Why Trump let up on Greenland while rampaging through Minnesota

Markets stopped Trump's Greenland misadventure. Eventually, they'll protest Trump's effort to destabilize America.

All it took for President Trump to drop his plan for conquering the independent territory of Greenland was one down day in financial markets.

Minnesota should be so lucky.

There’s a stark gap between the forces that govern Trump’s attacks on external targets, and on domestic ones. Any adverse reaction in financial markets forces Trump’s hand and compels him to cut his losses. Markets, however, aren’t registering much of a verdict one way or another as Trump sows chaos within the United States itself.

Trump’s immigration sweep in Minnesota has become a gross misuse of federal force that so far has left two Americans dead at the hands of trigger-happy federal agents. Trump has caused more mayhem in Minnesota than in Greenland. Yet he backed down on Greenland, while his masked thugs continue to maraud through Minnesota. What gives?

Trump’s failed effort to acquire Greenland involved a threat to impose tariffs on European nations unless they went along with the scheme. The tariff threat, which surprised markets, led to a 2% loss in the S&P 500 index on January 20 and a modest uptick in long-term interest rates. Trump called off his Greenland quest the next day and said he had made a deal that would allow the United States all the access it needs to Greenland. In other words, he caved.

Investors have gotten used to the TACO trade, for Trump Always Chickens Out. It began last April, when Trump announced sweeping tariffs on most countries and stocks sank 11% in one week. Trump backed off, and stocks recovered. That pattern has played out several times since then, as Trump ratchets his beloved tariffs up and down.

Trump, alas, does not always chicken out when it comes to abusing his fellow citizens. Traders may be appalled at the sight of federal goons hassling, detaining, pepper-spraying, and killing nonviolent protesters, but they don’t see how it affects corporate profits, cash flows or consumer spending. It certainly does affect those things for businesses and consumers in the Minneapolis-St. Paul area Trump has targeted. But not enough to affect global markets in tangible ways affecting market action today.

[Your 5-step guide to the next Trump crisis.]

Trump, it turns out, is not as cowed by political blowback as he is by a Wall Street selloff. His immigration crackdown is unpopular and he has lost the edge on an issue that was one of his biggest advantages against Democrats when he ran for president in 2024. His Republican allies in Congress are squealing about the Minnesota shootings and urging Trump to scale it back.

Trump says he’s rethinking the Minnesota operation, and he may fire an aide or two as an effort to whitewash the killings. But he’s sure taking his time. The January 7 killing of Renee Good was warning enough that amateurs with guns are in over their heads in Minnesota. Yet Trump changed nothing, setting the stage for the January 24 killing of Alex Pretti. Even then, Trump and his deputies lied about what happened and tried to convince Americans the victim was a terrorist threat when everybody watching the incident with their own eyes can plainly see that’s a fiction.

A sinister interpretation of Trump’s Minnesota operation is that it’s a trial run for an armed federal disruption of the upcoming midterm elections. If so, then Trump may not care if his actions are unpopular, because he plans to rule by the gun, not by the vote.

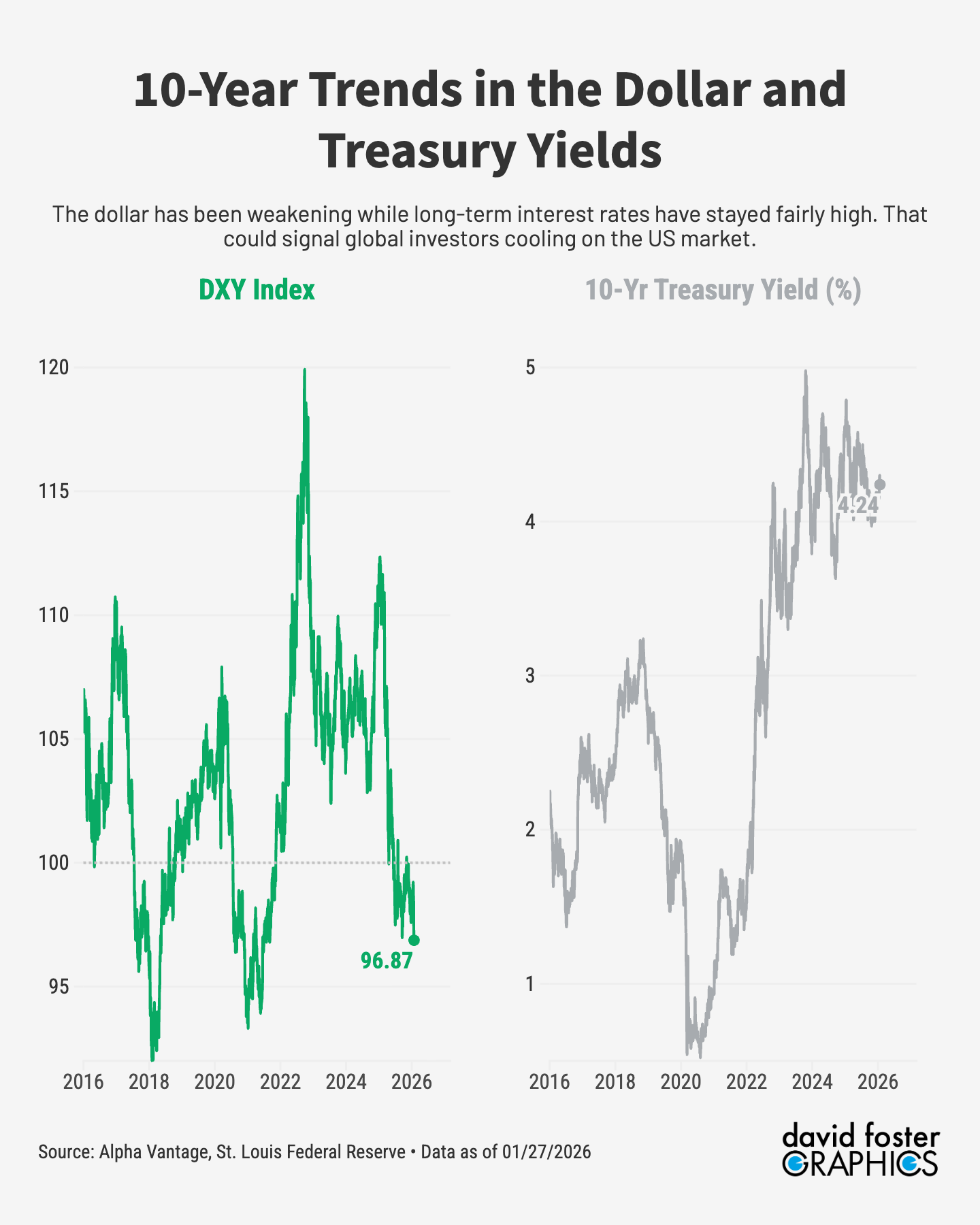

Yet Trump does make mistakes, and he’ll be wrong if he assumes that a hostile takeover of America will have no financial consequences. The “sell America” trade is alive and well, according to market signals that may be too subtle for Trump to notice. The US dollar has been losing value since Trump took office, and has recently hit the lowest levels of Trump’s second term. Part of the reason is that global investors are buying fewer American assets, lowering the demand for dollars.

[Why Americans say they’re worse off under Trump]

Long-term interest rates have been creeping up recently, a sign that investors are worried about inflation and instability. US stocks have been doing well, but they’ve also underperformed global stocks by a substantial margin during the last year. Investors no longer think America is all that.

If Trump really is warming up for a deeper authoritarian crackdown, markets will eventually try to talk Trump out of it. A core strength of the US economy is political stability and clear laws applied to everybody. It will take a lot to break that, but if it happens, Trump may find it’s not as easy to undo as simply canceling some tariffs.

Brillaint framing with the TACO trade. The asymmetry you're pointing out is really striking, how Wall Street meltdowns immediately pull him back but domestic chaos gets no such restraint. Kinda reminds me of past administrations reacting quikcer to donor concerns than constituent ones. The subtlety about long-term rates creeping up could be the early warning sign markets are starting to price in instability tho.

Trump thinks he can bully anybody into doing exactly what he wants but.i think maybe he may have a limit on that process. One thing i do no is i am not as positive on that as i would like to be.The problem here is the Republican Party itself.If some of these wads wise up it is all over for Trump.As yet they think their Party is okay. It is not okay.