Trump’s tariffs aren’t the inflation story. Something else is

The rising cost of services is still the driving force behind inflation, which has been worsening for the last five months.

Six months after President Trump imposed widespread tariffs on imports from almost every country, goods prices have not jumped the way many economists expected. That’s good news for Trump.

But inflation is creeping up anyway. There’s no single narrative to explain it, but several disparate forces are keeping pressure on the family budget. This is bad news for Trump, because voters will blame him for higher costs regardless of where they comes from. Plus, tariff inflation might still be coming, making the problem worse.

The overall rate of inflation ticked up from 2.9% in August to 3% in September. Markets liked that, because a few measures of inflation were slightly below forecasts. That means the Federal Reserve is still likely to cut interest rates, generally bullish for stocks.

The inflation news is less bullish for consumers, because the trend is going in the wrong direction. After hitting a 40-year high of 9% in 2022, the inflation rate got as low as 2.3% in April. That was almost at the 2% rate the Fed considers optimal. But since then, the inflation rate has risen by seven-tenths of a percentage point.

That timeline coincides with Trump’s tariff rollout. But the evidence of tariff-related inflation is spotty. Coffee prices, for instance, are up 19%, partly because of tariffs. But the cost of clothing, electronics, toys and other categories dominated by imports is relatively flat.

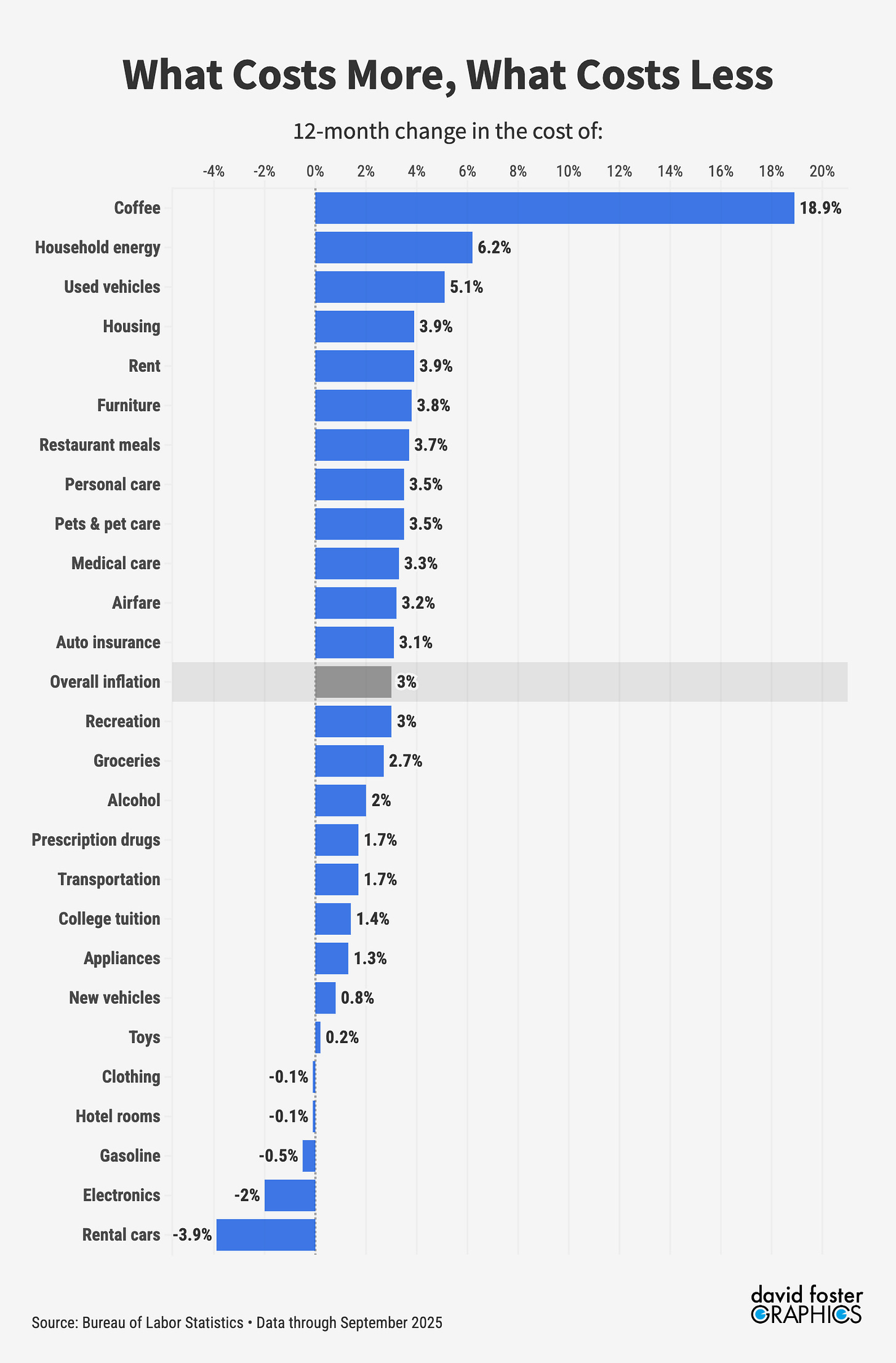

Here’s the inflation rate in a broad range of product categories graphics guru David Foster and I have been tracking since 2021:

Goods prices overall are up just 1.9% year-over-year. Services are up by nearly twice as much, at a 3.6% year-over-year inflation rate. Trump’s tariffs overwhelming affect goods, not services. That means most of the inflation is still coming from parts of the economy not directly affected by tariffs.

Energy costs are a stealthy source of pain for many households. Most people focus on gasoline prices, which are now at a comfortable $3.05 per gallon. But the typical family spends more on electricity and other utilities, which are rising by more than twice the overall rate of inflation. Household energy costs are up 6.2% year-over-year.

Electricity costs are spiking due to new demand from energy-hungry data centers and a lack of new supply. The residential price of natural gas, which heats about half of all American homes, is 72% higher than the average of the last 10 years. Those costs are likely to keep rising into 2026, according to forecasts from the Energy Information Administration. Many Americans will be dismayed by their winter heating bills.

Housing costs have been moderating, but the cost of housing and rent are both up 3.9% year-over-year. That’s after housing inflation exceeded 5% every month in 2022 and 2023. Incomes have been growing by less than housing costs for most of the last four years, which is why many people feel like they’re falling behind.

It is surprising that Trump’s tariffs haven’t led to more noticeable price hikes in product categories dominated by imports. There are a few likely explanations. One is that Trump’s tariffs come with numerous exemptions and carve-outs, so they don’t hit every imported product. American importers are eating some of the cost of the tariffs through lower profit margins and forcing their suppliers to absorb some, by cutting prices.

But many consumers won’t make such fine distinctions when assessing the impact of Trump’s tariffs on their personal budgets. Morning Consult finds that a majority of Americans think Trump’s tariffs are the cause of higher prices for food, gasoline, cars, clothes, electronics and other things. Yet inflation in most of those categories is subdued, as the chart shows. Tariffs may not be hurting Americans as much as they think, but Trump is still likely to get the blame for higher costs.

In most cases, tariffs have “long and variable” lag times. It takes time to implement them, time to run through pre-tariff inventories and goods previously ordered (where wholesale importers get hit on orders priced before implementation because prices cannot be passed through—the precise complaint that led to the case decided at the international trade court), time to seek bypasses and “persuade” customs agents, and time to persuade customers to accept new pricing.

We have only seen something like 35% cost pass through now. The longer term impacts, however. Will likely EXCEED 100% pass through if history holds true. Once all the “pushbacks” get pushed aside the “markups” will begin as sellers seek to impose “cost markups” on wholesale prices they convert to retail.

THEN, inflation “expectations” will build. My personal guess (from research as the Post-WW II inflation built to its 1972-83 peak impacts) is that the end-game is pricing increases that will roughly DOUBLE the actual tariffs.

The reason nobody sees it now is that nobody whose age is 80 or less was around to “manage” price policy back then. I learned it as a student learning econometric forecasting in the late 1960s. Less than 5% of economists study that stuff and all who did it then are either dead or heading there.

Several people are pointing to Milton Friedman's famous comment that inflation is always and everywhere a monetary phenomenon to suggest that when money supply remains more or less steady (as is the case now), the fluctuations in some prices due to tariffs will not cause generalized inflation because consumption patterns across categories of purchases goods & services will adjust to accommodate the price changes in selected categories.

Any thoughts from economists / other experts on this? I am but a lowly glorified plumber (PhD in engineering).