TrumpWeek 32: The data stinks, but at least it’s still real

President Trump may be losing patience with government data that shows stagflation setting in.

It’s President Trump’s 32d week in office. The dominant event has been the appalling assassination of conservative activist and Trump ally Charlie Kirk. The killing doesn’t directly affect financial markets, but it represents an alarming escalation of political violence that could get worse and put disconsolate Americans in an even darker mood.

Economic data continues to suggest stagflation is arriving. The “stag” part of stagflation is flatlining economic and job growth. The “flation” part is inflation going up. Stagflation stinks because prices are rising by more than usual while a weak economy keep a lid on hiring and income growth.

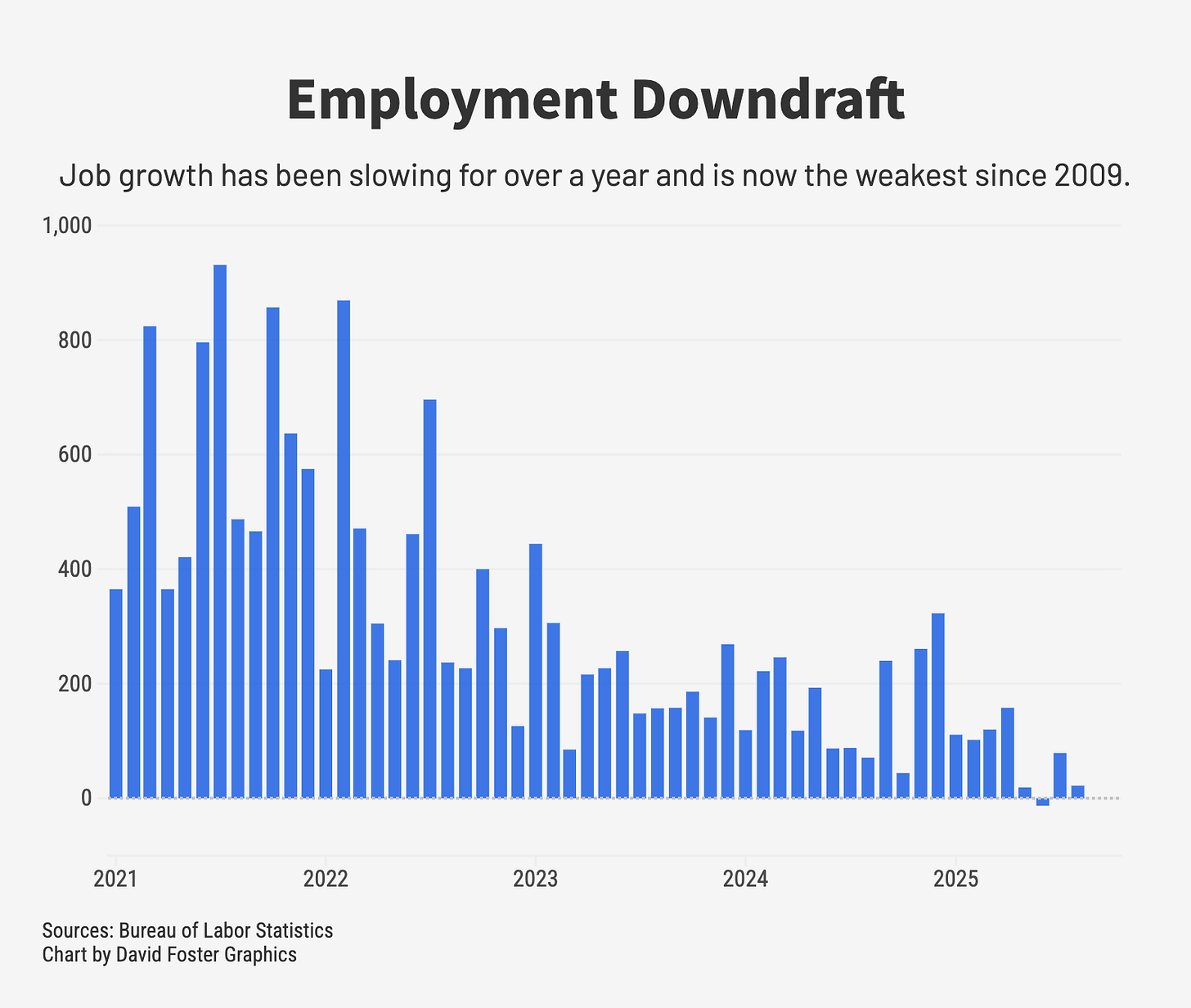

The stagnation part is showing up in rapidly decelerating job growth, which is now the weakest since President Obama took in 2009, in the midst of the Great Recession. Since May, employers have added just 27,000 new jobs per month, on average. The average in 2024 was 168,000 new jobs per month, which is normal for a healthy economy. The Trump tariffs are raising costs and causing widespread uncertainty, while Trump’s aggressive deportation push is shrinking the labor market. Those two things alone probably account for much of the hiring slowdown.

Graphics guru David Foster has the chart:

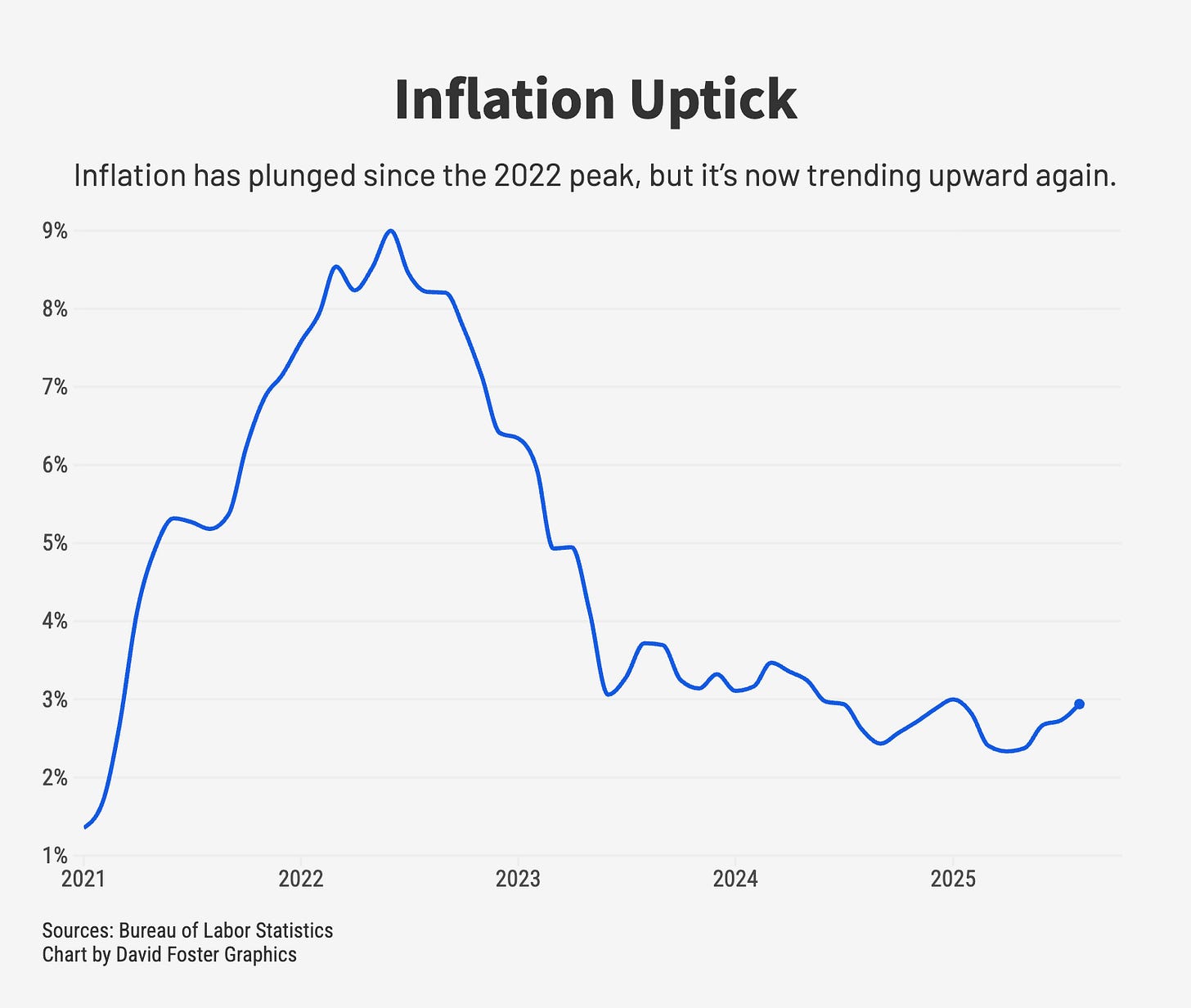

The inflation part is a gradual uptick in prices that has been underway for the past few months. The inflation rate hit a four-year low of 2.3% in April. It has since ticked up to 2.9%. That’s exactly what you’d expect from the Trump tariffs, which are a tax on imports that businesses pay first, then pass on to consumers to the extent they can.

Another Foster chart:

Before the Trump tariffs, the amount of customs duties collected by the government averaged about $7 billion per month. That has jumped to an average of $26 billion for the last four months. On an annualized basis , that’s a $158 billion tax hike on American importers, and some of that is bound to show up as higher prices ordinary shoppers pay for all the newly tariffed items.

Stagnation isn’t the same as a recession. Most economists still think the US economy is strong enough to avoid an outright recession, because corporate profits are holding up and big companies are superb at finding efficiencies that can offset at least some of the tariff damage. The artificial intelligence boom is clearly a huge factor keeping stock values afloat. And the Fed will probably create a tailwind by gradually cutting short-term interest rates for the next several months.

But many Americans think the economy’s in a recession, because they don’t see themselves getting ahead. Public attitudes are somewhat distorted by political affiliation, since Republicans and Democrats are more optimistic when their own party is running the government, and more pessimistic when the other guys are in charge. But overall, consumers attitudes are at dismal levels. In the University of Michigan’s ongoing monthly survey, overall consumer sentiment rose after Trump won the presidential election last November, but it has fallen sharply since then.

The economy is weakening and people feel it. That’s the bad news. The good news is that we can still gauge the health of the economy using government data available to everybody. Trump has threatened to overtake the agency overseeing inflation and jobs data, the Bureau of Labor Statistics, and he fired the agency director in August after the July job numbers came in lower than economists had forecast. Trump called the numbers rigged, a charge no serious economist supports.

The July numbers that got the BLS director fired showed 73,000 new jobs added that month. The August numbers were far worse, with only 22,000 new jobs. The same agency delivered the unhappy message about rising inflation. All of it undercuts Trump’s ongoing claim that a new “Golden Age” is underway in the US economy.

So what is Trump’s plan? While a BLS veteran runs the agency as a placeholder, Trump has nominated conservative economist EJ Antoni as the permanent replacement. The Senate needs to confirm Antoni, with hearings likely sometime this fall. Like many Trump appointees, Antoni has odoriferous baggage, but that hasn’t stopped the Senate from approving other Trump nominees.

Trump and his aides continue to hint that once a loyalist arrives, the jobs and inflation data might suddenly perk up. Labor Secretary Lori Chavez-DeRemer said BLS data revisions give people “even more reason to doubt the integrity of the data.” Commerce Secretary Howard Lutnick says the economy will start to look a lot better starting in 2026. Trump himself said there is “almost no inflation” after the official data showed there is more than anybody would like. A new Trump-ordered audit of BLS data sounds like a pretext to start fudging the numbers.

The cumbersome process of gathering all this data to measure a huge economic machine does give the Trump team a bit of cover. Some BLS data has grown more inaccurate lately, as it gets harder to reach people through traditional methods such as landline phones to collect surveys. Data collectors routinely publish revisions as they refine numbers often published on a provisional basis to provide a quick first take. Some of those revisions have gotten unusually large, which the Trump team claims as bias.

It isn’t bias. It’s just the normal process of trying to get complex measurements right. Real bias would be an arbitrary and opaque change in methodology that suddenly produces cheerier numbers for reasons nobody can understand. That may be coming. The ultimate lesson may be that it’s better to know the real facts about a weakening economy than some fishy claims about a mysterious one.