The jobs report we didn’t get yet is probably lousy

The agency that publishes the official job numbers is shut down, but plenty of other data shows the labor market under Trump flatlining.

Investors feel deflated. The monthly jobs report, typically due the first Friday of every month, is a no-show. That data provides crucial clues about the health of the economy and guides the Federal Reserve’s interest-rate moves. But the government shutdown has delayed the September numbers that were due October 3, muffling a trading catalyst and blurring the outline of the economy.

The government jobs report isn’t the only game in town, however, and economists still have a pretty clear idea what’s happening in the labor market. It’s not good. Moody’s Analytics, as one example, thinks job growth in September was 0: no jobs gained, on net.

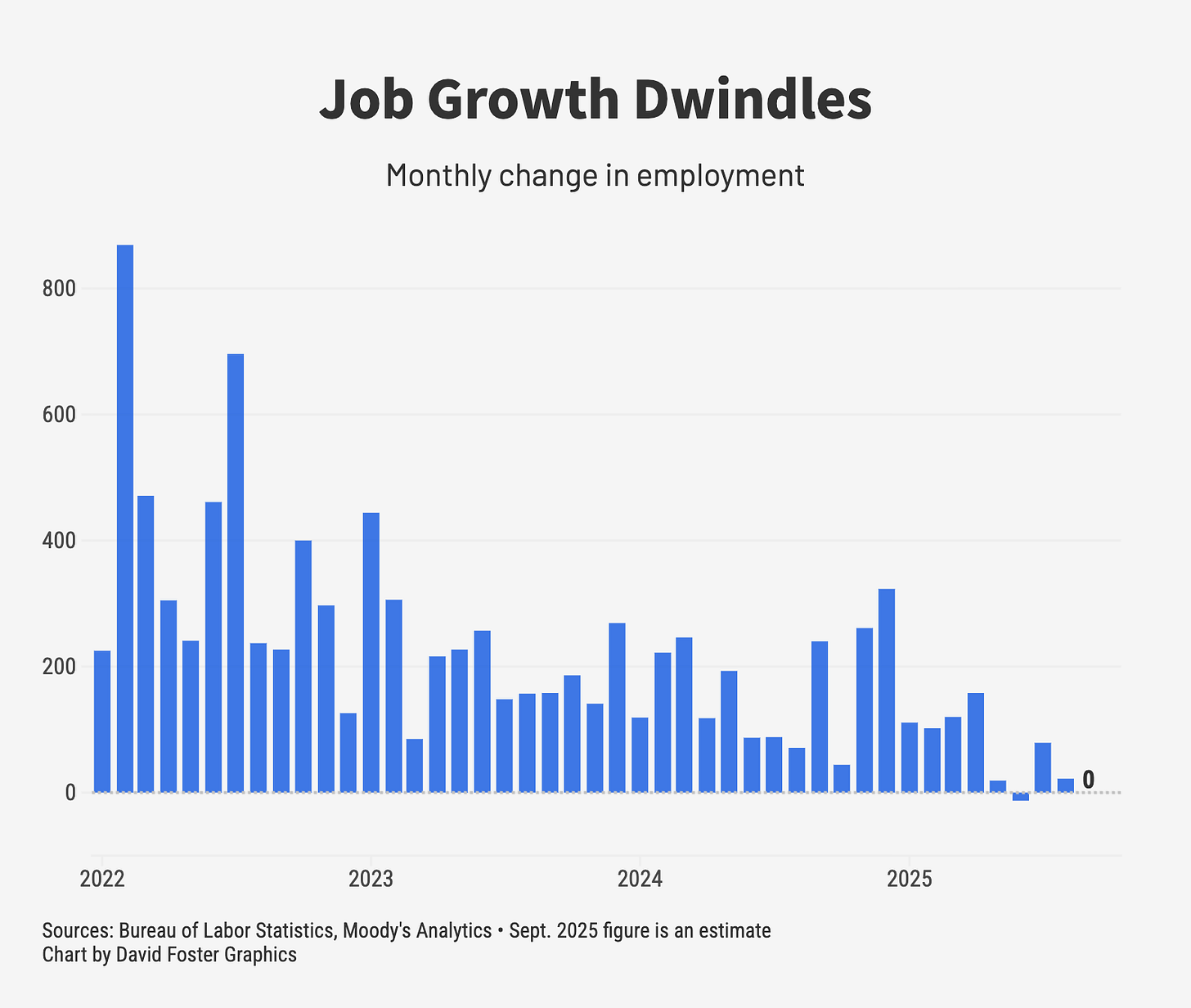

That would fit the trend of the last several months. The economy lost 13,000 jobs in June, the first negative print since the Covid pandemic in 2020. The average of the last three months has been a meager 29,000 new jobs. That’s a sharp drop from 2024, when employers added 154,000 new jobs per month, on average. Graphics guru David Foster put the numbers into this chart, using the Moody’s estimate for September.

President Trump may not mind that the government’s statistical agencies have gone dark. He’s plainly unhappy with the status of the job market. When the Bureau of Labor Statistics reported that the economy added just 73,000 jobs in July, he called the data “rigged” and fired the head of the agency. It didn’t help. Since then, the trend has gotten worse, not better.

Other data shows the same weakening in the job market. Payroll processor ADP says the private sector lost 32,000 jobs in September, the worst showing since March 2023. A key gauge of the service sector, which is where most Americans work, declined in September, suggesting stagnant hiring or even job losses. The Indeed job-posting index declined 2.5% in September.

Trump has a problem, because his own policies are probably causing the hiring slowdown, which will eventually become an economic slowdown. His tariffs on imports amount to a new tax of about $20 billion per month on American businesses and consumers. Raising costs almost always reduces economic activity. It’s rational for businesses that have to pay more for inputs and wholesale goods to slow or stop hiring as they try to figure out how the higher costs affect their cash flow.

[Check out my latest Konomy Quiz: How bad are government shutdowns, anyway?]

The other Trump policy affecting the job market is the deportation of migrants. This is a bit tougher to piece together, given that workers in the country illegally are hard to quantify. But any reduction in the labor force, whether the workers are authorized or not, is likely to reduce job growth. Even unauthorized migrants earn income, spend money and contribute to economic growth, which is what spurs hiring.

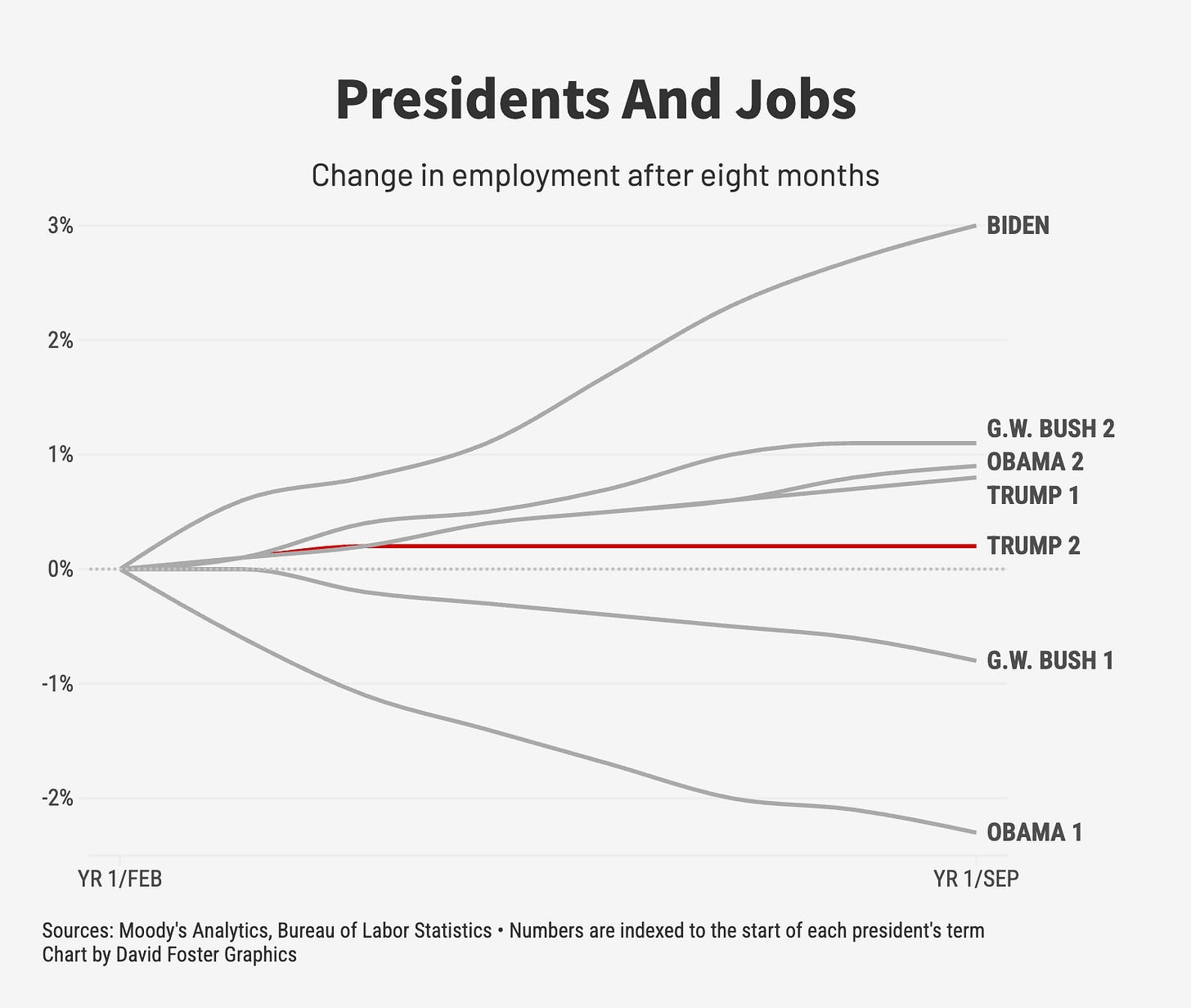

The Trump economy is off to a troubling start. Employment under Trump at the eight-month point is the third weakest among all presidents going back to Richard Nixon in the 1970s. The only two presidents who got off to a worse start had to deal with a recession during their first year: George W. Bush in 2001 and Barack Obama in 2009. Here’s the David Foster chart, using data provided by Moody’s Analytics, starting in 2000:

Trump tells a different story, of course. He claims a new “Golden Age” is underway in America, with inflation defeated, energy cheap and wages rising. But Americans don’t feel it. Confidence levels are weak. Trump’s import taxes are pushing prices up, not down. And voter views of Trump’s handling of the economy have turned solidly negative, with just 37% approving in a recent AP-NORC poll.

The stock market has Trump’s back, for now, with indexes at record highs and wealthy Americans cashing in. But the stock market and the underlying US economy seem to be diverging. Stock values, at the moment, are driven by artificial-intelligence hype and a handful of giant tech companies that global investors consider must-buy opportunities. Those tech titans depend more on worldwide investor demand than on the basics of the US economy.

The September jobs report will arrive eventually, based on how long the shutdown continues. One temporary blank in the data won’t derail the Fed as it debates whether to continue cutting rates, and investors have plenty of other metrics to help them decide what to buy and sell.

Trump may not like the government numbers once they actually arrive, but he doesn’t need to wait that long to decide that his economic plan is sketchy. The verdict is already in. It’s just not official, quite yet.

The Fed still understands what is going on:

https://open.substack.com/pub/arkominaresearch/p/government-shutdown-labor-markets?r=1r1n6n&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false