Job growth cratered in 2025

There's been a sharp slowdown in hiring since Trump started imposing tariffs in the spring.

The post-Covid jobs boom is officially over.

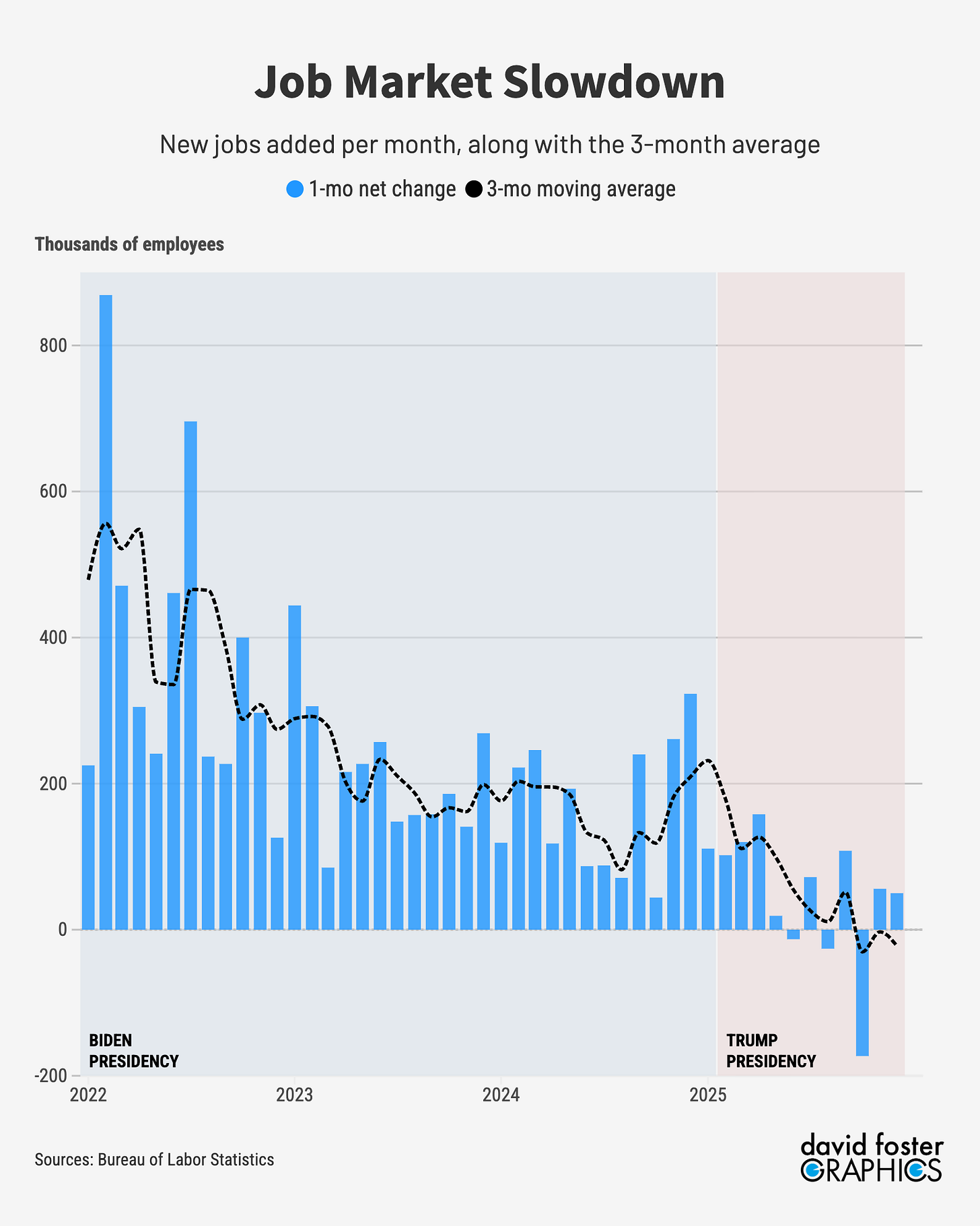

Employers created just 584,000 new jobs in 2025, down from 2 million new jobs in 2024. Excluding recessionary years, that’s the weakest yearly job growth since 2003.

The hiring slowdown correlates closely with the tariffs President Trump started imposing in the spring. When Trump took office, the average tax on imports was 2.5%. In April, Trump announced sweeping tariffs on imports from most countries that raised the average tariff rate to 28%. He has since rolled back some of those, but the average tariff rate is still about 17%.

Many economists warned that Trump’s tariffs would raise costs throughout the US economy, stoke inflation, add uncertainty and kill jobs. The worst forecasts haven’t panned out, but the tariffs do seem to have squelched hiring.

Employers added just 50,000 jobs in December. During the eight months that Trump’s tariffs have been in force, employment growth has averaged a piddly 12,000 new jobs per month. In the 12 months before Trump’s tariffs went into effect, job growth averaged 151,000 new jobs per month.

Part of the overall hiring slowdown has been Trump’s pruning of the federal workforce, which shrunk by 274,000 jobs in 2025. But private-sector hiring is stalling, anyway. Post-tariff job growth in the private sector has averaged just 38,000 new jobs since April. In the 12 months before that, private-sector job growth averaged 123,000.

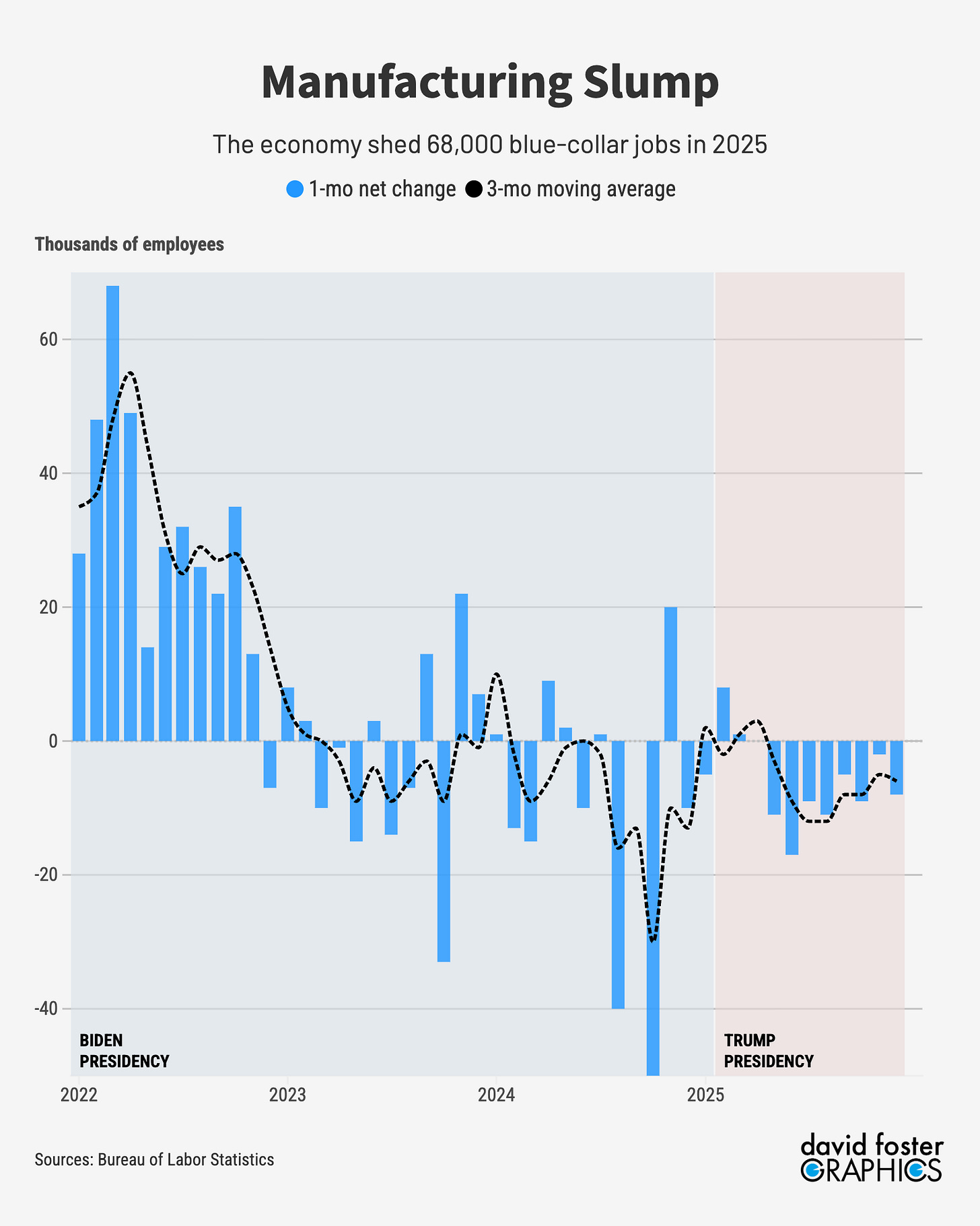

The manufacturing workforce is shrinking, with a loss of 68,000 jobs in 2025. That trend isn’t new; the sector lost 105,000 jobs in 2024. But a stated goal of Trump’s import taxes is to revive American manufacturing, and it isn’t happening.

This is not a recession. The overall economy is still holding up, with solid GDP growth likely for 2025, once the data arrives. But a lot of that growth is coming from massive investments in artificial-intelligence data centers, which don’t involve a lot of jobs.

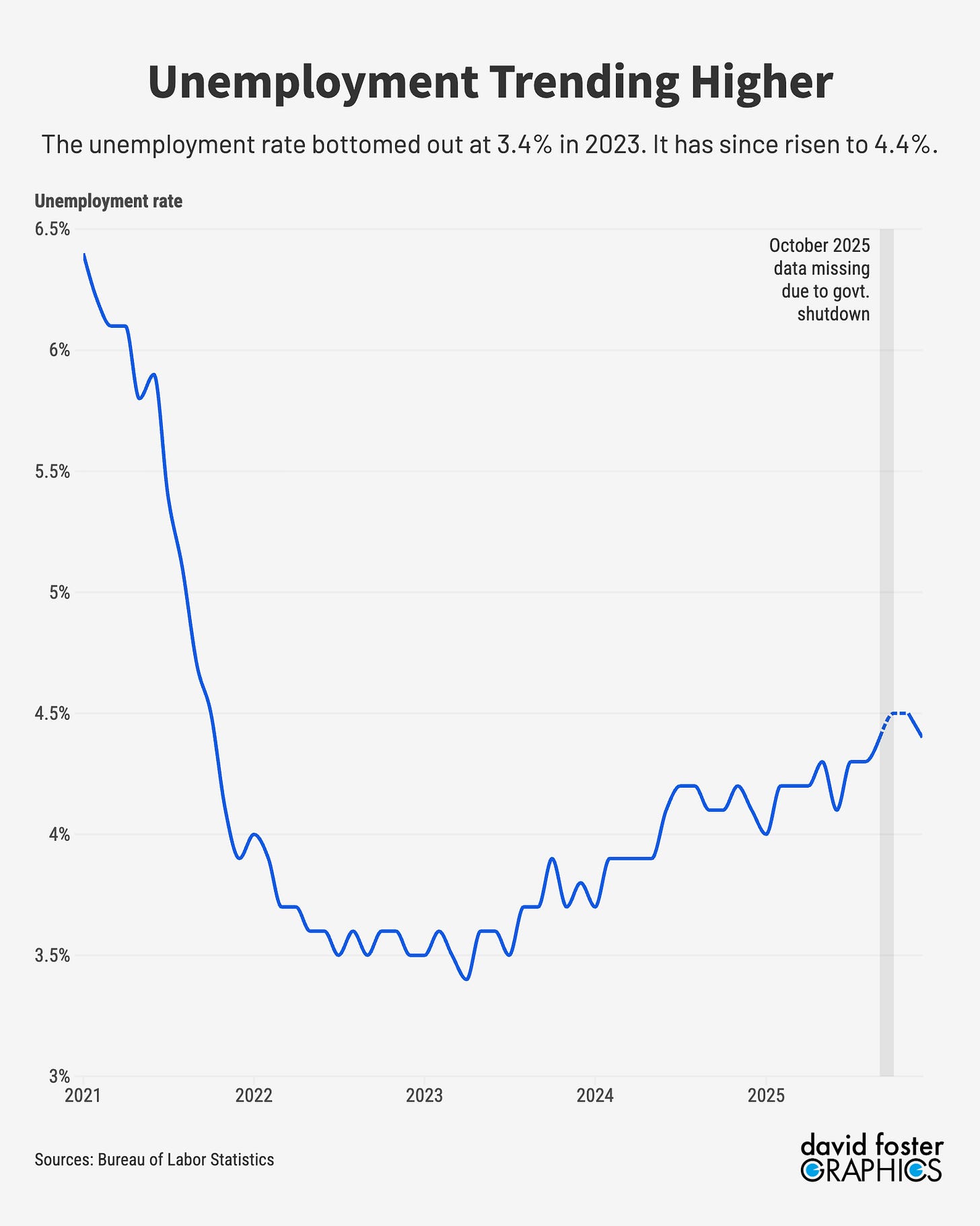

The sharp slowdown in hiring will intensify Americans’ affordability concerns in 2026. Confidence surveys show that Americans are clearly worried about scarce jobs. The average number of hours worked has been declining since 2021. That cuts into pay for hourly workers.

Inflation, meanwhile, has risen from 2.3% in April to 2.7%. That’s not a huge jump, but almost all the prices that rose during the last four years have stayed at those new, higher levels. Trump promised to bring prices down, and hasn’t delivered.

Hiring could pick up in 2026 if Trump continues to roll back tariffs or CEOs decide that most of the Trump tariff shock is in the past. But Americans may also have to adjust to a new labor market that feels pretty lousy.

Fred got it right but,what is going to change this situation since it reared it's ugly head.Duh maybe a new President.

Rick

It is easy to explain the correlation you note between macroeconomic shrinkage and tariffs.

ALL corporate finance is limited by the flow of funds available to investors as future cash that will support invested capital. Like it or not, "EBITDA" is the acronym investors accept to define that "flow of funds."

American investment thrives when EBITDA rises and declines when EBITDA falls. Lots of complex analyses can be used to explain that, but SINCE EBITDA IS WHAT INVESTORS USE (FOR THE MOST PART) TO DESCRIBE WHAT THEY SEEK TO GROW, WHATEVER REDUCES EBITDA HARMS INVESTMENT AND WHAT ENHANCES IT HELPS.

"Tariffs" (like ALL "transfer" taxes) reduce business revenues and, therefore, come out of cash flows "BEFORE" EBITDA while "income, estate and gift taxes" do NOT reduce EBITDA. INCOME, ESTATE AND GIFT TAXES are paid based on the financial situation of individual investors. They "disappear" when investor income and wealth go away. (Thus, UNLIKE TARIFFS, income estate and gift taxes create government incentives to enact policies that grow income and wealth.)

THEREFORE, TARIFFS ARE "BAD" WHENEVER THEY ARE IMPOSED.

That is why McKinley's tariffs of the 1890s were disastrous and why Taft's insistence on the 16th Amendment to end debate over the legality of taxing "incomes from whatever source" allowed the US to fight and win in two world wars (relying on income, estate and gift taxation that does NOT reduce investment growth).