Stock owners are better off under Trump. Most others are not

Our exclusive Better-Off Barometer shows where the Trump economy is surging, and sagging.

One year ago, Americans decided to give Donald Trump a second term as president. Low confidence in the economy was one of the big reasons voters dumped the incumbent Democrats in favor of Trump.

So how’s Trump doing? We’ve created the Better-Off Barometer to answer that question. The Rick Report tracks the Trump economy on an ongoing basis in six key categories, using data provided by Moody’s Analytics. We’ve established a methodology that lets us compare the Trump economy with that of prior presidents going all the way back to Jimmy Carter in the 1970s. By indexing the data to the start of each presidential term, we can do apples-to-apples comparisons between Trump and any of the 12 prior presidents on jobs, manufacturing jobs, inflation, incomes, stock values and GDP growth.

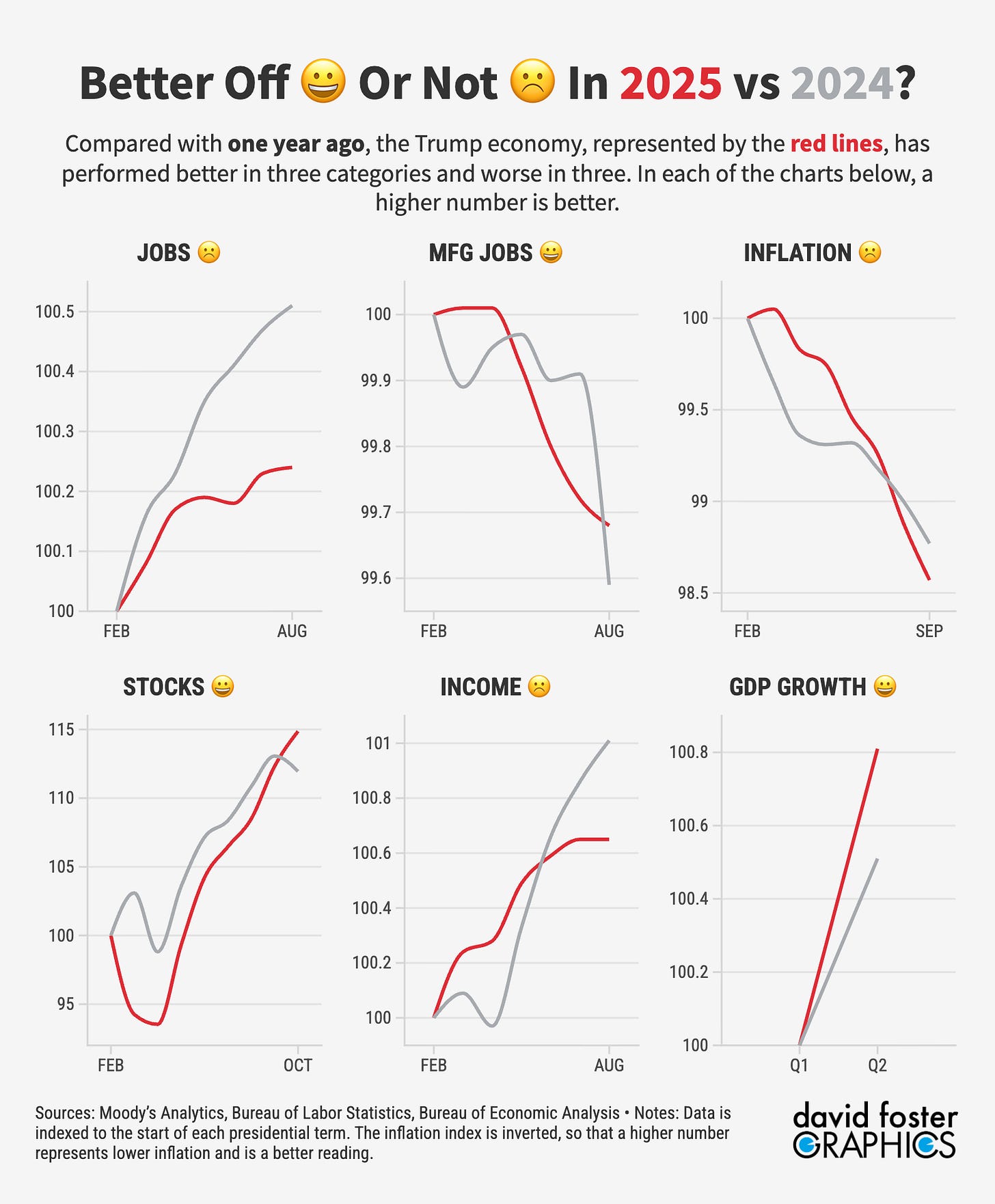

Compared with a year ago, Trump is doing better on three of those metrics and worse on three others. So on balance, the Better-Off Baromter says the economy is about the same as it was a year ago. Not so bad.

But the details reveal a more troubling story in which the things that matter most to working class Americans are worse off than in 2024, as the charts below show. The main thing that’s better is the performance of the stock market, which benefits the wealthy the most. This fuels the bifurcated economy many economists worry about, because extensive gains at the top offset losses at the bottom and make the overall economy look rosier than it is.

Our data measures change in those six categories since Trump took office in January. We’re not measuring raw levels of economic activity, but the increase or decrease during Trump’s second term. The pace and direction of change is how most people assess whether things are getting better or worse, and whether they’re getting ahead or falling behind.

The charts detail how the Trump economy has performed from February through October, compared with the same period in 2024. The S&P 500 stock index rose 14.9% from our starting point through October, besting the 12% gain during the same period in 2024. The artificial-intelligence revolution has propelled stocks to one record high after another this year, and corporate earnings have survived Trump’s tariffs much better than expected.

Those stock gains are generating a powerful wealth effect among those lucky enough to own stocks, who are spending with the confidence of boom-timers. That’s keeping aggregate spending up and growth solid. The Atlanta Fed’s GDP Now tool estimates that GDP growth in the current quarter is a robust 4%.

But job and income growth are both slower in 2025, and those slowdowns are more likely to affect people who live off a paycheck than those living off capital gains. Manufacturing employment is doing better under Trump, but that’s the lesser of two evils; blue-collar employment dropped in both years, and it has merely dropped by less under Trump.

Inflation has become an unlikely bugaboo for Trump. Inflation under Biden peaked at 9%, the highest level in 40 years, and high prices turned out to be the Achilles heel of the Biden economy. Trump hammered his Democratic opponent, Kamala Harris, on “Bidenflation” during last year’s election, and the results suggest voters bought it.

Yet inflation during Trump’s first eight months rose by more than during the same period the year before. Our chart on inflation is inverted, so that a higher number is better, as in all the other charts. If you flip it around, prices have risen by 1.43% under Trump, up from 1.23% in 2024. That’s a small difference, but it signals that inflation is once again going in the wrong direction, and consumers have noticed.

The overall inflation rate dropped gradually from that 9% peak in 2022 to a low of 2.3% this past April. But it has ticked up since then, and hit 3% in September. Trump’s tariffs are the main thing pushing prices higher, since they’re taxes on imports that raise costs, first at the wholesale level, then on store shelves.

We also compare the current economy to the one from four years ago, and that comparison is worse for Trump. The 2025 economy wins on inflation and income growth, but lags on job and manufacturing employment, stock gains, and GDP. We rate the 2025 economy “somewhat worse” than in 2021. The four-year comparison will likely matter more when the next presidential election rolls around.

Americans have soured quickly on Trump’s handling of the economy, and the Better-Off Barometer explains why. Trump’s approval rating on the economy peaked at 49% during his second week in office. It’s now at 39%.

Trump doesn’t face reelection. But many Trump acolytes do, and at the moment, they don’t have a lot of economic joy to brag about. Follow the Better-Off Barometer to gauge whether that changes.