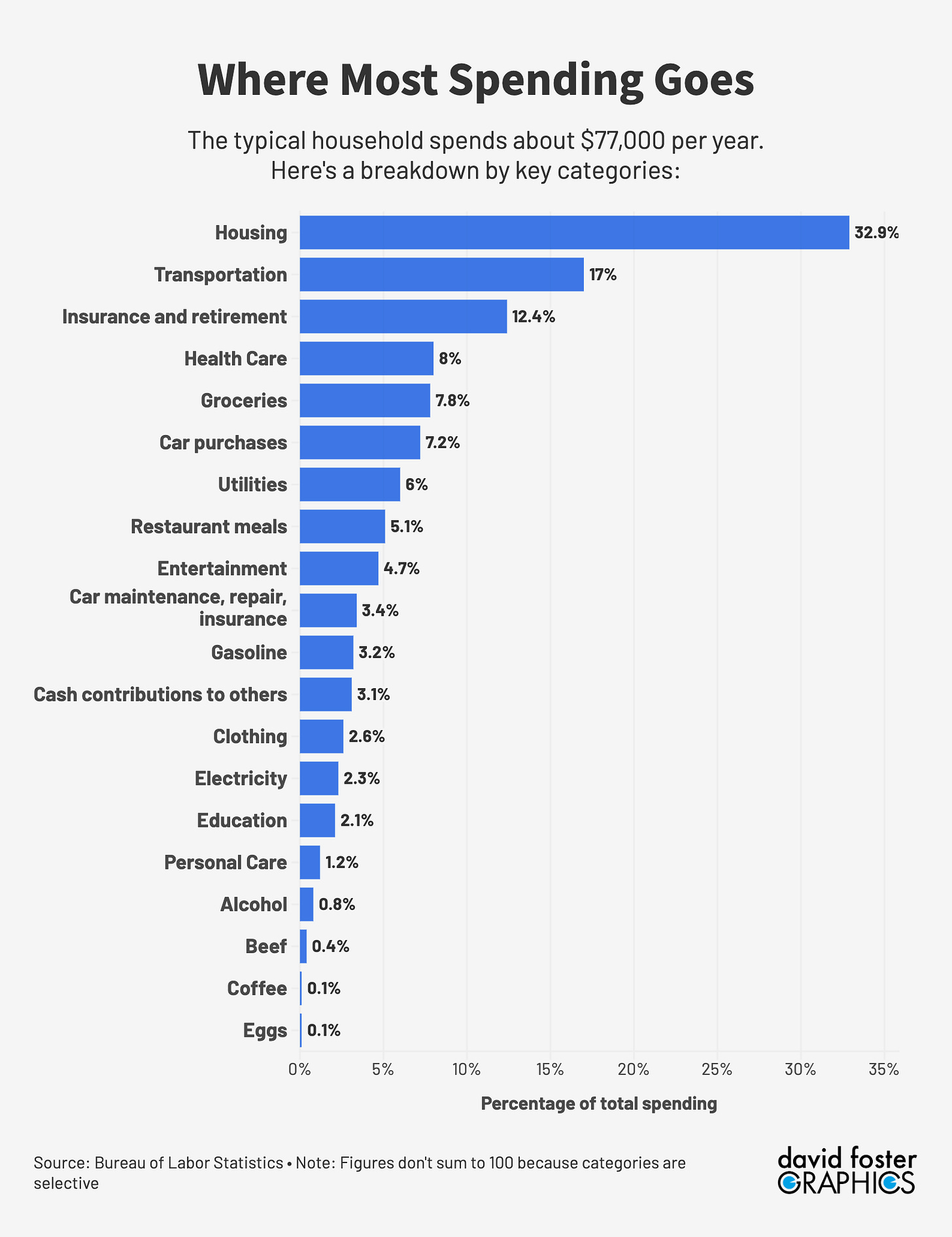

The typical family devotes about 3.2% of its spending to gasoline, according to government data. That’s about $2,450 per year, on average—certainly not nothing.

But 33% of all spending goes toward housing, 17% goes toward transportation overall (including gasoline), 13% goes toward food, 8% goes toward health care, and 6% goes toward utilities. Most of these things are getting more expensive, some uncomfortably so.

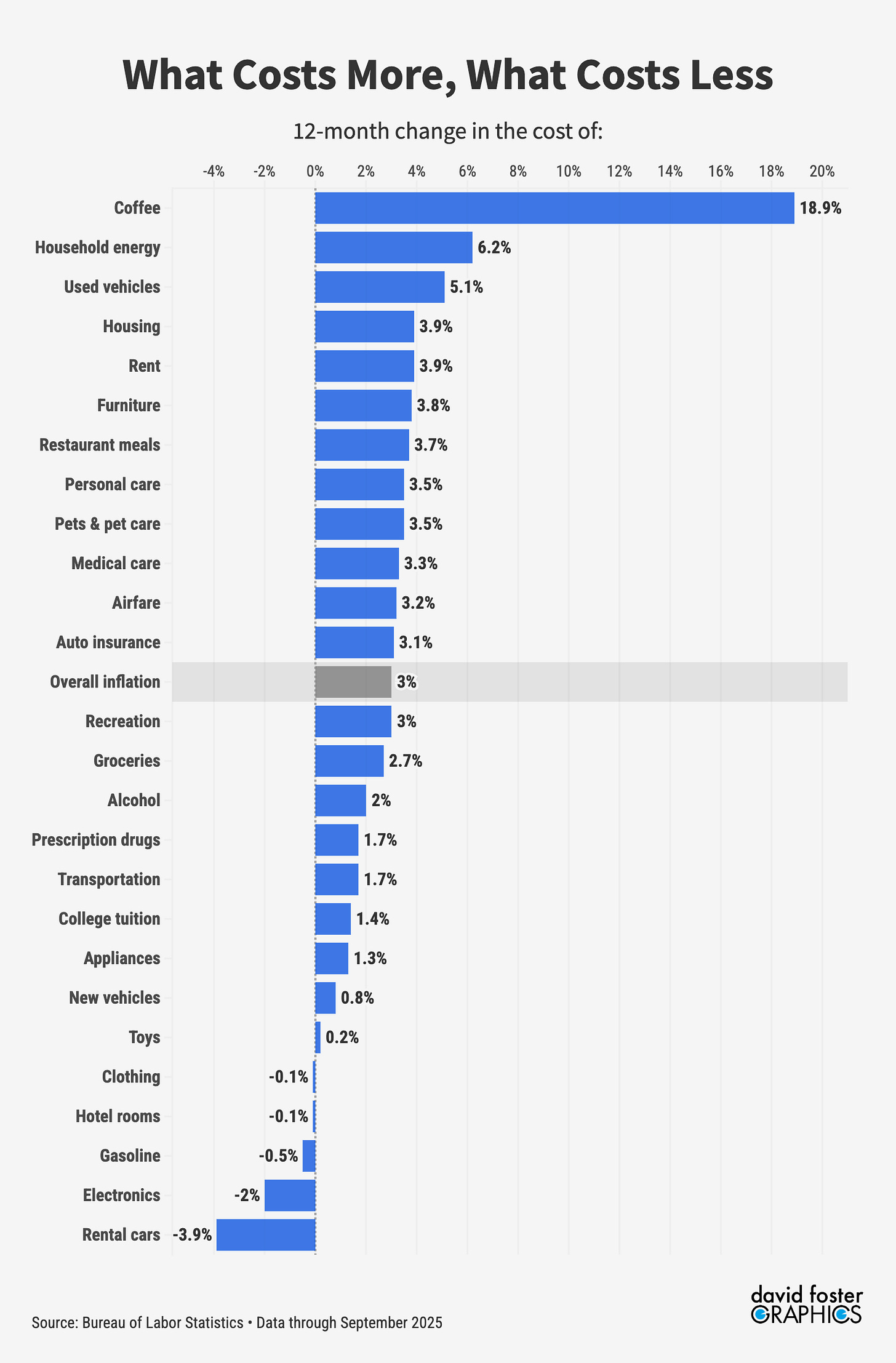

Housing and rent costs have risen 3.9% year over year, while incomes have risen only 3.7%. The biggest expense most people face is a budget-buster.

Transportation inflation has stabilized at 1.7%, but that’s after three years of double-digit increases in the cost of auto insurance. The average new car now costs more than $50,000 and repair costs are up, too.

Grocery inflation is a modest 2.7%, but that’s after four years of price hikes that have substantially raised the base cost of many staples. Soaring food prices tanked Joe Biden’s presidency. And almost all the food prices that went up stayed up.

Health care costs are a constant strain, particularly for 25 million adults who don’t have insurance and millions more who are “underinsured,” with inadequate coverage. This is a huge issue now, with insurance premiums set to spike for some 20 million Americans when federal health care subsidies expire at the end of 2025.

The cost of household energy has jumped by 6.2% during the last year, and Americans spend about twice as much on utilities as they do on gasoline. Electricity costs are rising 5.1% per year. Natural gas costs are up 11.7% year-over-year, which could mean eye-popping heating bills for many this winter.

Trump rarely addresses any of this, at least not in any meaningful way. But he does brag about egg prices coming down, which they have—from more than $6 per dozen in the spring to around $3 now.

Eggs account for 0.1% of all consumer spending. Gas and eggs together—Trump’s biggest victories on affordability—account for 3.3% of spending. Consumers are no doubt grateful that a trip out for breakfast is a little cheaper. But they’ve got a lot of other things to worry about.

Trump might be misunderstanding the concept of loss asymmetry: people feel a loss much more acutely than a gain of the same magnitude. That’s especially true with gas prices, which create a national depression when everybody sees filling station signs flip from $3 to $4, or, God forbid, $4 to $5.

But the opposite is not true: A drop in the prices of those same items does not produce an equal-and-opposite euphoria. It may simply free the consumer mind to focus on other things wrecking their budgets.

Beef and coffee are the new gas and eggs. Prices of both are up double digits since Trump took office. Like eggs, these kitchen staples represent a small slice of total spending: 0.4% for beef and just 0.1% for coffee. So Trump can hope people won’t mind all that much.

But shoppers might decide those price hikes are emblematic of bigger problems, as they did with eggs and gas under Biden. And if those prices come down, it won’t automatically means affordability woes are cured.

The issue is natural gas Henry Hub prices and the policy choice Trump made that has led to higher natural gas prices is approving every LNG export permit that Biden paused. So by January 2024 Biden had made us energy dominant but he could see more LNG export could lead to expensive natural gas for American consumers which defeats the purpose of being energy dominant. So Biden paused LNG permits to no ally countries because he wanted to help Europe wean off Russian natural gas. Republicans flipped out because Republicans are in the pocket of Big Energy and they don’t care about making America stronger they only care about profits…and exporting our natural gas to China is what they desire more than anything!!

Health Care prices, most notably insurance costs, are set to spike rapidly next year. That is not reflected in the graph above. That is one of the most important items that Americans will feel in the upcoming year that Trump and the Republican Party are ignoring. I agree that the ACA is broken, but none of the proposals so far make any sense. This is being driven by escalating medical costs that have so far not been addressed. I would not say that the insurers are benefiting from this as evidenced by the financial results of United Healthcare. Perhaps we should look at tightening what is covered by the ACA policies. GLPs are often pointed to as contributing to this, but what else? What is necessary and what isn’t? I think car prices, due largely to tariffs, will also drive transportation costs higher in the future, including another uptick in insurance costs due to higher values of the car prices themselves.