Elon Musk may never get that $1 trillion from Tesla

At Tesla's current growth rate, Musk might be in his 80s or 90s before he even gets close to earning $1 trillion in bonuses.

The headlines make it sound like an insane giveaway to Tesla CEO Elon Musk: A $1 trillion payday if he hits certain performance targets. It would be stratospheric pay for a stratospheric ego who thinks he’s worth more than hundreds of other CEOs, combined.

But digging into the details reveals how unlikely it is that Musk will ever get the full trillion. To earn it, Tesla would have to grow by multiples of its already gargantuan valuation, and avoid the sort of slowdown the company faces now. That would require groundbreaking innovation in robotics, artificial intelligence and other industries, comparable to Tesla’s success as an electric-car world-beater. Tesla would have to out-Tesla itself.

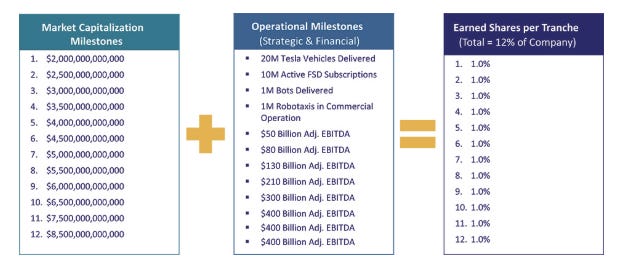

That’s the sort of challenge Musk obviously relishes. So here’s what he’ll have to do to pull it off. The new pay structure includes 12 levels of achievement, and at each point, Musk will receive an additional 1% share of Tesla stock, adding to the 15% he already owns. The value of 1% of the shares would rise as Musk performs his magic and Tesla’s market value grows.

Each of the 12 targets includes two milestones the company must meet for Musk to get his shares. The first is a new record-high market value, with targets ranging from $2 trillion to $8.5 trillion and mostly rising by $500 billion increments. So if Tesla hits $2 trillion and Musk earns his first bonus, the 1% of shares he will get will be worth around $20 billion.

Then there are operational milestones, including total cumulative sales of cars, robots, robotaxis and self-driving packages, plus pre-tax earnings targets. For each of the 12 targets, Musk must hit one valuation milestone and one operational milestone. Here’s a breakdown from Tesla’s official government filing:

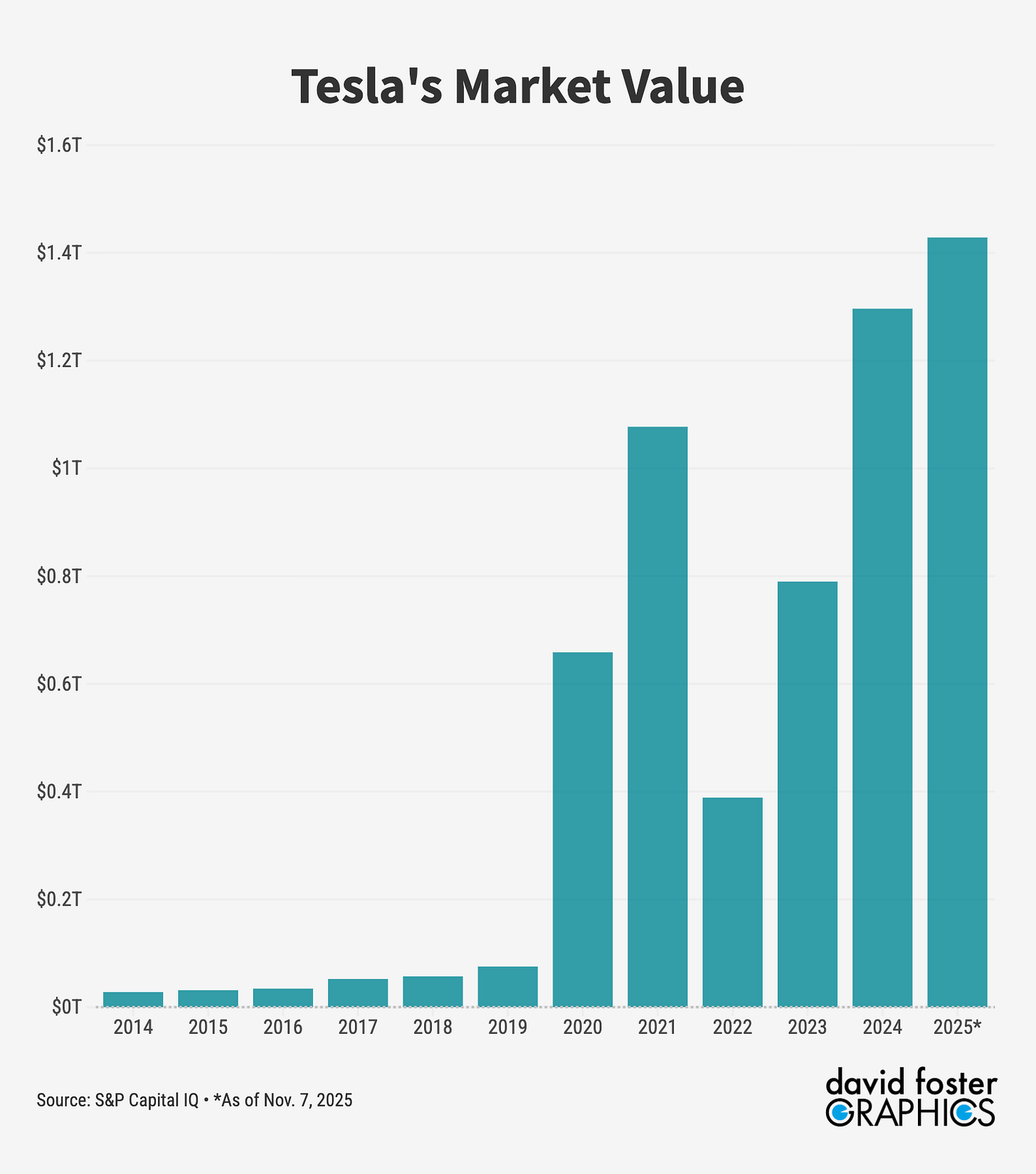

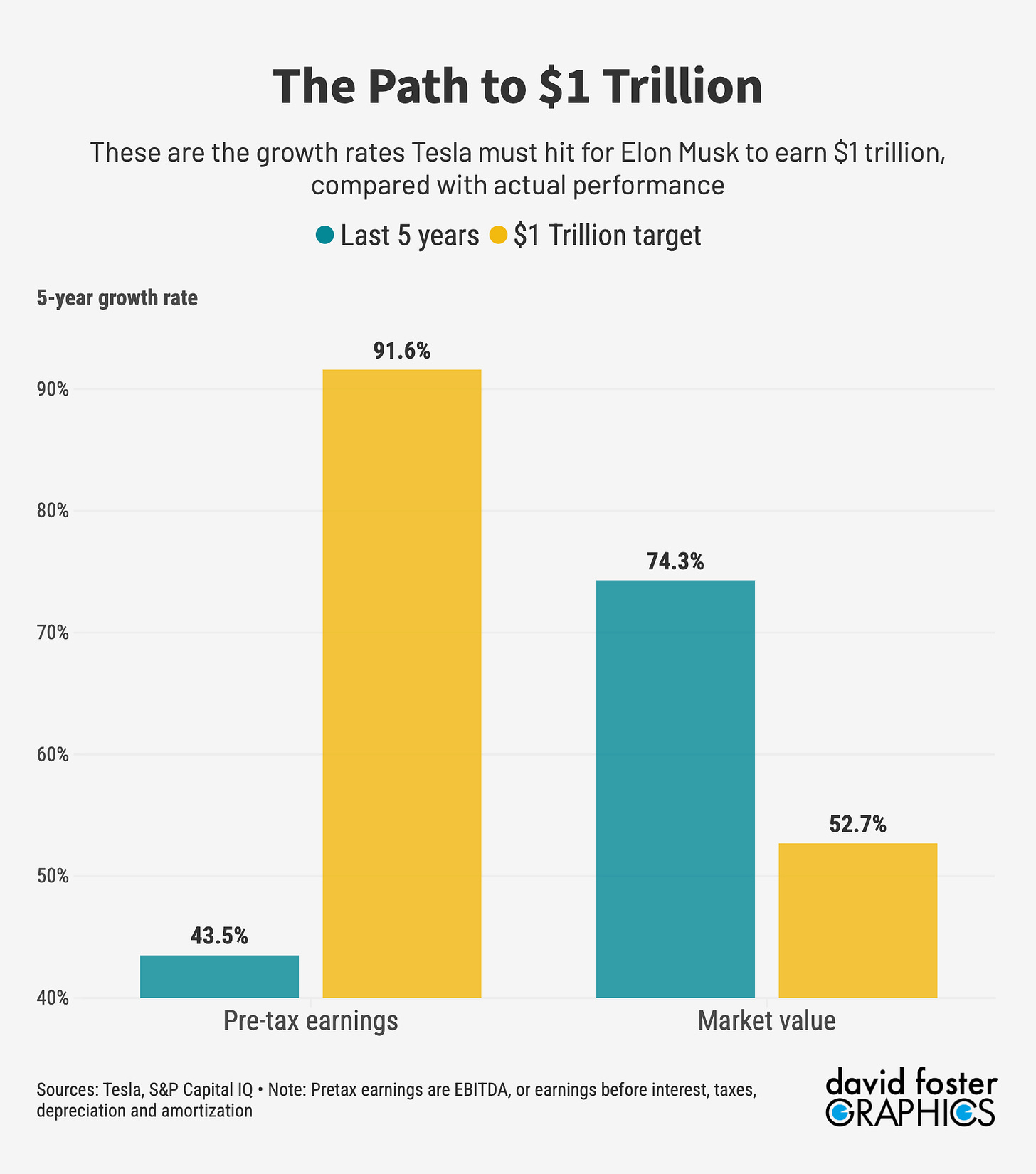

Comparing these targets with Tesla’s recent performance shows how tough they will be to meet. To hit an $8.5 trillion valuation, for instance, Tesla would have to achieve a 5-year average annual growth rate of 52.7%, according to the Tesla filing. That might seem possible, given that Tesla’s average annual valuation growth rate during the last five years topped that, at 74.3%.

But that historical growth rate includes an extraordinary runup Tesla experienced from 2020 to 2022, when its market value soared from $76 billion to nearly $1.1 trillion, a 1,271% gain. That came as President Joe Biden signed a huge set of tax incentives for green energy and Tesla looked like one of the huge beneficiaries of a global shift to renewables.

That sort of explosive growth will be hard to repeat. Just a few years since Tesla went on that tear, President Trump has killed much of Biden’s green-energy agenda and there’s a glut of electric cars. Tesla’s sales have also suffered from Musk’s radical political agenda.

The 3-year average annual growth rate in Tesla’s market valuation—which excludes the 2020-2022 boom—is just 6.4%, according to Capital IQ. So it’s crucial whether Tesla grows at the high-flying rates of the early 2020s or the pedestrian rates of the last few years.

If Tesla’s value grows at a high 74.3% annual rate, it would hit $8.5 trillion in value in just 3.2 years. But at 6.4% growth it would take 29 years. (ChatGPT helped with those calculations).

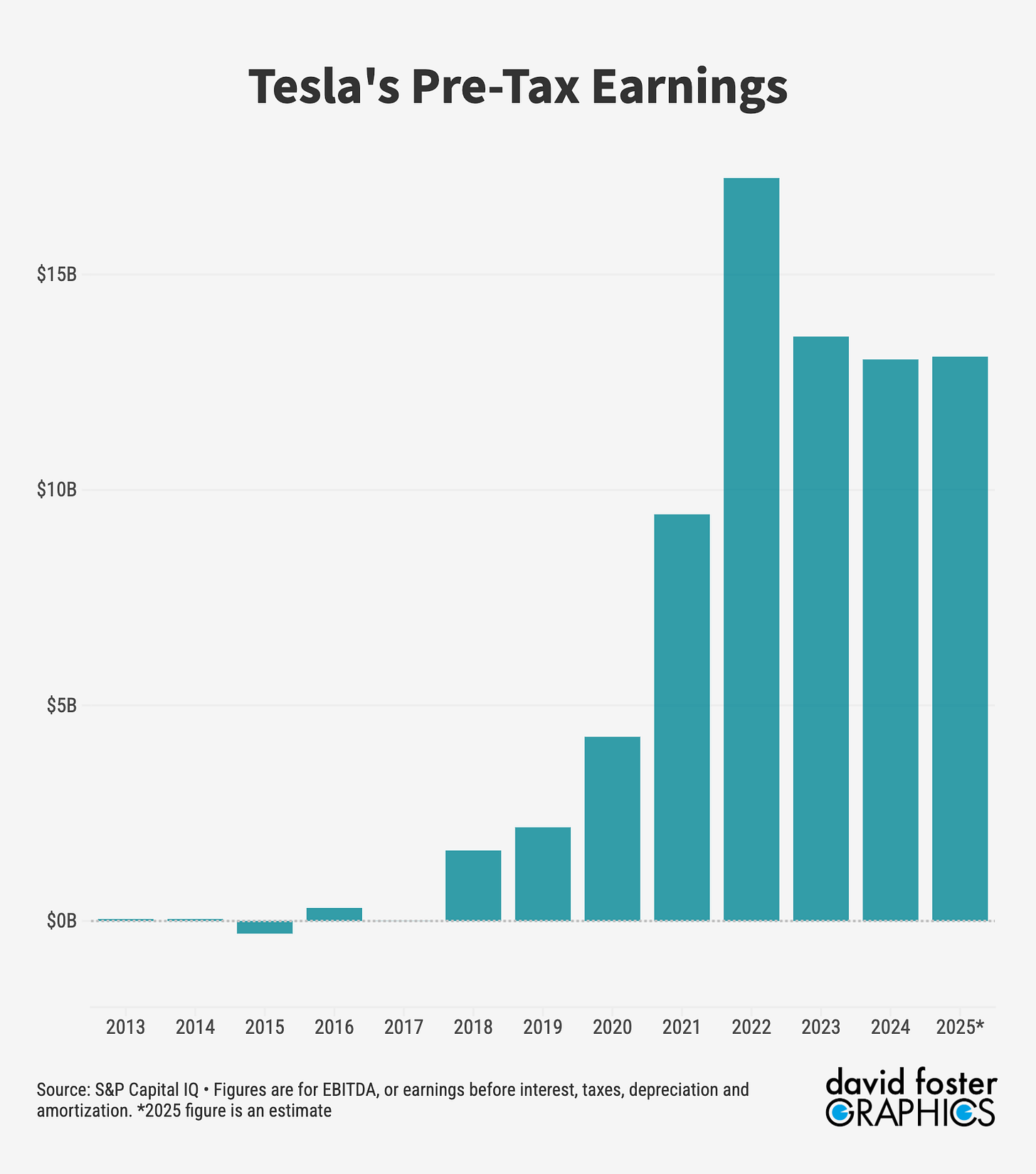

The pre-tax earnings targets Musk needs to hit are even harder. For Musk to get the full trillion, Tesla would have to hit $400 billion in pre-tax earnings, known as EBITDA. Tesla’s largest EBITDA number ever was $17.2 billion in 2022. This year’s EBITDA will be around $13.1 billion.

Again, it would take explosive and unprecedented earnings growth for Musk to hit his trillion-dollar target. Tesla says its five-year EBITDA growth would need to average 91.6% per year to hit $400 billion. The actual growth rate for the last five years was 43.5%. That slowed to an average of 11.4% for the last three years.

If Tesla’s current EBITDA grew at 43.5%, it would hit $400 billion in 9.5 years. But at the slower 11.4% growth rate of the last three years, it would take 32 years to reach $400 billion. Elon Musk would be 86 by then.

The product sales targets are harder to pinpoint, but obviously they’ll be a big factor in whether Tesla reaches those market value and earnings targets. Tesla has sold about 8 million cars in its history, and it moved about 1.7 million vehicles during the last 12 months. So at the current selling rate, it could hit 20 million in total vehicle sales within seven years. Robots, robotaxis and self-driving suites are newer, but Tesla could hit those targets in less than 10 years if it grabs and sustains first-mover advantage.

Musk and Tesla might be able to hit some of the preliminary targets on the way to $1 trillion. The first market-value target, $2 trillion, would require a 40% gain from Tesla’s current value. Tesla has gained that much in a single year several times before, so it could happen again.

But Musk would still have to pair that with an operational milestone that would likely take longer. It’s plausible Tesla could hit 20 million total car sales and a $2 trillion valuation within several years, unlocking Musk’s first 1% share increase.

Puny as it might seem to Musk, the first 1% award, if he gets it, would still probably make him the highest-paid CEO in corporate America, whenever it happens. With more than $900 billion in future earnings still on the table.

The math here really puts things in perspective. Even if Tesla hits that $2 trillion valuation, the operational milestones are the real hurdle. With current growth rates slowing down and competiton heating up in EV space, those EBITDA targets look increasingly unrealistic. Musk might need another goverment subsidy boom like 2020-2022 to even get close to these numbers.