Trump is way behind the affordability curve

The biggest cost pinch for most Americans comes from housing, healthcare and energy. Trump is focusing on bananas and coffee.

Six months after imposing new import taxes on bananas and coffee, President Trump is having second thoughts. He’s now planning to scale back those tariffs to help make a few pantry items cheaper.

Alas, it’s small bananas. The affordability crisis that Trump seems to have just discovered is entrenched and likely to worsen. Trump’s own policies are contributing to it. He’s obviously trying to pay more attention to cost-of-living issues, after off-year elections in which voters rejected Trumpism and screamed for lower costs. But most Americans will barely notice the tweaks Trump has in mind.

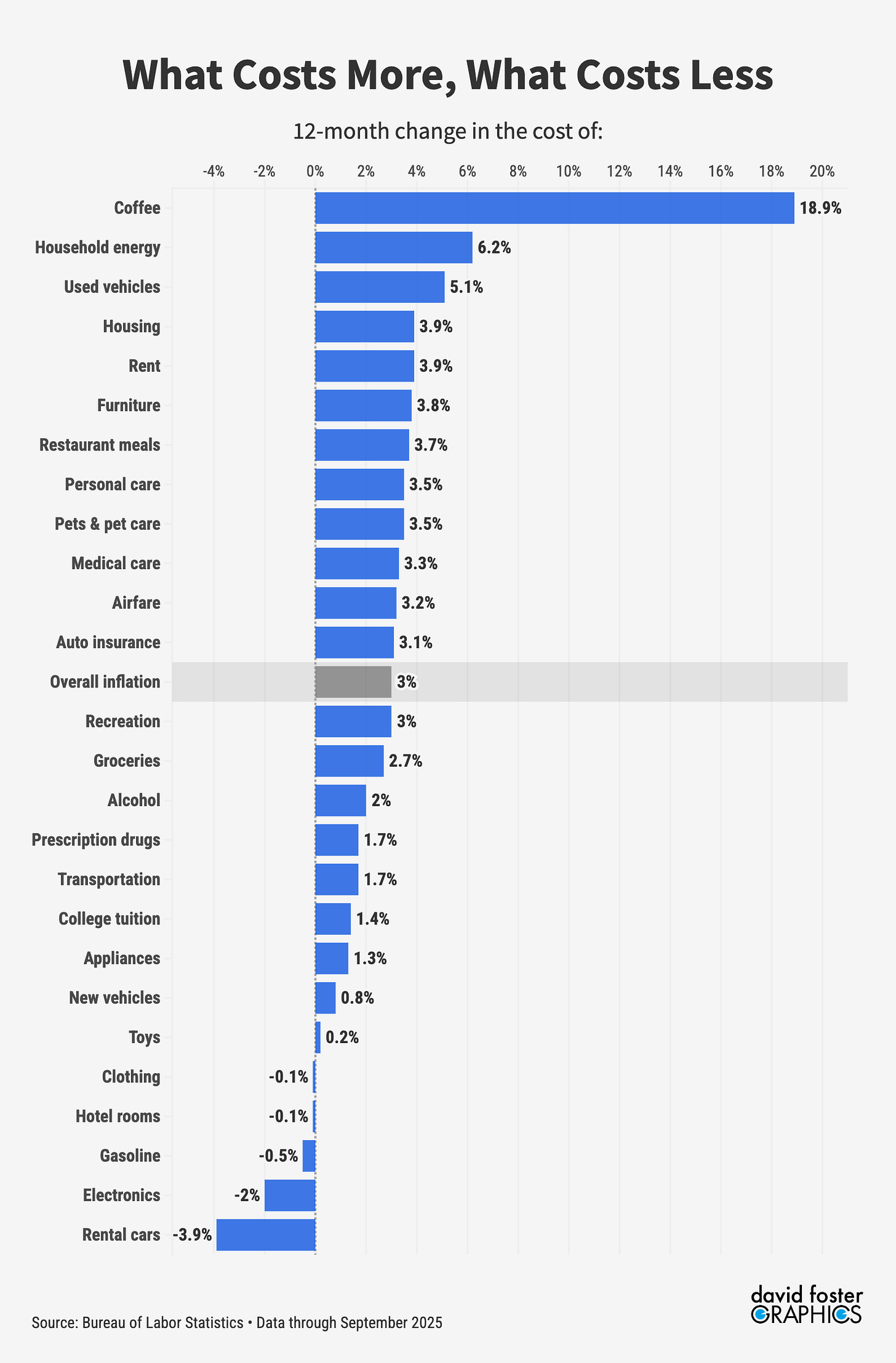

Trump’s tariffs have raised the average tax on imported goods from 2.5% to about 18%. Inflation has since risen from a low of 2.3% in April to what will probably be around 3% when the reopened government starts tracking prices again. Three percent inflation isn’t ruinous, but it comes after four years of elevated prices that have hammered family budgets.

The cost of some items has risen by much more than the 3% average. Coffee prices are up 19% year-over-year. Beef is up 15%, bananas, 7%. Bananas aren’t a must-have item, but when consumers feel strapped, they’re far more likely to notice what’s going wrong than what’s going right. And Trump’s tariffs have gotten so much attention that many Americans have been bracing for higher costs.

Trump responded on November 14 by removing his new tariffs on dozens of food items, including bananas, coffee, pineapple, cinnamon, and certain types of tomatoes. A few days earlier, Treasury Secretary Scott Bessent had heralded this as a move that “will bring the prices down very quickly.”

[👇I discussed Trump’s affordability push on CNN on November 15 👇]

Sorry, but nobody’s going to rejoice over Trump reversing his own tariffs on a weirdly handpicked list of food products. And there are many causes of the affordability crunch, in addition to tariffs.

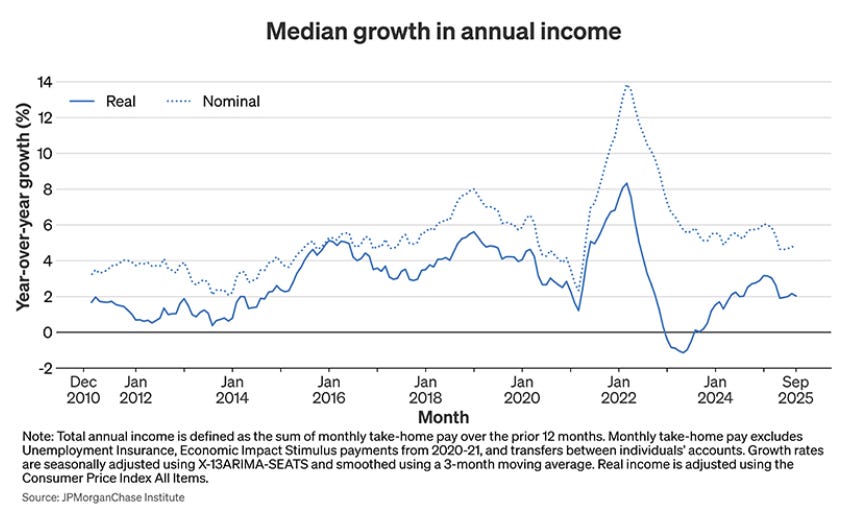

For one thing, incomes are flatlining, which is probably a long-term trend that Trump can’t easily reverse. New research by JP Morgan Chase finds that median real income, adjusted for inflation, has been falling since the start of the year and is settling at rates below the historical average. Young adults face the sharpest income slowdown, at the same time recent college grads face a punishing job market.

“These dynamics show a downgrade in purchasing power growth for all individuals,” the bank’s research found. “Persistently high increases in consumer prices have been a real headwind to purchasing power in recent years.”

Millions of households are also about to face higher winter heating bills. Natural-gas prices have risen by 67% from a year ago, to the highest levels since Russia’s invasion of Ukraine in 2022. Gas heats about 61 million US homes, and it also generates much of the electricity that heats another 57 million homes. Some utility costs are regulated, but higher spot prices inevitably push residential prices higher.

One reason gas prices are rising is a surge in natural gas exports that began under President Obama in 2016. President Biden banned gas exports to some countries in 2024. Trump lifted that ban this year, and he wants other countries to buy even more US gas. Natural gas exports have hit new record highs every year since 2016 and are 350% higher than they were then. US production has risen, too, but gas going overseas means prices rise at home.

Electricity prices are also rising, as natural gas prices jump and the huge buildout of data centers increases demand. Overall, household energy costs are up 6.2% during the last year, more than twice the rate of overall inflation.

Every family knows that healthcare costs are burdensome, too. Insurance premiums for people who get coverage through an employer are set to rise 6% next year, after two years of 7% increases. Premiums for government-subsidized plans will rise about 7%. Those costs will be much higher if Congress declines to extend subsidies set to expire at the end of this year, which was one of the things Democrats were fighting for during the recently concluded government shutdown.

On top of all of this, housing affordability is close to the worst levels on record, thanks to soaring home values since the Covid pandemic, a shortage of new housing and moderately high interest rates. The median age of a home buyer is 59, up from 39 just 15 years ago. Many Americans are simply priced out of homeownership.

Housing, healthcare, and utilities account for about 45% of all household spending. Those costs have been outstripping incomes for some time, and many Americans feel like they’re only falling further behind. Cheaper bananas or coffee isn’t going to change their minds.

Trump has a smattering of other ideas to help Americans with their finances, such as a 50-year mortgage, a new round of stimulus checks and cash payments for healthcare. But these are gimmicky schemes that would require approval by a skeptical Congress and might not help much, anyway. Trump is famous for lobbing ideas on social-media that he never follows up on, and these probably fall into that bucket.

Trump’s actual policies, meanwhile, contribute to the problem. The tax bill he signed into law over the summer will cut taxes for top earners but raise out-of-pocket costs for those at the bottom, mainly through cutbacks in Medicaid and food aid. And the higher costs resulting from his tariffs will cost the typical household about $1,800 per year. Nobody can eat enough discounted bananas to make up for that.

Lots of folks are going to be "going bananas" when they start checking the totals in their shopping cart after Thanksgiving. Let's hope Trump 2.0 won't start "talking turkey" too!