The gold rally has an ominous message for investors

A lot of people seem to be betting that a period of turmoil is coming.

Key takeaways: 😉

Gold has hit astonishing record highs above $5,500 per ounce.

Private investors are hedging against inflation and the falling value of the US dollar.

There are also worries that a long-anticipated global debt crisis is finally emerging.

The most notable feature of a debt crisis would be rising interest rates.

A debt crisis wouldn’t necessarily happen suddenly. It could develop slowly, which might be happening now.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~

If you own gold, you’re doubtless delighted that the precious metal has doubled in value during the last year, surging to record highs above $5,500 an ounce. If you’re an investor who doesn’t own gold, you might be wondering if there’s still time to cash in.

Rallies boost optimism.

Yet there’s a dark side to the gold rally that carries warnings for anybody invested in stocks and other risk assets. Gold is taking off because global investors think something is wrong. They’re parking money in the world’s oldest safe-haven asset to ride out turbulence they think is coming.

“Behavior among investors continues to push capital into assets like gold and silver because of a general reassessment of economic and geopolitical risk,” Joe Brusuelas, chief economist at RSM, explained recently.

Part of the calculus, he says, is the “sell America” trade that came into vogue last April. When President Trump imposed his extensive “Liberation Day” tariffs (“Obliteration Day” to traders), stocks tanked and the value of the US dollar fell to the lowest level in three years. The dollar fell because global investors sold assets denominated in dollars, weakening demand for the greenback.

Trump reined in many of those tariffs, and stocks recovered. But the sell America trade now seems to be back. Trump has been threatening new tariffs on a host of countries, while also warning Iran of an imminent US attack and banking Venezuelan oil profits in an unorthodox offshore account. His masked immigration agents are killing American citizens in Minnesota and operating like a rogue internal-security brigade. The dollar is now at even lower levels than it was at in April.

[More: You’re only better off under Trump if you own stocks]

Trump doesn’t follow through on every threat he makes, but his hostility to free trade and new taste for gunboat diplomacy is breaking a lot of china. Canadian Prime Minister Mark Carney calls this a geopolitical “rupture” and is urging middle-sized nations to form their own trading blocs to protect themselves from Trump’s bullying. Some nations spurned by Trump are now, in fact, forming trade alliances with each other, while Trump threatens more and more tariffs in response.

It’s more than Trump making investors jumpy. The United States and other developed nations have been piling on debt for years, and markets may finally be developing the indigestion some analysts have long predicted. Recent tremors in the Japanese bond market are pushing up interest rates there and devaluing the yen. That could be a preview of what’s coming to US markets.

“We’re at the start of a global debt crisis, with markets increasingly fearful governments will attempt to inflate away out-of-control debt,” economist Robin Brooks of the Brookings Institution wrote on January 25. “A falling dollar will supercharge the rise in gold prices.”

There’s a lot going on here, and the relationships between currencies, metals, bonds and other assets are not fixed or linear. The message for ordinary investors is that markets are pricing in growing doubts about the stability of the United States and other governments, along with the viability of their massive debt loads.

[More: Your 5-step guide to the next Trump crisis]

The main indicator of a debt crisis would be rising interest rates on government bonds, which in turn would push all long-term interest rates higher. In the United States, interest costs already account for 14% of all federal outlays, the second largest category of spending after Social Security. Higher borrowing costs would push that even higher. At some point, investors might question whether the United States could even pay its debts. That would be an emergency requiring quick action.

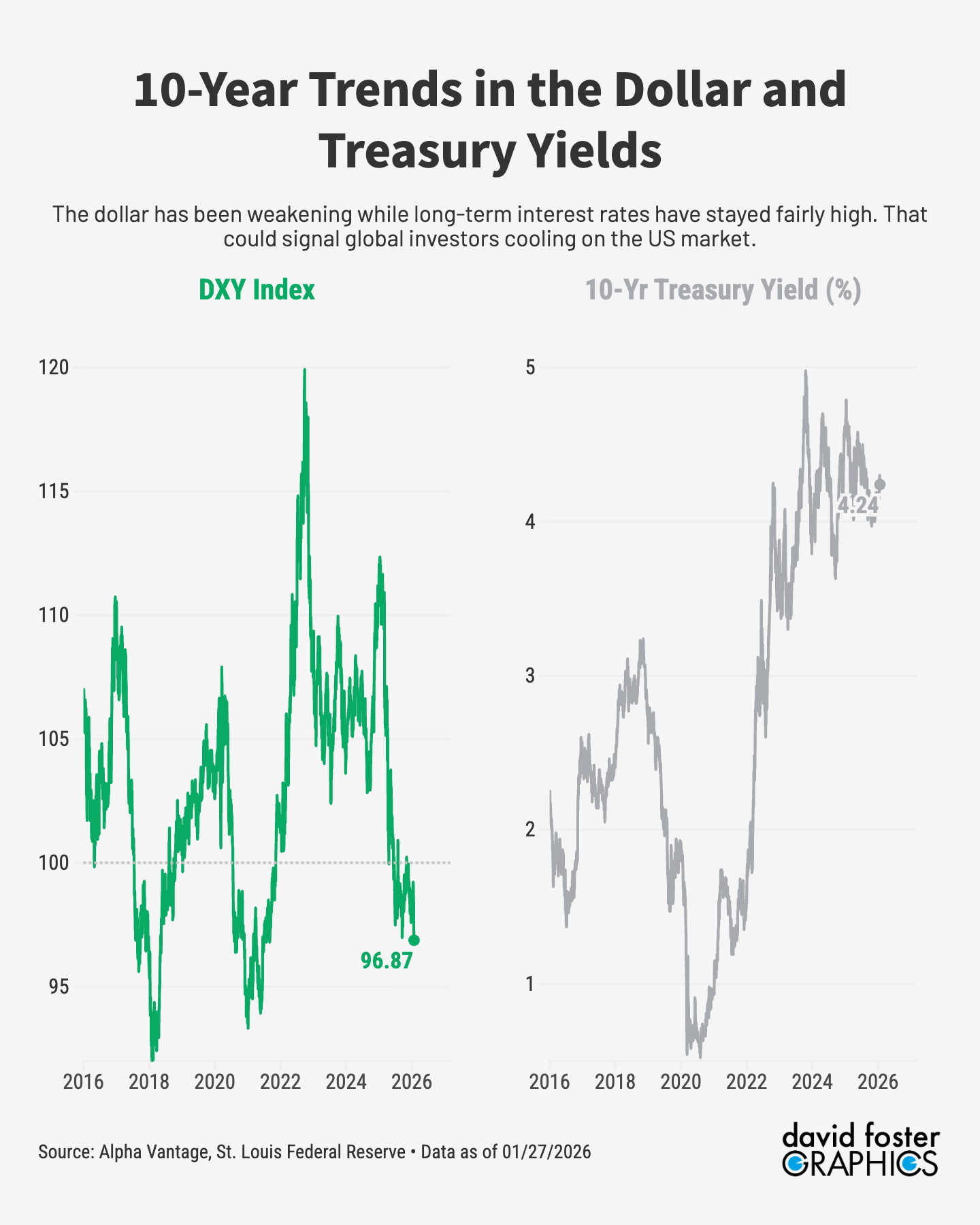

But a debt crisis wouldn’t necessarily be a sudden catastrophe. It could occur slowly and fitfully, with governments trying fiscal and monetary tricks to manage their debt. That may be happening now in Japan. In the United States, the benchmark 10-year Treasury bond yields around 4.25% and has drifted higher during the last 18 months, even as short-term rates set by the Federal Reserve have fallen. That’s odd.

One way governments can manage debt is by printing money, which causes inflation and lowers the value of outstanding debt in real terms, making it easier to pay off. Gold is a classic hedge against inflation.

The prices of gold, silver and other metals have surged for a variety of reasons. Some central banks are buying gold, as they do from time to time. Goldman Sachs cites increasing buying by private-sector investors, including wealthy families, as protection against possible losses caused by Trump’s recklessness or other policy mistakes.

Silver and other metals serve as cheaper surrogates for gold, and some of those metals are also in high demand for their use in electronics and other products. And some buyers may simply be piling into trendy assets to catch the ride up.

The surge in demand for gold could still be temporary. “We are sympathetic with the view that the surge in retail interest and ‘explosive’ pace of gold price increases is indicative of a bubble,” Capital Economics said in a research note earlier this month. “It is surely not overreaching to apply a similar logic to other precious metals.”

If the gold runup does turn out to be a bubble, that means investors fearing debt crises, chronic inflation and the devaluation of the dollar guessed wrong. That would play out through gold bugs bailing out and putting some of that money back into traditional stocks or bonds. The dollar would probably regain strength and the 10-year Treasury yield might drop back toward 4% or below.

But the gold bugs have Trump on their side. He favors a weak dollar, which in itself makes gold more attractive. And he seems intent on roiling global markets with tariff threats for the rest of his second term. Gold may have a robust future.

I gave my grandkids a 32 ounce bar of silver i bought for about 1000 dollars it should now be worth about 3000.Trump does not care about the dollar because, it does not work into his plan.Dictator's do not worry about money because, it is not important but, power is always on that mind.If you have gold or silver hang on to it because , stocks are going to fall.Trump has all the gold he needs as most rich folks.It is that fake bitcoin he is into because,it rises or falls on the money rich people invest in the manufactured coin.