What mattered this week: ChatIOU, Netflix onslaught, Costco tariff rebates

Would you care if the Netflix purchase of Warner Brothers means fewer movies in theaters?

AI Bubble Watch. The artificial-intelligence bubble still hasn’t popped, but there might be a few more darts in the air. British banking giant HSBC published a recent report examining the financing needs of OpenAI, which runs ChatGPT. The analysis assumes that by 2030, Open AI will have 3 billion users, with 10% of them paying, generating $129 billion in revenue. Yet with the firm pledging to spend more than $1 trillion on data centers and other infrastructure, it would have a huge funding shortfall of $207 billion in 2030. The analysis has stoked worries that some AI firms may never become profitable, with many billions of borrowed dollars written off.

OpenAI is privately owned, but Microsoft owns a big stake and other tech companies such as Amazon, Oracle and Nvidia do significant amounts of business with the firm. So if OpenAI hit the skids, it would bring tech stocks down with it.

OpenAI CEO Sam Altman has other things to worry about. New testing shows that the latest version of Google’s Gemini AI outperforms ChatGPT, prompting Altman to declare a “code red” at his company and rally the whole staff to make Chat better. Altman is also thinking about starting or partnering with a rocket company—to deploy data centers in space, where they could be solar-powered. HSBC may have to push those estimated losses even higher.

The bullish view is that a few casualties won’t stop an AI productivity revolution. “Sure, some individual firms may stumble under the weight of their own balance sheets,” Yardeni Research argued in a December 3 analysis. “But deals will be struck, capital will reallocate, and the broader productivity cycle will move on.” Yardeni thinks AI will eventually boost GDP growth and generate output gains much larger than what AI companies are investing.

Investors are going with that, for now. The S&P 500 and NASDAQ both edged up for the week. The S&P is 0.3% below the record high from late October. The NASDAQ is 1.6% off the record.

[More: A step-by-step guide to the AI bubble]

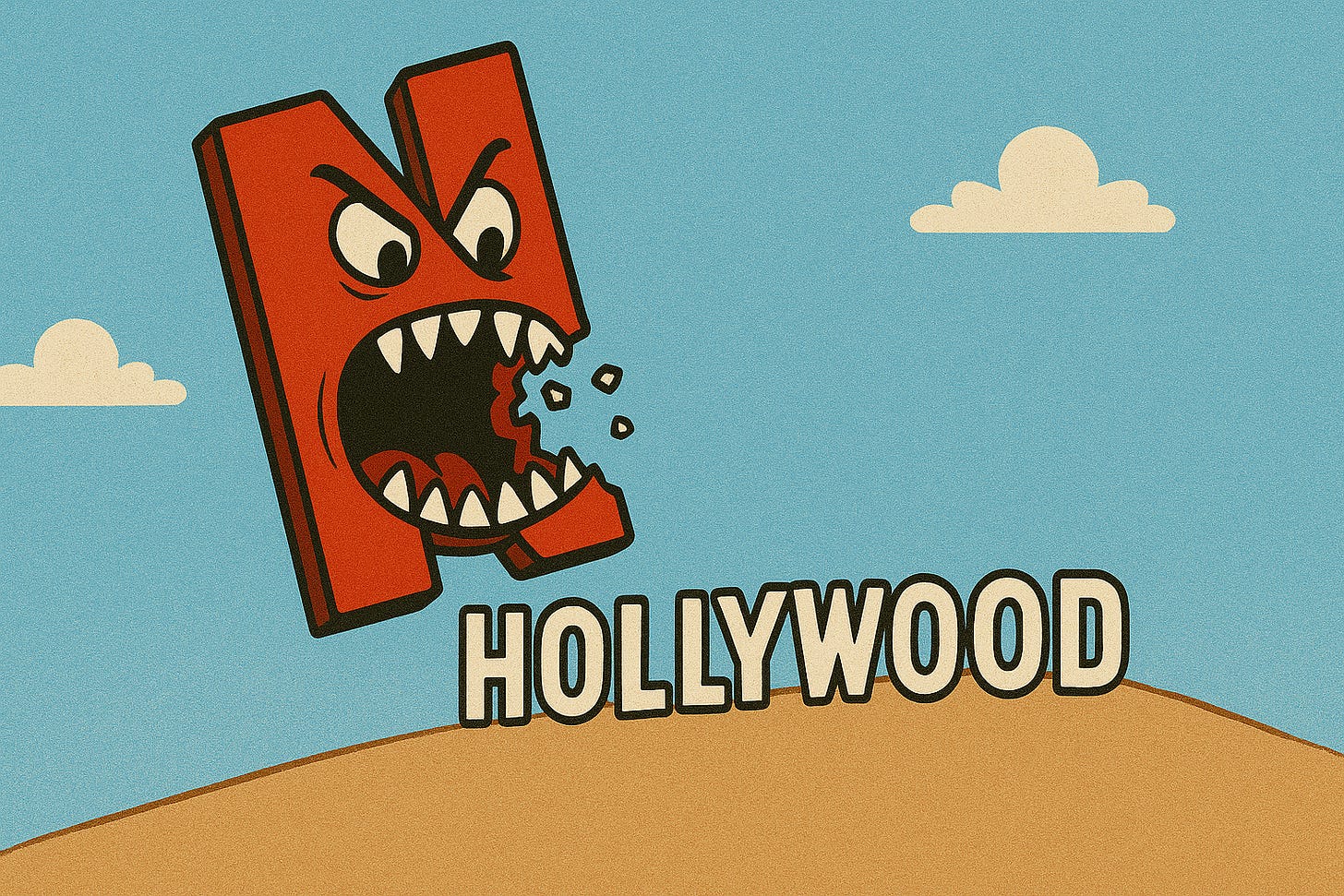

Netflix storms Hollywood. The streaming giant won a bidding war for Warner Brothers Discovery, beating out Comcast and Paramount with its $83 billion deal to acquire the storied studio. That will make Netflix the owner of HBO and a suite of franchises that include DC Comics, Harry Potter, Looney Tunes and a lot more.

It’s obviously a huge flex for a company that began as a mail-order movie rental startup in 1997. Media companies are constantly buying and selling each other and most of their customers don’t know or care who owns what, as long as the entertainment measures up. But the Netflix deal could be different. Since Netflix prefers streaming over theater showings, some theater owners worry that Warner Brothers films will disappear from theaters.

Netflix says don’t worry, but it needs government approval for the deal and that could be tricky. Losing bidder Paramount is run by David Ellison, son of Oracle’s Larry Ellison and pal of President Trump. He already appears to be lobbying for some kind of help to block the deal. If it goes through, the Netflix purchase probably wouldn’t be complete until 2027.

Trump says he picked a new Federal Reserve chair. He’s not saying who, but it’s probably Kevin Hassett, now the top economist in Trump’s White House. Hassett isn’t a kook, but some investors worry that Hassett would do Trump’s bidding by pushing for lower short-term interest rates than necessary, which could push inflation higher and actually force longer-term interest rates up rather than down. Liberal economist Paul Krugman calls Hassett “an ideological DEI hire [whose] career has depended not on getting things right but on displaying unswerving loyalty to conservative causes.”

If Hassett does get the nod, you’ll hear a lot about “Dow 36,000,” the 1999 book he co-authored, which made the case for why the Dow Jones Industrial Average could quintuple in value in just six years. It actually took 22 years, making Dow 36,000 one of the sillier calls in stock market history.

The normally staid Fed could generate a lot of drama in 2026. The term of the current chair, Jerome Powell, ends in May. But some analysts think he might leave early if Trump does announce a new pick soon. Trump’s guy won’t be able to dictate rates on his own, but Trump is looking for ways to stack the 12-person rate-setting committee with allies and influence some of the other members. It’s also possible Trump is floating Hassett as a trial balloon, to see how markets react. “We would emphasize that these varieties of decisions under Trump have remained fluid until the final moment,” analysts at Raymond James advised clients on December 5.

[More: The Trump economy is subpar]

Jobs vanish. The government’s jobs report for November was due December 5, but the shutdown delayed that until December 16. Payroll firm ADP filled the gap with the dispiriting news that the private sector shed 32,000 jobs in November. Big companies are still hiring, while small businesses are shrinking. Some economists point out that the K-shaped economy applies to businesses as well as workers. The upward slant represents big businesses that are doing well and still hiring, while the downward slant represents small businesses that are struggling and cutting jobs.

Companies have announced nearly 1.2 million job cuts so far this year, according to placement firm Challenger, Gray & Christmas. That’s up 54% from the pace of layoffs in 2024, and the highest since the Covid shutdowns in 2020. Challenger also said hiring is down 35% from last year, to the lowest levels since 2010.

This private-sector data doesn’t always align with the government’s official employment report, but the signs of a cooling job market are everywhere.

[More: Feeling worse off? The data says you’re right]

Importers want their tariff money back. Costco and dozens of other companies have filed lawsuits to recoup import taxes they paid if the Supreme Court invalidates many of the tariffs Trump has imposed this year, as seem likely. Two courts have already found that Trump’s “emergency” tariffs, which account for more than half of all the tariffs Trump has imposed this year, are illegal. The Supreme Court heard the appeal on November 5, with several justices sounding skeptical of the Trump argument. The Court could rule within weeks.

If the court does strike down those tariffs, the government, in theory, would have to refund more than $100 billion in tariff revenue it has collected—something that has never happened before. Costco seems to have filed its lawsuit to get close to the front of the line and make sure it doesn’t miss out on a refund because of any technicalities. Thousands of businesses have been paying Trump’s tariffs and are likely to apply for refunds if the Supreme Court invalidates those taxes.

[More: Here’s the scheme behind Trump’s $2,000 tariff rebate]

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

WHAT WILL MATTER NEXT WEEK:

Job openings will probably drop. The “JOLTS” report on job openings arrives on December 9. The forecast is for a small decline. The Fed will digest that data as it’s debating its next interest-rate move.

The Fed will probably cut interest rates by a quarter-point. The decision is due December 10 at 2 pm, and as usual, financial media will provide wall-to-wall coverage. Since investors put the odds of a cut at more than 90%, it would be a surprise if the Fed stood pat and did nothing.

It could be the last rate cut of the Powell era. Investors think the next cut won’t come until April, when Powell might be gone, if he leaves early. Then, the forecast is for another cut in September. If each of those is a quarter point, three rate cuts would lower the Fed’s short-term interest rate from about 3.9% now to just above 3%. Trump wants it lower. That will be Hassett’s problem, if he’s the next chair.

Costco reports earnings on December 11, and analysts will probably ask about that tariff-rebate filing. Costco hasn’t said how much it has paid in additional tariffs this year, or how much it might expect in refunds. It would be nice to hear some detail. Costco is America’s third-largest retailer, after Walmart and Amazon, and its tariff predicament is probably similar to many other retailers.

Republicans might finally reveal a health care plan. Time is running out for Congress to do something about health care subsidies that expire at the end of the year. If Congress does nothing, insurance premiums will spike for more than 20 million Americans buying marketplace plans through the Affordable Care Act. Democrats want to extend the subsidies as they are, but Republicans won’t rubber-stamp those subsidies without changes. One possibility is a new income cutoff level. But it’s very possible the subsidies will expire and ACA enrollees will just have to pay more.

The HSBC analysis on OpenAI's funding gap is pretty wild when you think about it. $207 billion shortfall by 2030 basically means their business model doesn't work at current infrastructure costs. The space data center stuff from Altman feels like a Hail Mary to escape those economics, but launching and maintaining servers in orbit is gonna be way more expensive than just building bigger AWS contracts.

The funding shortfall analysis really highlighted a critical issue.