Trump really needs a hot stock market

Stock-market performance is tied more than ever to Americans’ views of the economy—and to Trump’s own standing with voters

For the last five months, one thing has been going conspicuously right in the US economy: the stock market. Since May 1, the S&P 500 index has jumped by 12%, hitting several new record highs and erasing the gloom of a spring correction.

The stock market isn’t the economy, as the old saying goes. But more than ever, the stock market affects what Americans think about the economy and, by extension, how they grade President Trump’s job performance. And at the moment, the hot stock market may be the main thing keeping Trump’s economic approval rating out of the basement.

The University of Michigan reports that 74% of American households now own stocks, the highest level in data going back to 2008. Gallup reports a similar trend, with 62% of adults saying they own stocks, nearly matching the record of 63% in 2004.

Since Michigan measures households and Gallup measures individuals, both surveys are telling the same story: Americans are more invested in the stock market than they have been in years, and possibly ever. That makes sense, given that mutual funds and ETFs make it easy to invest, with new platforms such as Robin Hood luring young investors.

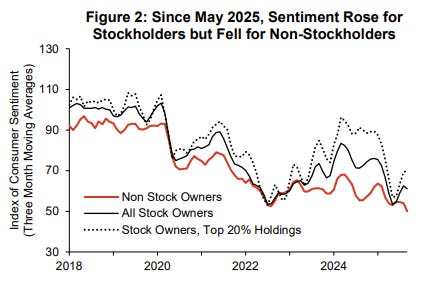

The Michigan data shows an important connection between a booming stock market and improved confidence for those who own stocks. In April and May, for instance, sentiment levels were similarly low for those who owned stocks and those who didn’t. That was a trying time in the market, with stocks down nearly 20% as President Trump rolled out punishing tariffs. Stock market losses basically made stock owners just as gloomy as those with no stocks.

Since May, however, sentiment has jumped among stock owners, but declined among the stockless. And sentiment has jumped the most among those with the biggest portfolios, defined in the chart above as those with the top 20% of holdings.

For the 74% of households with stocks, the median portfolio value is now around $262,000, according to the Michigan data. That’s up from $149,000 a year ago--a 75% jump. The “wealth effect” has been making a lot of people more upbeat about the economy as they watch their financial assets grow.

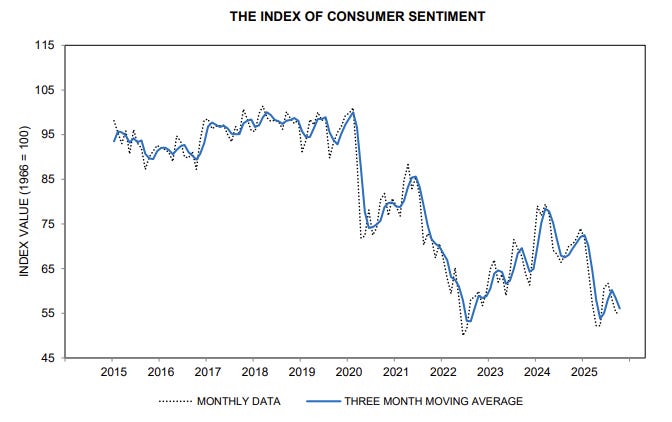

Even so, the overall Michigan sentiment index is depressed. It started the year at 71.7 but is now down to 58.2. That’s about the same level it was at in the middle of 2022, when inflation was at a 40-year peak of 9%. Other measures of confidence show more or less the same thing.

If three-quarters of household own stocks, and their confidence has been improving, yet overall sentiment levels are weak, that reveals two crucial things: One is that Americans left out of the stock-market boom are really unhappy. The other is that a sharp stock-market decline could torpedo confidence levers more than it usually would, as shareholders watch some of their newfound wealth evaporate.

That meshes with other data showing that jobs are getting harder to find, inflation is creeping back up and home affordability is terrible. Americans locked out of the stock-market rally see very little to get excited about.

Does Trump get how important the stock market is to his own standing as president? Maybe. Stocks tanked in the spring because Trump announced import taxes that were far steeper than investors were expecting. After a painful selloff, he “paused” those tariffs, setting the stage for the runup that kicked off in May.

Trump’s trade war is still on, alas, but he responds faster to market signals now. Trump sent stocks careening again on October 10, when he threatened new punitive tariffs on China. But this time, he dialed back the threat quickly, which seems to have stopped a broader selloff. Traders now believe that Trump will “chicken out” and rescind any tariffs that cause a pronounced selloff.

Yet Trump is on thin ice with voters. His net approval rating is nearly 19 points lower than when he took office, with net approval on his handling of the economy down by slightly more. That has neutralized one of Trump’s main advantages over Democrat Kamala Harris in last year’s presidential election.

Trump doesn’t have to worry about reelection, but a lot of his Republican allies in Congress do when the 2026 midterm elections roll around. The stock market could stay in rally mode until then, but if it doesn’t, those Republicans will struggle to convince Americans they’re better off with the GOP in charge.

https://open.substack.com/pub/thiagodearagao/p/five-things-that-happen-if-the-us?r=2di31u&utm_medium=ios

Hi Rick,

I would point out that a very large proportion of tax collections come from the sale of stocks. If those gains become losses the impact on our deficit would be significant. Like you, I have no idea what Trump has considered or not considered.