3 numbers that will tell you where the Trump economy is heading

These are the key thresholds for long-term interest rates, monthly job gains and average tariff rates.

Since this is my inaugural post for The Rick Report, I thought it might be useful to treat it as a kind of mission statement. Don’t worry, I won’t bore you to death with gassy preaching.

President Donald Trump has obviously wrought a lot of chaos during his first year in office, and there’s doubtless more to come. Trump’s modus operandi is to break things, just for the sake of breaking them. If he can upset or harass perceived enemies, he’ll do it, without much care about the cost. He flexes power by demonstrating that he can and will do things no other president has dared.

The mainstream media continually expresses outrage and disdain. I share much of that outrage. But outrage isn’t a useful coping mechanism. It doesn’t help you plan for how Trump’s decisions might affect your own life. It doesn’t help you anticipate what Trump might do next or maybe even benefit from it.

The purpose of the Rick Report is to help people surmount the complexities of the modern economy and, for however long he dominates it, out-trump Trump. In my prior job as a columnist at Yahoo Finance, I always tried to add value by anticipating change and illuminating what was around the bend, to the extent possible. The Rick Report will go a step further by trying to provide actionable information ordinary folks can use to prep for a stormy future.

So let’s start with the factors that will directly determine the direction of the Trump economy and the prospects for millions of Americans. Nobody can follow everything Trump does, so focus on these three things:

1. The 10-year Treasury rate. Key level: 4.5%. Few Americans normally pay attention to the bond market, which is incredibly important but normally dull. The bond market, however, may now be the single best indicator of whether the Trump economy is in trouble.

Bond markets have been flashing yellow since the fall of 2024, when the Fed cut short-term rates by a full percentage point and long-term rates, instead of following short term rates lower, rose by a point. That was an unusual move indicating that investors grew more worried about future inflation, and therefore demanded a higher rate of return on long-term bonds to compensate for the higher risk. Worries about the soaring national debt contributed to those concerns since more Treasury debt coming onto the market could also push longer-term rates higher.

After sitting tight for nine months, the Fed is likely to start cutting short-term rates again this month. But long-term rates are the ones to watch. If the 10-year rises, that means investors are worried anew about higher inflation ahead. When the 10-year rate rises, so do rates for mortgages and almost every other consumer and business loan.

Trump is hammering the Fed to cut rates, but it’s really long-term rates he cares about, not short-term rates—and the market, not the Fed, sets short-term rates. The 10-year Treasury is now subdued at just under 4.1%. If it stays there or goes lower, things are okay. You can monitor it here or at many other financial sites. If the 10-year Treasury crosses 4.5% and heads toward 5%, that’s a warning that investors see higher inflation and lower growth ahead. For ordinary families, that means higher costs, less job security and unsettling times. Higher rates also tend to send stock prices lower, since higher returns on bonds make stocks less attractive.

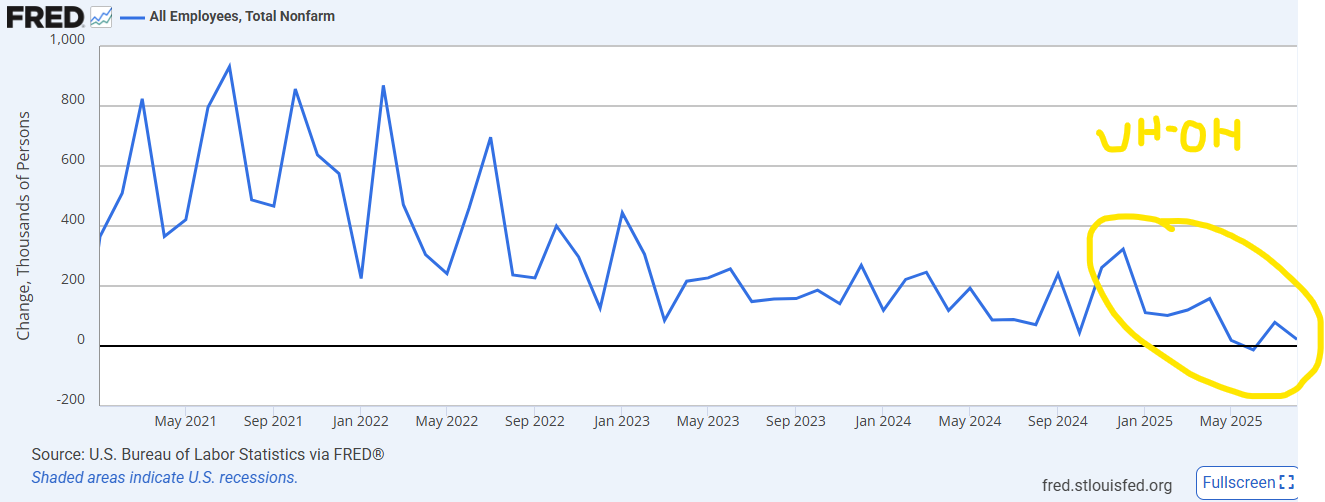

2. Permanently lower job numbers. Key level: 30,000 new jobs per month. During Joe Biden’s presidency, employers created 336,000 new jobs per month, on average. Those days are over.

Job creation in 2025 has averaged just 75,000 new jobs per month. During the last three months, that has dropped to an average of just 29,000 new jobs per month. Part of that is the end of the post-Covid hiring boom that boosted job growth under Biden. But two specific Trump actions have also crimped hiring.

One is the closing of the southwest border and the deportation of hundreds of thousands of unauthorized migrants. Many Americans may favor those moves, but the economic reality is Trump’s immigration policy reduces the size of the US labor force, which means lower job growth and overall growth. The other Trump factor is tariffs, which have massively increased uncertainty and added new costs for thousands of American businesses. When businesses can’t confidently forecast their numbers, one of the first things they do is stop hiring.

The unemployment rate used to be the go-to number to gauge the health of the labor market. But the unemployment rate can stay low in a weakening job market if the labor supply is declining, as it has from April to August. That means the unemployment rate won’t really tell you if there’s stress in the labor market, as it has in the past.

The breakeven rate for job creation used to be around 100,000 new jobs per month. That was the number of new jobs needed to keep the unemployment rate stable. Economist Ed Yardeni of Yardeni Research thinks it may now be around 30,000 new jobs per month, which is nearly the average of the last three months. Here’s one way to think of that: If job growth exceeds 30,000 per month, the economy might be outperforming, given the restraints Trump has imposed. Anything less than 30,000 definitely means trouble.

The effective tariff rate: Key level: 10%. As Trump has imposed, removed and reimposed tariffs, the average import tax has jumped from 2.5% in January to as high as 28%. As the average import tax has gyrated, markets have sank and soared, providing important clues and how much tariffs investors can live with, and what makes them rebel.

The huge tariff announcement on April 2, which Trump called Liberation Day and traders called Obliteration Day, would have pushed the average import tax to 28%, according to the Yale Budget Lab. Trump’s backpedaling and other changes since then have brought the average tariff down to about 17%. Those numbers come from computer modeling of how the tariffs would affect imports at historical levels.

But the actual tariff importers are paying could be lower than 17%. Capital Economics found that the actual import duty paid to the Customs Bureau in June averaged only 9%. That means American importers were finding clever ways to rewire supply chains or change their product offerings to minimize the tariff hit.

The stock market tanked on Obliteration Day, then started to recover a month later as Trump backtracked on many of the stiffest tariffs. The S&P 500 hit a record high over the summer with the average tariff in the 18% range in the modeling, but around 9% in reality. So for markets, 28% is too high but 9% is tolerable.

A federal appeals court recently invalidated all the tariffs Trump has imposed on an emergency basis, which is more than two-thirds of them. The court left those tariffs in place until October 14, on the presumption that the Supreme Court could take up the case by then.

Here’s a key point for investors: If the Supremes do rule against the emergency tariffs, that would bring the average tariff rate all the way down to about 4.5%, according to the Budget Lab. Trump would still try to impose tariffs through other means, but those methords are more difficult and take longer. If markets can live with 18% tariffs in the modeling, and 9% tariffs in reality, then 4.5% could trigger quite a party.

A lot of other stuff will happen by then. Trump could start fudging economic data, or gain a bit more control at the Federal Reserve, or find new ways to bring corporate America under his thumb. But the bond market will declare when investors lose confidence in Trump’s helming. Companies will stop hiring if they get too worried, or start hiring if their executives start to feel more confident. And markets will rejoice if the courts put some tangible limits on Trump’s tariffing ability.

Don’t get outraged. Just prepare.

Appreciate the note. Always reassuring to observe signs of intelligent life in the universe.....

Hello Rick, A hearty welcome to Substack! Have been following you since your early days at Yahoo Finance over a decade ago. Thank you for your sanity and objectivity. Excellent post as always, and look forward to more down the road...