What mattered this week: The marvelous Trump economy, fading AI trade , a Venezuelan trophy

Plus, coming soon, maybe: Cheaper weed and the Full Epstein.

THE TOP 5:

The AI rethink. The artificial intelligence revolution is happening, but the market sometimes has fits figuring out how to price it. The latest narrative is that a rotation is underway from giant tech stocks that have led most of the gains of the last three years—the Mag 7—to the other 493 stocks in the S&P 500 index, plus smaller companies represented by the Russell 2000. That was the explanation for a 2% selloff on December 12, anyway. And forecasters say the best gains in 2026 will come outside tech, and even in foreign investments.

The thinking on AI now is that it’s kind of a winner-take-all battle among the “hyperscalers,” including publicly owned firms such as Amazon, Google, Meta, Microsoft and Oracle. Privately owned hyperscalers include OpenAI and Anthropic. Nvidia is right in the middle of this hyperscaling, or massive data center buildout for AI processing. But Nvidia is more of a supplier than a builder. At any rate, if one or more of these companies begins to struggle with the huge debt loads taken on to finance this revolution, that could be the thing that deflates the AI bubble. Up till now, however, small selloffs have always led to dip-buying.

Here are some insights from private-equity giant Carlyle on what might burst the AI bubble.

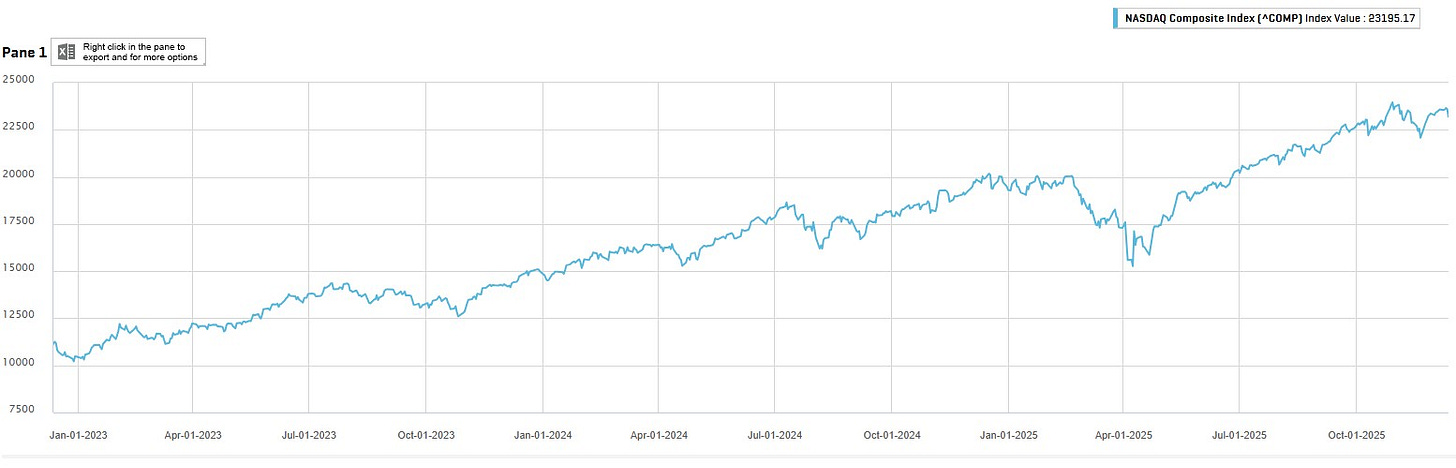

And here’s a chart of the 3-year NASDAQ stock index, which hit its all-time record high on October 29. Note that every downdraft has been short-lived. The worst began in April of this year, and that was a man-made mess caused solely by President Trump’s rollout of insanely high tariffs.

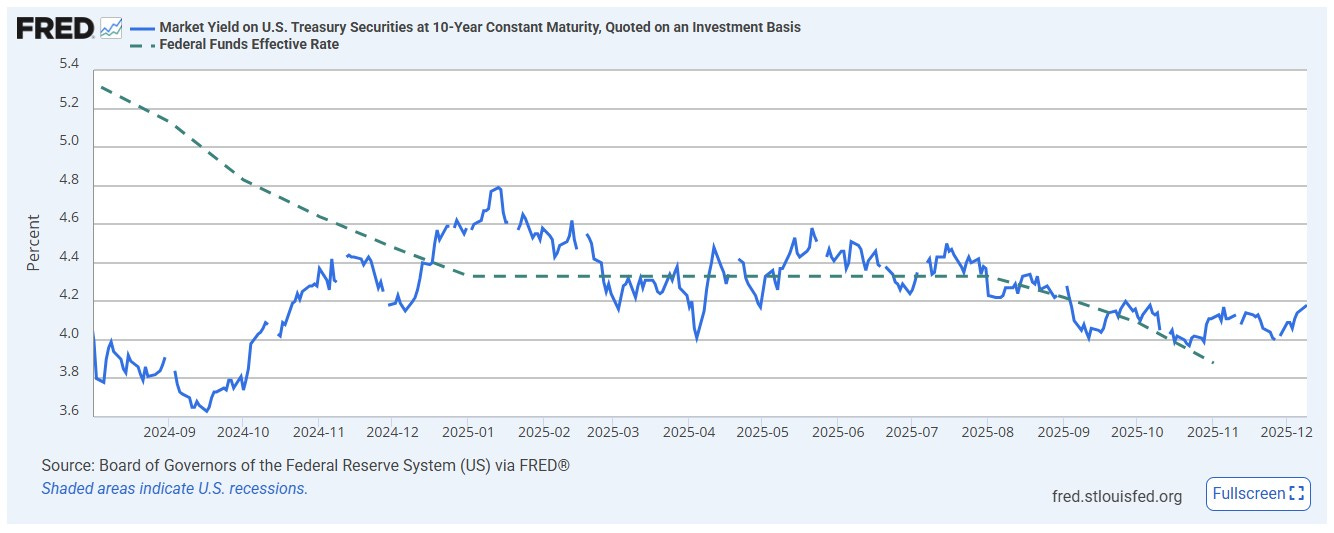

The Fed gets it done. As everybody expected, the Federal Reserve cut interest rates by a quarter-point on December 10. Stocks jumped once the rumor became the news, but that rally was ephemeral, see above. There was a lot of chatter about an unusual split among the 12 voting members, with two voting for no rate cut and one calling for a steeper cut. But so what if the Fed is more divided than usual. It’s actually a close call whether the Fed should be cutting rates with unemployment still pretty low and inflation higher than it should be.

Investors now think there will be at least one more quarter-point cut in 2026, with a chance of two. But these estimates change all the time based on what the data on jobs, inflation and growth shows. More important for most people is what long-term, not short-term, rates will do, and most forecasters think they’ll stay about where they are. The 10-year Treasury is around 4.2% and the average 30-year mortgage is around 6.25%. The Fed doesn’t directly control those rates, which have disconnected from short-term rates during the last 18 months, as this chart shows.

Venezuela clarity. What has President Trump been up to in Venezuela? We now have a pretty good idea: His main goal is to force dictator Nicolás Maduro from power. That wasn’t obvious back in September, when Trump ordered the Pentagon to start blowing up boats departing Venezuela on suspected drug-running missions. Trump has characterized those boat attacks—at least 22 so far—as an effort to interdict drugs coming into the United States.

But Trump decided he needed a bigger boat, and ordered the December 10 seizure of a Venezuelan oil tanker. The legal justification for this seems more solid than the attacks on civilian boats, which some characterize as possible war crimes. A federal judge issued a warrant validating the seizure, and the ship was already under sanctions from the Biden administration for its role as a “shadow tanker” transporting black-market oil.

Trump didn’t want the tanker because it was ferrying drugs. He wanted it because Maduro and his cabal enrich themselves with oil profits, and choking off the money is a way to squeeze Maduro. Trump keeps threatening land strikes on Venezuela, and there’s an armada of US military power in the Caribbean. But Trump could be bluffing and an invasion involving US troops seems extremely unlikely. Trump has made clear he wants Maduro gone, but most dictators aren’t pushovers and getting rid of one bad guy often opens the door for another. Trump could be courting an epic mess.

Here’s some background on the whole conflict at the Council for Foreign Relations.

Gerrymander stalemate. Indiana Republicans jumped off the gerrymander bandwagon and declined to do the Congressional redistricting President Trump wanted, which was supposed to give Republicans an additional two safe seats in the House of Representatives. The gerrymander war has been an infuriating power grab that started with Republicans in Texas and then spread to California and other states. Redistricting is supposed to happen once every 10 years, after the decennial census, when states redraw their districts to account for population shifts and other changes. Like so much else, this exercise has become badly abused, with some state authorities now redrawing the lines whenever it might give them the best shot of boosting their margins. Voters are an afterthought.

The GOP gerrymander push isn’t exactly working out, and maybe Indiana Republicans refused to play along because they sensed they might end up on the losing side. The Texas redistricting will probably add five House seats to the GOP column, but California probably offset that with its own redistricting plan. Some other states are fiddling around with the district lines and the whole thing could end up a wash. “If House Republicans were counting on redistricting to save their endangered majority, it isn’t working,” Punchbowl News reported on December 12. “Republicans may net two or three seats, but even that outcome is uncertain.”

If you’re concerned about Republicans efforts to rig the 2026 midterm elections, this podcast with David Frum and Michael Waldman of the Brennan Center for Justice will make you smarter.

Trump struggles with affordability. We should all live in Donald Trump’s economy. Trump told Politico on December 9 that he gives the economy a grade of A+++++. Trump must have gone to innovative schools where teachers could exercise infinite variability in grading just by adding more + signs.

Trump keeps saying prices are down when most prices are actually up. At a December 10 rally in swing-state Pennsylvania, he repeated his mantra that affordability is a hoax. That came one day after a Democrat won the Miami mayor’s race for the first time in 30 years. Many moderates and Independents who voted for Trump in the 2024 presidential election flipped and went for the Dem this time around.

A top Republican party official is sounding the alarm, saying that Trump’s affordability gaffes and the general unpopularity of most of his policies are leading the party to a “pending, looming disaster” in next year’s midterm elections.

This makes the Congressional debate over expiring health care subsidies quite a barn-burning drama. Republicans have opposed virtually every Democratic move on health care for the last 15 years, including the subsidies Democrats enacted in 2021, which lower the cost of insurance people buy through the Affordable Care Act. Those expire on December 31, which will force premiums sharply higher for more than 20 million Americans.

Democrats want to simply extend the subsidies, which is normally anathema to Republicans. But some GOP members are seeking a way to keep them going or replace them with something else. If Republicans can’t get that done, and premiums skyrocket, they deserve whatever treachery voters visit on them next November.

[More: The Trump economy is subpar]

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

WHAT WILL MATTER NEXT WEEK:

Data backfill. The delayed jobs report for November will arrive on December 16. The last report covered September. The Labor Dept. will report some data for October but other data wasn’t collected and can’t be reconstituted. The job market has cooled substantially and the number of new jobs will probably be low. Bank of America thinks the net change in total jobs in October and November will be a loss of about 15,000 jobs. The DOGE cuts from earlier this year will factor into that.

The delayed inflation report will arrive on December 18, and it, too, will have some gaps in the data. The inflation rate is currently 3%—a full point higher than the Federal Reserve’s target—and there’s no obvious reason to think it will change much.

If the job numbers are weak and inflation is steady or declining, that could boost the case for more Fed rate cuts in 2026. Strong job growth could negate the case for further cuts.

Cheaper weed? Trump is reportedly considering a change in the federal classification of marijuana that could boost its commercial prospects and maybe lower prices. The Washington Post reported that Trump is preparing an order to downgrade weed’s status as a narcotic, which could make it easier for weed purveyors to operate like normal businesses that can get credit and use banks for everyday operations. That would lower costs and, in theory, consumer prices. The current classification forces weed businesses to do a lot of financial workarounds, even though 24 states have legalized recreational use. Federal law typically trumps state law.

The president can make this change with no action by Congress. Biden wanted to do the same thing, but never quite got to it. Still, Trump could face political blowback. Solid majorities of Democrats and Independents favor legalization. But the portion of Republicans who favor legalization fell from a high of 55% in 2023 to just 40% this year, according to Gallup. So Trump would be doing something his base generally opposes. Trump is famous for hearing a persuasive argument and siding with it, only to change his mind when he hears a contradictory argument he likes. So maybe the whole thing will go poof.

Pot stocks rallied on the Post report. If you celebrate, burn one down.

The Full Epstein? The deadline for the Justice Dept. to release all of the Epstein files is December 19. That’s the deadline Congress set last month when it passed a law requiring the executive branch to release mostly everything on dead sex trafficker Jeffrey Epstein. The scandal has linked many prominent figures—well, men—to the debauched Epstein. That includes Donald Trump. The main outstanding question is whether Trump ever had sex with any of Epstein’s underage women. There’s no evidence he did. But the unreleased files may yet contain many secrets.

It would be a bombshell if the Justice Dept. released anything implicating Trump in a sex crime. It’s possible there will be something that looks like a full release of the documents, with no damning evidence against Trump. Maybe he really has nothing to hide, other than a friendship with Epstein. It’s also possible the Justice Dept. could hold back some files, which would stoke further intrigue. It might also miss the deadline. Whatever happens, there are bound to be gaps for anybody who wants to believe it’s all a huge conspiracy.

[More: Epstein scandal: The short guide]

Just knowing how all thing's new are used by Wall Street i assume that all the debt Wall Street is taking on will be paid for by AI.How about that 300 million dollar ball room . Nothing like spending a little tax payer money.