Layoffs are suddenly making the "vibecession" seem like the real thing

Under Biden, the bad vibes came from high prices. Under Trump, jobs are becoming the main worry.

Those skittish workers were onto something.

For months, workers have been sending a troublesome message about what they see in the labor force: Jobs are getting scarce, the odds of losing your job are rising, and good luck finding a new one if you get laid off. Gathering gloom about the job market has pushed Americans’ outlook for the economy to recessionary levels.

Economists and investors have viewed labor market stress as a kind of outlier. Employers aren’t adding jobs at the hyperactive pace they did in the aftermath of the Covid downturn, after unprecedented amounts of fiscal and monetary stimulus. Yet the unemployment rate has stayed low. Consumer spending has held up. And look at that stock market! New record highs week after week.

Yet a sudden surge in layoffs suggests those gloomy workers had pretty good intuition. UPS recently disclosed it has downsized its workforce by 48,000 people so far this year. Amazon said it’s axing 14,000 workers. Intel, Accenture, Target, Meta and other firms are also downsizing in large numbers. The labor shortage of just a few years ago now looks like a glut.

Big layoff announcements don’t mean a recession is imminent. But these five-digit downsizings arrive as employment growth has dwindled to nearly 0 in recent months. The government shutdown delayed the latest jobs report, yet it’s clear that the hard data on actual jobs is starting to merge with the soft data on lousy attitudes about the hiring environment. Bottom line: It’s not just a bad vibe about jobs. It’s an actual lack of jobs.

There’s also mounting evidence that artificial intelligence—a boon for stock-market investors—is starting to displace workers. Layoffs are now mounting in white-collar occupations where AI is a plausible replacement for some middle managers and office toilers. If that trend solidifies, it could mean years of displacement in the labor force, not just a one-time period of adjustment.

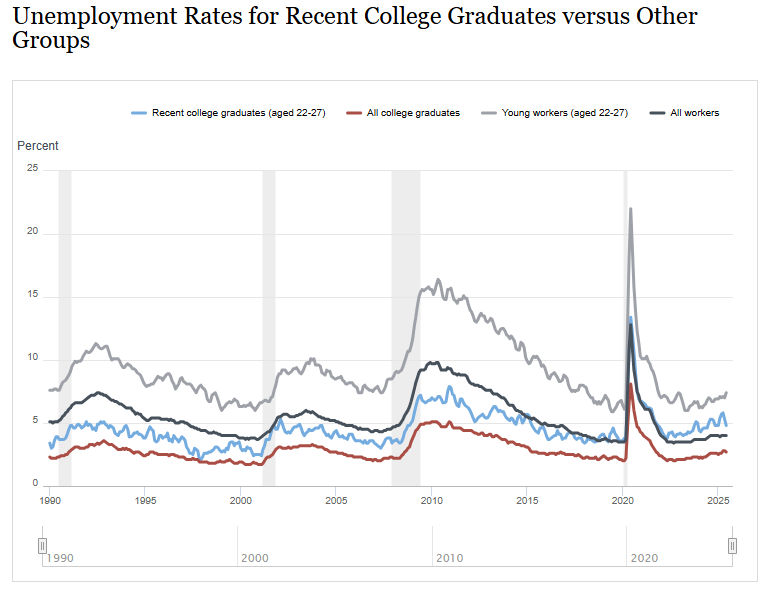

Young workers may have felt it first. The unemployment rate for college grads aged 22 to 27 is nearly a full percentage point above the rate for all workers, according to the New York Federal Reserve. That’s a sharp downgrade for America’s future taxpayers. For the 30 years prior to the Covid disruption in 2020, the unemployment rate for recent grads was 1.3 points lower than the rate for all workers, on average.

The “vibecession” materialized around 2022 amid the highest inflation in 40 years. Growth in employment, incomes and output were strong for most of Joe Biden’s presidency. But inflation that peaked at 9% in 2022 hammered family budgets and drove confidence down to recessionary levels. Biden repeatedly tried to get voters to look on the bright side, but all the things going right were not enough of a counterweight to lost purchasing power. Voters punished the incumbent Democrats by electing Donald Trump to his second presidential term in 2024.

The bad vibes now seem to be emanating from jobs, not prices. Inflation has dropped from 9% to 3%, but job worries are now the main thing keeping confidence depressed. And if the layoffs continue, it won’t just be worries about a weak job market, but actual unemployment that bums people out.

The vibecession still isn’t an actual recession, even though many Americans think that’s where we’re heading. Economists expect the surging stock market and the massive wealth of the shareholder class to support robust spending, even as the gap between the rich and the rest widens. Corporate earnings are generally strong, and the Atlanta Fed’s forecasting tool projects 3.9% GDP growth in the current quarter. Wealth inequality is getting so pronounced that a minority of rich spenders can keep the whole economy afloat.

Yet the job-market vibecession carries the same warnings for Trump that the inflation vibecession did for Biden. Trump’s approval rating is underwater and his marks for handling the economy—a strong point in the 2024 election—are even worse, with net approval of just 39%. Trump doesn’t need to worry about reelection, but hundreds of other Republicans do, in next year’s midterm elections, and beyond.

Trump seems blasé. He’s relentless about imposing tariffs that raise costs and heighten business uncertainty, which might be contributing to layoffs and a reluctance to hire. The tax cuts Trump signed into law over the summer will mainly benefit businesses and the wealthy, which could help keep the aggregate economy solid. But that law also includes benefit cuts that will leave the bottom 20% of earners worse off, and those are folks who can’t just sell a few shares of Apple to make up the difference.

Bad vibes start with workers. But they come for politicians, too.